Warning Shot: Stocks, Bonds, Inflation, and Interest Rates

The first quarter of 2018 offered some validation of my number one concern (expressed in detail in last year’s Q2 newsletter) along with two emerging issues. These three concerns (in order of importance) roiled the financial markets in the first quarter:

Higher Inflation Leading to Higher Interest Rates

International Trade Disputes

White House Chaos

These factors negated the stock market’s robust January gains, leaving it slightly down for the first quarter ending

03/31/2018. Real estate, which is more sensitive to interest rates than stocks, suffered even more.

First Quarter Results

If MCS clients’ investments were treated as one large portfolio including their cash, on average clients lost 0.48% in the first three months of 2018, after fees. For comparison purposes, the S&P 500 Total Return Stock index lost 0.76%, and the Barclays Aggregate Bond Index lost 1.46%. The range of individual client returns was from a loss of 2.00 % to a gain of 2.68%.

Clients with the highest returns had a higher percentage of their portfolio invested in inherited, low-basis stock that outperformed. Clients who underperformed had higher equity allocations or lower cash and short term bond holdings.

Although the differences are small, MCS outperformed both stock and bond indexes because of our shift to short term bonds.

Higher Inflation Leading to Higher Interest Rates

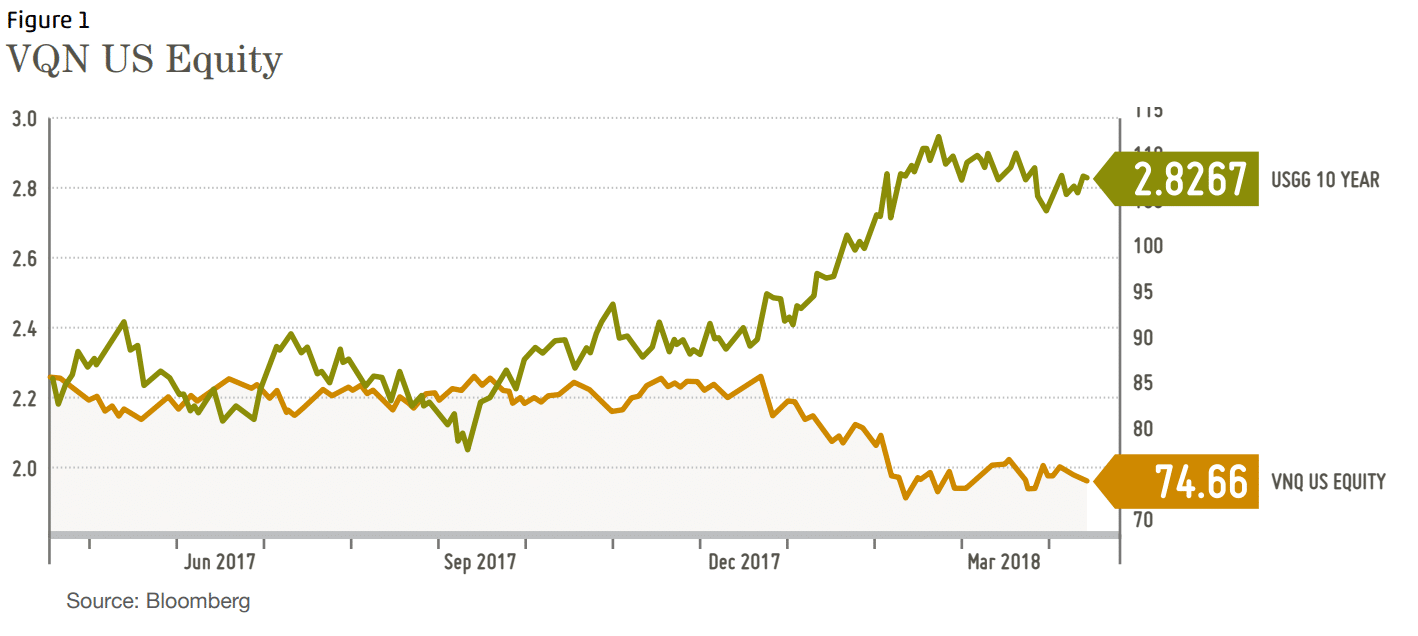

Here are two charts to illustrate how higher interest rates negatively impact other asset classes:

As the yield on the 10-year US Treasury Bond increased, the price of Real Estate Investment Trusts (REITs) fell. The graph below illustrates this by comparing the Vanguard Real Estate ETF (VNQ), a REIT index, to the 10-year US Treasury Bond Index (USGG 10 YEAR).

