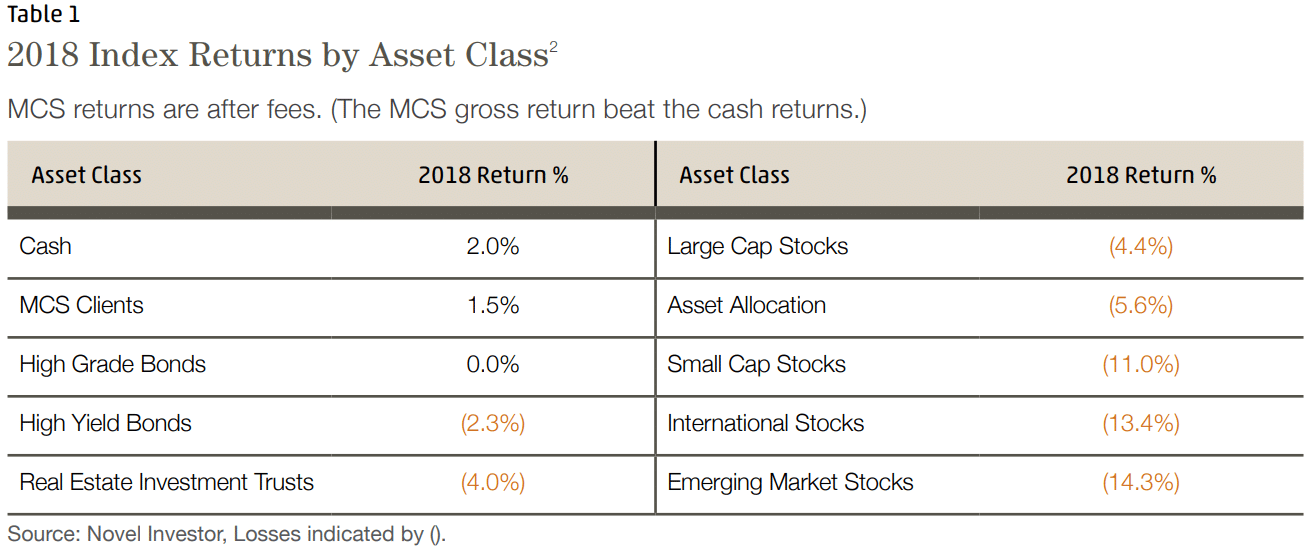

2018 placed MCS clients, measured as one large portfolio, in the top return categories among asset classes. This is no small feat. Until the fourth quarter, most investors were enjoying the gains of a ‘risk-on’ mode while stocks made new highs. December serves as a reminder of how quickly gains can be reversed and that diversification among riskier assets will not save investors from losses.

If MCS clients’ investments were treated as one large portfolio including their cash, on average clients gained 1.47% in 20181, after fees. For comparison purposes, the S&P 500 Total Return Stock index lost 4.38%, and the Barclays Aggregate Bond Index was essentially flat, gaining 0.01% for the year. The range of MCS individual client returns was from a loss of 6.15 % to a gain of 5.65%.

Clients with the highest returns outperformed due to selling concentrated stock positions in June and August. The client with the lowest return had much higher allocations to equities than most clients, and others who underperformed had exposure to concentrated, low-basis stock that underperformed.

As you can see in the table below, only one asset class had a positive return last year. Even though MCS portfolios were invested in all asset classes, we were able to provide positive returns (after our fees were deducted) by increasing our short-term bond allocation while reducing exposure to the asset classes with negative returns, and through timely asset sales.

2018 provided almost no place for investors to hide. Stock markets fell worldwide on fears of an economic slowdown, or worse – a possible recession. Long term bond prices fell as yields increased through September. In the 4th quarter, a slowing global economy and recession fears triggered a rally in the Barclay’s U.S. Aggregate Bond Index which turned its third quarter, year-to-date loss into a break even return for the full year.

