This spring, MCS participated in a survey performed by Inside Information, a financial industry publication produced by Bob Veres. From 956 responses, a majority of which were fee-only advisors like us, we found that MCS clients with $1-$2 million accounts pay 61% of what the median clients in the Inside Information report pay for their financial advice. Why do MCS clients pay almost 40% less than the median client of similar fee-only firms (and 60% less than the median brokerage firm client)?

Michael Stalker founded MCS because he was unhappy with the investment industry’s focus on their compensation rather than what the client earned. Client earnings are reduced by more than just their advisor’s fees – they are also reduced by the fees related to the adviser’s investment recommendations. Our clients have significantly lower portfolio costs because our goal is to manage risk and increase wealth which, in part, means limiting the use of mutual funds and other investments that add hidden costs to our clients’ investment portfolios.

For example, an adviser charging 1% might recommend a portfolio of mutual funds. If each of those mutual funds has a 1% expense ratio, the all-in cost to the client is 2%. By investing primarily in bonds and stocks, and being mindful of the mutual fund and ETF expense ratios in its clients’ portfolios, MCS is able to keep your portfolio costs low.

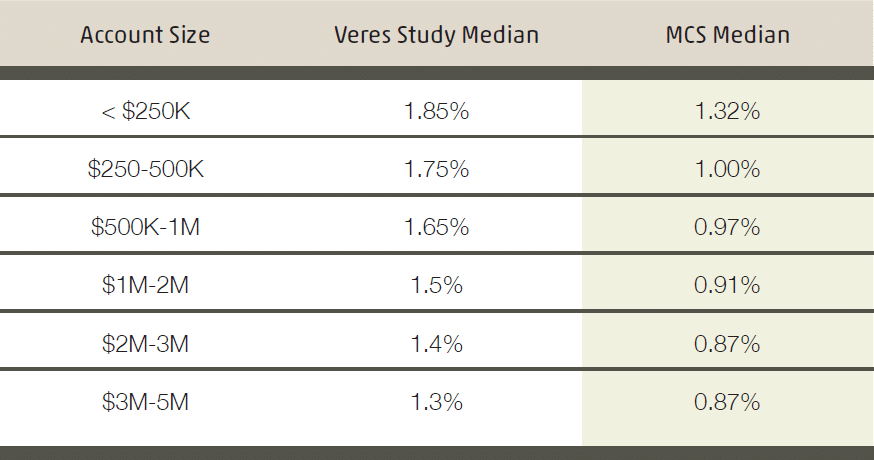

The Inside Information survey confirmed what we have suspected for years. In the past, prospective clients have asked us to review their investment portfolios and tell them how much they are paying for investment advice at their current advisor. We discovered that their portfolio costs ranged from 1.5% to 4% per year. Our analysis was from a very small sample, however, and the Inside Information report was the first time we had seen a large group of advisors disclose their clients’ “all-in portfolio costs” (which include mutual fund expense ratios, platform fees, and trading expenses). The report found that the median costs for $1-$2 million dollar accounts was 2.27% for brokerage firms (not including commissions they may have earned on the account), and the median costs for feeonly firms was 1.5%. In contrast, the median all-in costs for $1-$2 million dollar account at MCS is 0.91%.

Here’s a more detailed breakdown:

The Veres report provides even greater detail regarding the distribution of fees among advisors. Please let us know if you would like a copy of this very detailed report.