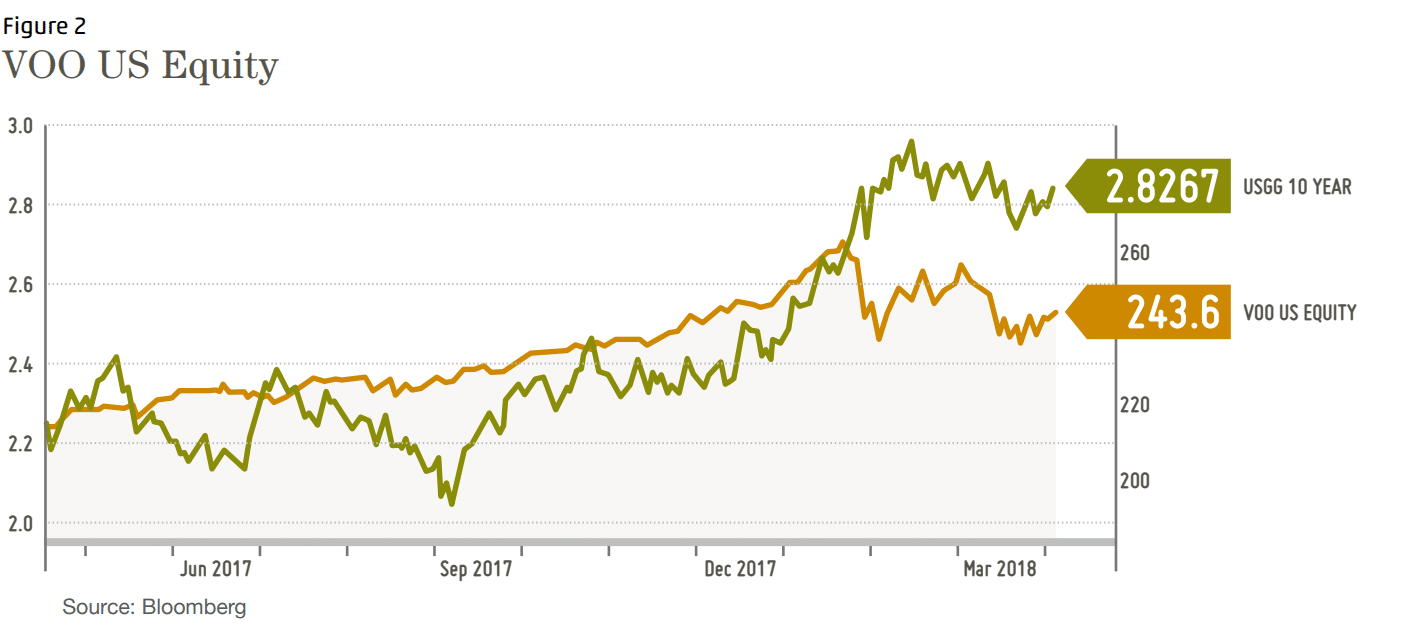

The Vanguard S&P 500 Stock Index (VOO) responded negatively to rising rates also, but less so. Strong corporate earnings, due to solid economic growth and lower tax rates, mitigated the negative effect of interest rate increases.

Investors should pay attention to how quickly stocks unravel at the merest hint of higher-than-expected inflation. Stocks declined 4.1% on February 5th after declining 2.1% the previous trading day. A takeaway from the inflation tantrum should be: “Look how fast down can be.” Nevertheless, January’s inflation scare isn’t enough to prove higher inflation is on its way. It was just one data point. March inflation data is also pointing to a gradually higher inflation scenario, which is fuel for higher interest rates.

Real Interest Rates Collapse. What If Rates Revive?