Due to year end market turmoil, Fed Chairman Powell implied in an announcement that the Fed may delay or reduce the projected number of interest rate increases in 2019. This has boosted stock prices since the beginning of this year.

The chaotic political and economic climate has many cross currents, making it difficult to navigate. Chaos creates good or bad outcomes without clear antecedents. The risk of investing in chaotic markets is believing that you understand more than you do – and then getting your head handed to you when unforeseeable events wreck your strategy.

Looking ahead

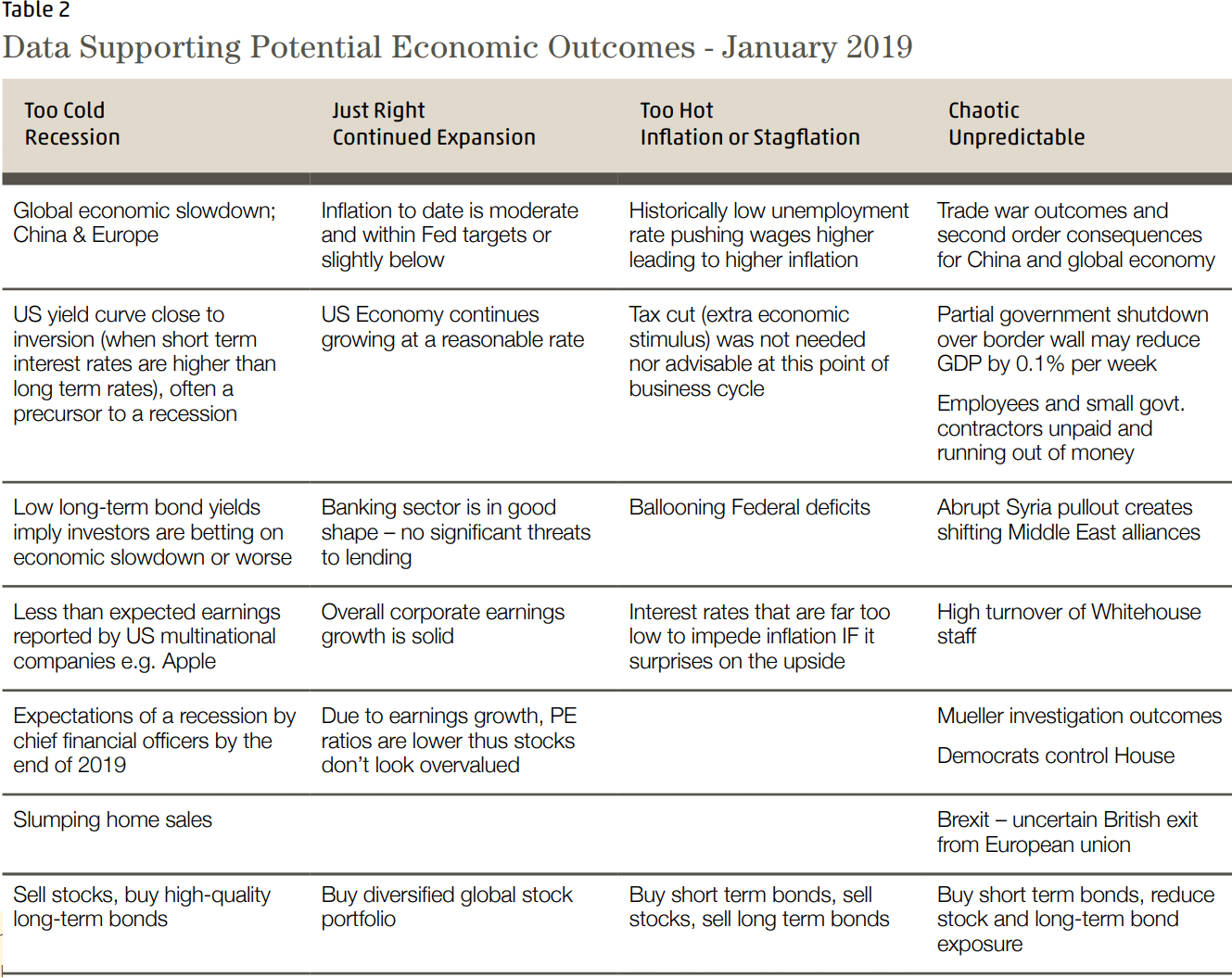

To give you a sense of the many things that I am considering as we enter 2019, I have created the table below.

There are counter arguments to what I’ve categorized above. For example, slumping home sales may not be a sign of a weak economy, rather, slow sales may reflect high prices and a lack of inventory. The demand for housing is strong and supported by demographics. In the chaotic column, many of the issues might be dismissed as not very relevant to US economic growth (Syria) or temporary (government shutdown). I’ve provided the chart to help you visualize some of the variables I am considering as I invest your money.

Thinking About China

Within two generations, China has become the world’s largest economy (based on purchasing power parity) or its second largest (based on currency exchange rates).

How did this happen? It’s called State capitalism.

“In China, the majority of investment is carried out by entities that are at least partially state-owned. Most of these are under the control of local governments. Thus booms are primarily the result of perverse incentives at the local government level. Unlike entrepreneurs in a free-enterprise economy, Chinese local officials are motivated primarily by political considerations. As their performance evaluations are based, to a large extent, on GDP growth within their jurisdictions, they have a strong incentive to promote large-scale investment projects. They also don’t face any real bankruptcy risk. When localities get into trouble, they are invariably bailed out by state-owned banks. Under these circumstances, overinvestment is inevitable.3” emphasis added.

Over-investment is another way of saying too much money went into a project and too little came out of it. When that happens in the US, bankruptcies – and in the worst case, Great Recessions – are the result. For several years, China has been regarded by a small vocal minority of investors as financial bubble waiting to burst. See the Forbe’s article dated 8/29/2017 “Is China’s Economy Just A Giant ‘Ponzi Scheme’?” https://bit.ly/2DkC7hy. The article provides a summary of the pro /con views on China.

The conventual wisdom is that China has the means to manage its way out of its debt problems.

A friend of mine who manages a large foundation recently sent me the translated text of a speech by Professor Xiang Songzuo of Renmin University School of Finance, and who is also the former chief economist of China Agriculture Bank. He spoke of about China’s situation from an insider’s perspective. Talk about a terrifying analysis! The essence of the speech is that most of the Chinese economy is bankrupt, economic growth is vastly overstated and the system stays afloat by creating new loans.

For Professor Xiang’s entire speech, see this4 article from China Change. It should be noted that the website provides what the Chinese would call ‘dissident’ viewpoint , and the editors of China Change commented that the speech “was apparently applauded by the audience but immediately censored over the Chinese internet.” Here are some excerpts:

“How bad are things? The number that China’s National Bureau of Statistics (NBS) gives is 6.5 percent, but just yesterday, a research group of an important institution released an internal report. Can you take a guess on the GDP growth rate that they came up with using the NBS data?”

“They used two measurements. Going by the first estimate, China’s GDP growth this year was about 1.67 percent. And according to the other calculation, the growth rate was negative.”

“Look at our profit structure. To put it plainly, China’s listed companies don’t really make money. Then who has taken the few profits made by China’s more than 3,000 listed companies? Two-thirds have been taken by the banking sector and real estate. The profits earned by 1,444 listed companies on the SME board and growth enterprise board are not even equal to one and half times the profit of the Industrial and Commercial Bank of China. How can this kind of stock market become a bull market?”

“I’m acquainted with many bosses of listed companies. Frankly speaking, a large part of their equity pledge funds did not go into their primary business, but used on speculation. They have many tricks. They buy financial products; they buy housing. The government said listed companies have spent 1-2 trillions on speculative real estate. Basically China’s economy is all built on speculation, and everything is over leveraged.”

“Starting in 2009, China embarked on this path of no return. The leverage ratio has soared sharply. Our current leverage ratio is three times that of the United States and twice that of Japan. The debt ratio of non-financial companies is the highest in the world, not to mention real estate.”