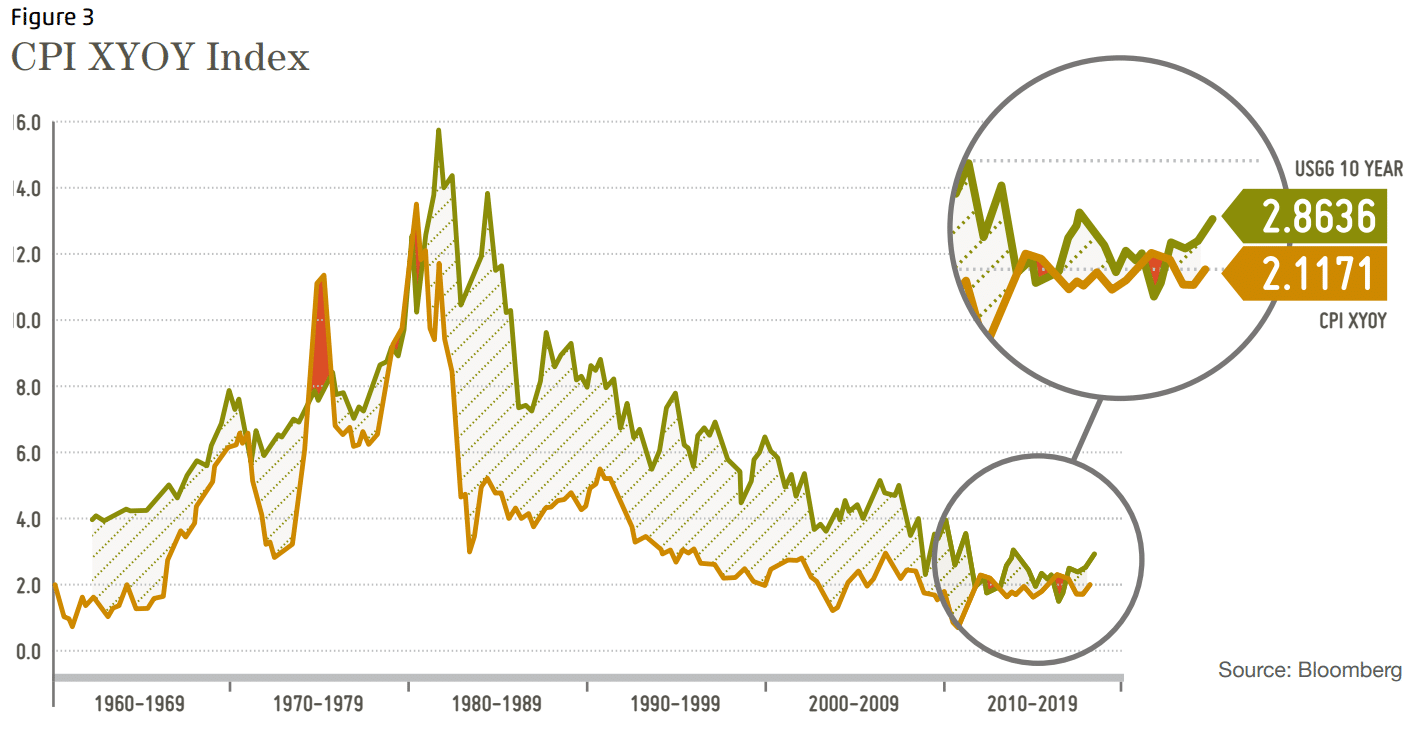

The chart below shows a shrinking real interest rate, which is illustrated below as the gap (striped area) between 10-year Treasury Bond yields (USGG 10 YEAR, green line) and core inflation (CPI XYOY, orange line). Conceptually, the real interest rate is the return you keep after inflation (for example, 3% bond interest minus 2% inflation = 1% real interest rate.)

This chart is a warning that the past 6 six years have been fairly unique regarding how little real interest investors have earned. Should Investors demand real interest rates at pre-2012 levels, it would bludgeon most portfolios. Currently institutional investors and economists buy the “Low for Long” story2. By accepting the story, they accept meager real interest rates, and they convince their clients to go along. My conclusion; take no comfort from a story about why a crappy deal is acceptable. A new story is developing. For those who would rather watch paint dry than read an economic research paper, here is what you need to know. People change their collective minds about what is a good vs. bad story. When the story goes from good to bad (here, when market participants decide they no longer buy the “Low for Long” story), the investor experience is ugly.

Trade War? Them’s Fightin’ Words!

Unlike many aspects of US governance, trade agreements are an area in which the President can exert significant influence in a short period of time. I have no idea how the Trade War story plays out, and based on the stock market’s up/down/up/down reactions, neither does anyone else.