“What are our current financial risks? They are hidden, complex, acute, contagious, and malevolent. Structural imbalance are massive, and violations of law and regulations are rampant.”

In the US, the lending referred to in the speech is called ‘Extend (the loan) and Pretend (it will be paid)’. A version of this took place in US commercial property markets during the Great Recession. US Banks did it to avoid a classifying their bad loans in default because too many bad loans result in a failed bank, stock that plunges to zero and losses to depositors. Spanish and Italian banks play extend and pretend as well. Professor Xiang also mentions Huawei in his speech:

“There are many U.S. public companies with tens of billions dollars in profits. How many Chinese tech and manufacturing companies are there that have accomplished this? There is only one, but it’s not listed, and you all know which one that is. [Xiang is referring to Huawei, the Chinese tech company.]” Huawei commands the largest market share in Telecom equipment sales.

The US has long worried that Huawei’s equipment contains hidden spying technology. Two Huawei executives have been recently arrested: one in Canada at the request of the US government and one in Poland on charges of spying. Germany is considering denying Huawei the opportunity to upgrade its infrastructure to G5 networks on national security grounds. China’s corporate cash cow has a problem.

A Dark Thought About Second Order Consequences

I agree with the President’s insistence that China stop ripping off US companies’ intellectual property. What if President Trump’s trade battle unwittingly becomes the falling domino that ultimately pushes the teetering Chinese economy over the edge and into chaos?

If China is in the desperate straits that Prof. Xiang Songzuo describes, then it seems to me that their best strategy is to agree to revised trade terms (to get trade flowing again) with no intention of fulfilling the agreement while working hard to create the illusion of fulfillment. In the absence some explosive spying exposé, stock markets

would rally on a revised trade agreement.

The last thing overleveraged, unprofitable Chinese companies need is a level, competitive playing field.

Of course, if the Chinese economy did start to unravel the global implications could be devastating; a deep recession, perhaps worse than the Great Recession of 10 years ago is one possible outcome.

Yet, I am not sure how much weight I should give to such an outcome in my investment strategy.

The Soviet Union tried to keep up with US economy and its concomitant military and foreign aid expenditures and wound up bankrupting itself in the process. One of the greatest failures of US intelligence agencies was missing the signs of impending economic collapse of the Soviet Union.

Is it a too much of a stretch to compare the failure of the Soviet Union with China’s circumstances today? China has pulled back from its free market, democratic reforms. Its state capitalism model concentrates economic decision making in the ruling class; historically the most privileged and esteemed (or corrupt, depending on your point of view) class of Chinese citizens. In 2018, the Chinese constitution was amended to eliminate term limits allowing Xi Jinping to become a ruler for life, a modern-day Emperor. The Chinese appear to have built a better economic model than the Soviets, but is it flexible enough to allow for massive financial failures and subsequent recovery that characterizes the history of capitalism?

As I am finishing this newsletter, this news is coming out China:

Jan 21, 2019: reported by Reuters in the Times of India:

Xi Jinping keeps China on high alert for ‘black swan’ events …

• “BEIJING: China must be on guard against “black swan” risks while fending off “grey rhino” events, President Xi Jinping said on Monday, adding that the economy faces deep and complicated changes, state news agency Xinhua reported.

• A “black swan” event refers to an unforeseen occurrence that typically has extreme consequences, while a “grey rhino” is a highly obvious yet ignored threat.

• Xi’s warning came after the release of data on Monday showed the economy posted the slowest growth in 28 years last year, hurt by faltering domestic demand and bruising US tariffs.”

Jan 22, 2019: the same story reported by The Wall Street Journal:

China’s Annual Economic Growth Rate Is Slowest Since 1990

• “The 6.6% growth rate for 2018 reported Monday is the slowest annual pace China has recorded since 1990. The economic slowdown, which has been sharper than Beijing expected, deepened in the last months of 2018, with fourth quarter growth rising 6.4% from a year earlier.”

• “Some economists and investors have said China’s economy is far more anemic than the government’s 6.6% rate of expansion for 2018. They note the government’s move on Friday, just ahead of Monday’s data release, to cut the 2017 growth rate to 6.8% from 6.9%, which they said provides a slightly lower base, giving a slight boost to the fresh 2018 data.”

• The Wall Street Journal article does not mention President Xi Jinping’s “black swan risks or ‘grey rhino’ events” comment. A reader of the WSJ article would likely conclude that its just another news article about China. But, is it? In trying to figure out how the future may unfold, I look for ‘sentinel’ articles. These are articles that when looking backwards, you could point to as evidence of what is to come.

Jan 22, 2019; the same story reported by South China Morning Post:

Be vigilant about threats to China’s stability and reforms, Xi Jinping tells top cadres

• “In an opening address, Xi told provincial bosses, ministers and top generals that although China’s economy was generally performing well, they must not let their guard down and they should be aware of potential turbulence and disruption ahead.”

• “[We are] confronted with unpredictable international developments and a complicated and sensitive external environment. Our task at hand is to maintain stability as we continue our reform and development,” Xi was quoted as saying by state news agency Xinhua.

• “We must maintain a high degree of vigilance. We must keep our high alert about any ‘black swan’ [or unforeseen] incident, and also take steps to prevent any ‘grey rhino’ [highly possible yet ignored threats].”

• Economic meltdowns occur when smart people become so heavily invested in their world view that they won’t recognize the elephant in the room until it is sitting on their chest, about to collapse a lung. Once recognized, that’s when the shouting and panic begins…

Bottom Line

I find this environment confusing and fraught. I am following developments closely. The news out of China sounds like the leader of the world’s second largest economy is preparing his people for hard times ahead. My underlying philosophy is risk management first. Please don’t hesitate to contact me if you have any questions or concerns.

1MCS Family Wealth Advisors (MCS) consolidated client returns are dollar-weighted, net of investment management fees unless stated otherwise, include reinvestment of dividends and capital gains and represent all clients with fully discretionary accounts under management for at least one full month in 2018. Individual client returns represent client discretionary accounts under management for the entire period – starting on 12/31/2017 and ending on 12/31/2018.These accounts represent 97% of MCS’s discretionary fee-paying assets under management as of 12/31/2018 and were invested primarily in US stocks and bonds (15% of client assets on 12/31/2018 were invested in tax-exempt municipal bonds). The Stock Index values are based on the S&P 500 Total Return Index, which measures the large capitalization US equity market. The Bond Index values are based on the Barclays Capital US Aggregate Bond Index, which measures the US investment-grade bond market. Index values are for comparison purposes only. The report is for information purposes only and does not consider the specific investment objective, financial situation, or particular needs of any recipient, nor is it to be construed as an offer to sell or solicit investment management or any other services. Past performance is not indicative of future results. 2Asset Class Index Key

Cash — 3 Month Treasury Bill Rate

High Grade Bonds – Barclay’s U.S. Aggregate Bond Index

High Yield Bonds – BofAML US High Yield Master II Index

Real Estate Inv Trusts – FTSE NAREIT All Equity Index

Large Cap Stocks – S&P 500 Index

Asset Allocation Portfolio – Asset Allocation is made up of 15% large cap stocks, 15% international stocks, 10% small cap

stocks, 10% emerging market stocks, 10% REITs, 40% high-grade bonds, and annual rebalancing.

Small Cap Stocks – Russell 2000 Index

International Stocks – MSCI EAFE Index

Emerging Market Stocks – MSCI Emerging Markets Index 3Wikipedia contributors. (2019, January 21). Economy of China. In Wikipedia, The Free Encyclopedia. Retrieved 14:27,

January 22, 2019, from https://en.wikipedia.org/w/index.php?title=Economy_of_China&oldid=879540089 4Source: https://chinachange.org/2018/12/28/a-great-shift-unseen-over-the-last-forty-years/

Categories

2018 Year End Newsletter and Outlook

2018 placed MCS clients, measured as one large portfolio, in the top return categories among asset classes. This is no small feat. Until the fourth quarter, most investors were enjoying the gains of a ‘risk-on’ mode while stocks made new highs. December serves as a reminder of how quickly gains can be reversed and that diversification among riskier assets will not save investors from losses.