Markets aren’t that fond of this shtick. Buckle up.

White House Chaos

Trump is clear that he likes conflict3 and admittedly there are times when assertive public confrontation may be necessary. Nevertheless, using the “I like conflict” method of negotiating and decision making as the “go to” strategy runs a very high risk of undermining the very relationships that Trump hopes to improve while increasing the odds of unintended consequences.

What does that message send to those would like to serve their country after a successful career elsewhere? Or to those that serve in government who have appointed leadership that is hostile to the mission of their department? What are the national and international implications? I don’t know the answers, but it’s hard imagine broadly positive outcomes

Summary

Despite the stock market’s 2017 enthusiasm, the world is adopting a more polarized, win/lose conflict resolution approach which makes investing more risky. Do not be surprised if we see a 10% plus down day in stocks should geopolitical risks and interest rate complacency (as measured by low real rates) be replaced by investors worried about the many risks they face.

Investment Strategy

The most attractive investments on a risk-adjusted basis are short term bonds. Rates have risen steadily since November 2016 and continue to do so. I have reinvested maturing long term bonds into short term bonds. I am also aggressively moving cash out of low yielding money market funds into higher yielding short term bonds, CDs or US Treasury Bills. While I have not yet reduced exposure to stocks (our allocation is already fairly low), I am considering some selective stock selling.

As always, I encourage you to review your portfolio and reach out with any questions. My investment philosophy is to manage your money in a way that minimizes your worries about it. My previous newsletter described the pros and cons of stock market investment given the current circumstances. If you would like to own more stock or if you have any questions, concerns or suggestions, I would love to hear from you.

1MCS Family Wealth Advisors (MCS) consolidated client returns are dollar-weighted, net of investment management fees unless stated otherwise, include reinvestment of dividends and capital gains and represent all clients with fully discretionary accounts under management for at least one full month in 2017. Individual client returns represent client discretionary accounts under management for the entire period – starting on 12/31/2016 and ending on 12/31/2017. These accounts represent 97% of MCS’s discretionary fee-paying assets under management as of 12/31/2017 and were invested primarily in US stocks and bonds (15% of client assets on 12/31/2017 were invested in tax-exempt municipal bonds). The Stock Index values are based on the S&P 500 Total Return Index, which measures the large-capitalization US equity market. The Bond Index values are based on the Barclays Capital US Aggregate Bond Index, which measures the US investment-grade bond market. Index values are for comparison purposes only. The report is for information purposes only and does not consider the specific investment objective, financial situation, or particular needs of any recipient, nor is it to be construed as an offer to sell or solicit investment management or any other services. Past performance is not indicative of future results. 2The “Low for Long” story describes a future of persistent low interest rates due to a variety of economic factors. See https://www.bis.org/publ/work685.pdf for an overview of the beliefs underpinning the “Low for Long” story and the tenuous nature of such a conclusion. 3At a press briefing on March 6, President Trump stated, “It’s tough. I like conflict. I like having two people with different points of view, and I certainly have that. And then I make a decision. But I like watching it, I like seeing it, and I think it’s the best way to go.”

Categories

2018 First Quarter Newsletter & Outlook

Warning Shot: Stocks, Bonds, Inflation, and Interest Rates

The first quarter of 2018 offered some validation of my number one concern (expressed in detail in last year’s Q2 newsletter) along with two emerging issues. These three concerns (in order of importance) roiled the financial markets in the first quarter:

These factors negated the stock market’s robust January gains, leaving it slightly down for the first quarter ending

03/31/2018. Real estate, which is more sensitive to interest rates than stocks, suffered even more.

First Quarter Results

If MCS clients’ investments were treated as one large portfolio including their cash, on average clients lost 0.48% in the first three months of 2018, after fees. For comparison purposes, the S&P 500 Total Return Stock index lost 0.76%, and the Barclays Aggregate Bond Index lost 1.46%. The range of individual client returns was from a loss of 2.00 % to a gain of 2.68%.

Clients with the highest returns had a higher percentage of their portfolio invested in inherited, low-basis stock that outperformed. Clients who underperformed had higher equity allocations or lower cash and short term bond holdings.

Although the differences are small, MCS outperformed both stock and bond indexes because of our shift to short term bonds.

Higher Inflation Leading to Higher Interest Rates

Here are two charts to illustrate how higher interest rates negatively impact other asset classes:

As the yield on the 10-year US Treasury Bond increased, the price of Real Estate Investment Trusts (REITs) fell. The graph below illustrates this by comparing the Vanguard Real Estate ETF (VNQ), a REIT index, to the 10-year US Treasury Bond Index (USGG 10 YEAR).

The Vanguard S&P 500 Stock Index (VOO) responded negatively to rising rates also, but less so. Strong corporate earnings, due to solid economic growth and lower tax rates, mitigated the negative effect of interest rate increases.

Investors should pay attention to how quickly stocks unravel at the merest hint of higher-than-expected inflation. Stocks declined 4.1% on February 5th after declining 2.1% the previous trading day. A takeaway from the inflation tantrum should be: “Look how fast down can be.” Nevertheless, January’s inflation scare isn’t enough to prove higher inflation is on its way. It was just one data point. March inflation data is also pointing to a gradually higher inflation scenario, which is fuel for higher interest rates.

Real Interest Rates Collapse. What If Rates Revive?

The chart below shows a shrinking real interest rate, which is illustrated below as the gap (striped area) between 10-year Treasury Bond yields (USGG 10 YEAR, green line) and core inflation (CPI XYOY, orange line). Conceptually, the real interest rate is the return you keep after inflation (for example, 3% bond interest minus 2% inflation = 1% real interest rate.)

This chart is a warning that the past 6 six years have been fairly unique regarding how little real interest investors have earned. Should Investors demand real interest rates at pre-2012 levels, it would bludgeon most portfolios. Currently institutional investors and economists buy the “Low for Long” story2. By accepting the story, they accept meager real interest rates, and they convince their clients to go along. My conclusion; take no comfort from a story about why a crappy deal is acceptable. A new story is developing. For those who would rather watch paint dry than read an economic research paper, here is what you need to know. People change their collective minds about what is a good vs. bad story. When the story goes from good to bad (here, when market participants decide they no longer buy the “Low for Long” story), the investor experience is ugly.

Trade War? Them’s Fightin’ Words!

Unlike many aspects of US governance, trade agreements are an area in which the President can exert significant influence in a short period of time. I have no idea how the Trade War story plays out, and based on the stock market’s up/down/up/down reactions, neither does anyone else.

Markets aren’t that fond of this shtick. Buckle up.

White House Chaos

Trump is clear that he likes conflict3 and admittedly there are times when assertive public confrontation may be necessary. Nevertheless, using the “I like conflict” method of negotiating and decision making as the “go to” strategy runs a very high risk of undermining the very relationships that Trump hopes to improve while increasing the odds of unintended consequences.

What does that message send to those would like to serve their country after a successful career elsewhere? Or to those that serve in government who have appointed leadership that is hostile to the mission of their department? What are the national and international implications? I don’t know the answers, but it’s hard imagine broadly positive outcomes

Summary

Despite the stock market’s 2017 enthusiasm, the world is adopting a more polarized, win/lose conflict resolution approach which makes investing more risky. Do not be surprised if we see a 10% plus down day in stocks should geopolitical risks and interest rate complacency (as measured by low real rates) be replaced by investors worried about the many risks they face.

Investment Strategy

The most attractive investments on a risk-adjusted basis are short term bonds. Rates have risen steadily since November 2016 and continue to do so. I have reinvested maturing long term bonds into short term bonds. I am also aggressively moving cash out of low yielding money market funds into higher yielding short term bonds, CDs or US Treasury Bills. While I have not yet reduced exposure to stocks (our allocation is already fairly low), I am considering some selective stock selling.

As always, I encourage you to review your portfolio and reach out with any questions. My investment philosophy is to manage your money in a way that minimizes your worries about it. My previous newsletter described the pros and cons of stock market investment given the current circumstances. If you would like to own more stock or if you have any questions, concerns or suggestions, I would love to hear from you.

2The “Low for Long” story describes a future of persistent low interest rates due to a variety of economic factors. See https://www.bis.org/publ/work685.pdf for an overview of the beliefs underpinning the “Low for Long” story and the tenuous nature of such a conclusion.

3At a press briefing on March 6, President Trump stated, “It’s tough. I like conflict. I like having two people with different points of view, and I certainly have that. And then I make a decision. But I like watching it, I like seeing it, and I think it’s the best way to go.”