If MCS clients’ investments were treated as one large portfolio including their cash, on average clients gained 1.47% in 20181, after fees. For comparison purposes, the S&P 500 Total Return Stock index lost 4.38%, and the Barclays Aggregate Bond Index was essentially flat, gaining 0.01% for the year. The range of MCS individual client returns was from a loss of 6.15 % to a gain of 5.65%.

Clients with the highest returns outperformed due to selling concentrated stock positions in June and August. The client with the lowest return had much higher allocations to equities than most clients, and others who underperformed had exposure to concentrated, low-basis stock that underperformed.

As you can see in the table below, only one asset class had a positive return last year. Even though MCS portfolios were invested in all asset classes, we were able to provide positive returns (after our fees were deducted) by increasing our short-term bond allocation while reducing exposure to the asset classes with negative returns, and through timely asset sales.

2018 provided almost no place for investors to hide. Stock markets fell worldwide on fears of an economic slowdown, or worse – a possible recession. Long term bond prices fell as yields increased through September. In the 4th quarter, a slowing global economy and recession fears triggered a rally in the Barclay’s U.S. Aggregate Bond Index which turned its third quarter, year-to-date loss into a break even return for the full year.

Due to year end market turmoil, Fed Chairman Powell implied in an announcement that the Fed may delay or reduce the projected number of interest rate increases in 2019. This has boosted stock prices since the beginning of this year.

The chaotic political and economic climate has many cross currents, making it difficult to navigate. Chaos creates good or bad outcomes without clear antecedents. The risk of investing in chaotic markets is believing that you understand more than you do – and then getting your head handed to you when unforeseeable events wreck your strategy.

Looking ahead

To give you a sense of the many things that I am considering as we enter 2019, I have created the table below.

There are counter arguments to what I’ve categorized above. For example, slumping home sales may not be a sign of a weak economy, rather, slow sales may reflect high prices and a lack of inventory. The demand for housing is strong and supported by demographics. In the chaotic column, many of the issues might be dismissed as not very relevant to US economic growth (Syria) or temporary (government shutdown). I’ve provided the chart to help you visualize some of the variables I am considering as I invest your money.

Thinking About China

Within two generations, China has become the world’s largest economy (based on purchasing power parity) or its second largest (based on currency exchange rates).

![]()

How did this happen? It’s called State capitalism.

“In China, the majority of investment is carried out by entities that are at least partially state-owned. Most of these are under the control of local governments. Thus booms are primarily the result of perverse incentives at the local government level. Unlike entrepreneurs in a free-enterprise economy, Chinese local officials are motivated primarily by political considerations. As their performance evaluations are based, to a large extent, on GDP growth within their jurisdictions, they have a strong incentive to promote large-scale investment projects. They also don’t face any real bankruptcy risk. When localities get into trouble, they are invariably bailed out by state-owned banks. Under these circumstances, overinvestment is inevitable.3” emphasis added.

Over-investment is another way of saying too much money went into a project and too little came out of it. When that happens in the US, bankruptcies – and in the worst case, Great Recessions – are the result. For several years, China has been regarded by a small vocal minority of investors as financial bubble waiting to burst. See the Forbe’s article dated 8/29/2017 “Is China’s Economy Just A Giant ‘Ponzi Scheme’?” https://bit.ly/2DkC7hy. The article provides a summary of the pro /con views on China.

The conventual wisdom is that China has the means to manage its way out of its debt problems.

A friend of mine who manages a large foundation recently sent me the translated text of a speech by Professor Xiang Songzuo of Renmin University School of Finance, and who is also the former chief economist of China Agriculture Bank. He spoke of about China’s situation from an insider’s perspective. Talk about a terrifying analysis! The essence of the speech is that most of the Chinese economy is bankrupt, economic growth is vastly overstated and the system stays afloat by creating new loans.

For Professor Xiang’s entire speech, see this4 article from China Change. It should be noted that the website provides what the Chinese would call ‘dissident’ viewpoint , and the editors of China Change commented that the speech “was apparently applauded by the audience but immediately censored over the Chinese internet.” Here are some excerpts:

In the US, the lending referred to in the speech is called ‘Extend (the loan) and Pretend (it will be paid)’. A version of this took place in US commercial property markets during the Great Recession. US Banks did it to avoid a classifying their bad loans in default because too many bad loans result in a failed bank, stock that plunges to zero and losses to depositors. Spanish and Italian banks play extend and pretend as well. Professor Xiang also mentions Huawei in his speech:

The US has long worried that Huawei’s equipment contains hidden spying technology. Two Huawei executives have been recently arrested: one in Canada at the request of the US government and one in Poland on charges of spying. Germany is considering denying Huawei the opportunity to upgrade its infrastructure to G5 networks on national security grounds. China’s corporate cash cow has a problem.

A Dark Thought About Second Order Consequences

I agree with the President’s insistence that China stop ripping off US companies’ intellectual property.

What if President Trump’s trade battle unwittingly becomes the falling domino that ultimately pushes the teetering Chinese economy over the edge and into chaos?

If China is in the desperate straits that Prof. Xiang Songzuo describes, then it seems to me that their best strategy is to agree to revised trade terms (to get trade flowing again) with no intention of fulfilling the agreement while working hard to create the illusion of fulfillment. In the absence some explosive spying exposé, stock markets

would rally on a revised trade agreement.

The last thing overleveraged, unprofitable Chinese companies need is a level, competitive playing field.

Of course, if the Chinese economy did start to unravel the global implications could be devastating; a deep recession, perhaps worse than the Great Recession of 10 years ago is one possible outcome.

Yet, I am not sure how much weight I should give to such an outcome in my investment strategy.

The Soviet Union tried to keep up with US economy and its concomitant military and foreign aid expenditures and wound up bankrupting itself in the process. One of the greatest failures of US intelligence agencies was missing the signs of impending economic collapse of the Soviet Union.

Is it a too much of a stretch to compare the failure of the Soviet Union with China’s circumstances today? China has pulled back from its free market, democratic reforms. Its state capitalism model concentrates economic decision making in the ruling class; historically the most privileged and esteemed (or corrupt, depending on your point of view) class of Chinese citizens. In 2018, the Chinese constitution was amended to eliminate term limits allowing Xi Jinping to become a ruler for life, a modern-day Emperor. The Chinese appear to have built a better economic model than the Soviets, but is it flexible enough to allow for massive financial failures and subsequent recovery that characterizes the history of capitalism?

As I am finishing this newsletter, this news is coming out China:

Jan 21, 2019: reported by Reuters in the Times of India:

Xi Jinping keeps China on high alert for ‘black swan’ events …

• “BEIJING: China must be on guard against “black swan” risks while fending off “grey rhino” events, President Xi Jinping said on Monday, adding that the economy faces deep and complicated changes, state news agency Xinhua reported.

• A “black swan” event refers to an unforeseen occurrence that typically has extreme consequences, while a “grey rhino” is a highly obvious yet ignored threat.

• Xi’s warning came after the release of data on Monday showed the economy posted the slowest growth in 28 years last year, hurt by faltering domestic demand and bruising US tariffs.”

Jan 22, 2019: the same story reported by The Wall Street Journal:

China’s Annual Economic Growth Rate Is Slowest Since 1990

• “The 6.6% growth rate for 2018 reported Monday is the slowest annual pace China has recorded since 1990. The economic slowdown, which has been sharper than Beijing expected, deepened in the last months of 2018, with fourth quarter growth rising 6.4% from a year earlier.”

• “Some economists and investors have said China’s economy is far more anemic than the government’s 6.6% rate of expansion for 2018. They note the government’s move on Friday, just ahead of Monday’s data release, to cut the 2017 growth rate to 6.8% from 6.9%, which they said provides a slightly lower base, giving a slight boost to the fresh 2018 data.”

• The Wall Street Journal article does not mention President Xi Jinping’s “black swan risks or ‘grey rhino’ events” comment. A reader of the WSJ article would likely conclude that its just another news article about China. But, is it? In trying to figure out how the future may unfold, I look for ‘sentinel’ articles. These are articles that when looking backwards, you could point to as evidence of what is to come.

Jan 22, 2019; the same story reported by South China Morning Post:

Be vigilant about threats to China’s stability and reforms, Xi Jinping tells top cadres

• “In an opening address, Xi told provincial bosses, ministers and top generals that although China’s economy was generally performing well, they must not let their guard down and they should be aware of potential turbulence and disruption ahead.”

• “[We are] confronted with unpredictable international developments and a complicated and sensitive external environment. Our task at hand is to maintain stability as we continue our reform and development,” Xi was quoted as saying by state news agency Xinhua.

• “We must maintain a high degree of vigilance. We must keep our high alert about any ‘black swan’ [or unforeseen] incident, and also take steps to prevent any ‘grey rhino’ [highly possible yet ignored threats].”

• Economic meltdowns occur when smart people become so heavily invested in their world view that they won’t recognize the elephant in the room until it is sitting on their chest, about to collapse a lung. Once recognized, that’s when the shouting and panic begins…

Bottom Line

I find this environment confusing and fraught. I am following developments closely. The news out of China sounds like the leader of the world’s second largest economy is preparing his people for hard times ahead. My underlying philosophy is risk management first. Please don’t hesitate to contact me if you have any questions or concerns.

1MCS Family Wealth Advisors (MCS) consolidated client returns are dollar-weighted, net of investment management fees unless stated otherwise, include reinvestment of dividends and capital gains and represent all clients with fully discretionary accounts under management for at least one full month in 2018. Individual client returns represent client discretionary accounts under management for the entire period – starting on 12/31/2017 and ending on 12/31/2018.These accounts represent 97% of MCS’s discretionary fee-paying assets under management as of 12/31/2018 and were invested primarily in US stocks and bonds (15% of client assets on 12/31/2018 were invested in tax-exempt municipal bonds). The Stock Index values are based on the S&P 500 Total Return Index, which measures the large capitalization US equity market. The Bond Index values are based on the Barclays Capital US Aggregate Bond Index, which measures the US investment-grade bond market. Index values are for comparison purposes only. The report is for information purposes only and does not consider the specific investment objective, financial situation, or particular needs of any recipient, nor is it to be construed as an offer to sell or solicit investment management or any other services. Past performance is not indicative of future results.

2Asset Class Index Key

Cash — 3 Month Treasury Bill Rate

High Grade Bonds – Barclay’s U.S. Aggregate Bond Index

High Yield Bonds – BofAML US High Yield Master II Index

Real Estate Inv Trusts – FTSE NAREIT All Equity Index

Large Cap Stocks – S&P 500 Index

Asset Allocation Portfolio – Asset Allocation is made up of 15% large cap stocks, 15% international stocks, 10% small cap

stocks, 10% emerging market stocks, 10% REITs, 40% high-grade bonds, and annual rebalancing.

Small Cap Stocks – Russell 2000 Index

International Stocks – MSCI EAFE Index

Emerging Market Stocks – MSCI Emerging Markets Index

3Wikipedia contributors. (2019, January 21). Economy of China. In Wikipedia, The Free Encyclopedia. Retrieved 14:27,

January 22, 2019, from https://en.wikipedia.org/w/index.php?title=Economy_of_China&oldid=879540089

4Source: https://chinachange.org/2018/12/28/a-great-shift-unseen-over-the-last-forty-years/