Despite a trade war and recession fears, 2019 was a blowout year for risk taking. Long-term bonds and stocks posted significant gains as the Fed reduced interest rates to abate recession fears. In 2019 (if MCS clients’ investments were treated as one large portfolio including their cash), on average clients gained 5.35%1, after fees. For comparison purposes, the S&P 500 Total Return Stock Index (S&P 500) gained 31.49%, and the Barclays Aggregate Bond Index gained 8.72%. The range of MCS individual client returns was from a gain of 0.99% to a gain of 17.33%.

Clients with the lowest returns were newer to MCS and were cautiously invested in the low interest rate environment of the past few years (in the hopes rates would increase), whereas clients with the highest returns had high coupon bonds and higher overall allocations to equities. Overall, MCS client returns were muted by the defensive posture of portfolios. Short-term bonds and low overall exposure to stocks, an excellent strategy in 2018, was a middling strategy in 2019. What about this year?

The general consensus for 2020 is ‘risk on’ – meaning take more risk: more stock exposure should be rewarded.

If you have a contrarian bent, you’d observe that at the end on 2018 it was a more ‘risk off’ consensus and the market subsequently performed very well. If the consensus is ‘risk on’ now, the contrarian view would be a ‘risk off’ tilt since prices already reflect a positive outlook for 2020. The argument for still higher prices is there isn’t much alternative to achieve higher returns except to take more risk; bond yields are extremely low and stocks, despite the high prices, offer more potential upside. This is certainly possible.

The 2020 risk factors include:

Political: Wall Street is betting that Trump will win the next election. Thus, any unexpected shifts in the political landscape regarding the impeachment outcome or the expected democratic presidential candidate could introduce significant volatility into the markets.

Trade War: The recent US-China Phase 1 trade agreement has theoretically tamped down trade tensions, but given the mercurial nature of Trump’s approach to trade negotiation, who knows?

Higher than Expected Inflation: During the 1960s the labor market was tight, and inflation was low until it suddenly jumped higher after 1967. While an inflation surprise similar to the late 1960s and 1970s is highly improbable, the impact of a modest surprise of just ½ of one percent is not. Financial markets do not expect an inflation increase and are preoccupied with lower inflation. The Fed is explicitly trying to encourage higher inflation and has indicated that it would be comfortable with a period of overshoots (above its 2% target) to move current long-term expectations higher. If current inflation were to rise to 2.4% or more for a couple quarters, the markets would not take it well. Most advisers see higher inflation as a very low probability.

In summary, the consensus view is ‘take more risk’ because the above cited risks are unlikely to manifest in a materially negative way. My view is more in line with Howard Marks, Co-Chairman of Oaktree Capital Group, a very well-respected, high yield (junk) bond investor. Both junk bond and stock prices are highly sensitive to the economic outlook and, in a recession, can decline significantly. Falling junk bond prices may foreshadow trouble for stocks.

“The market’s been up for 11 years, it’s quadrupled off the low, we’re in the longest bull market, the longest expansion in history, profits are not rising, stock prices are, it’s what we call a liquidity-driven rally,” he (Marks) said in an interview on Bloomberg Television. “It doesn’t mean that the market’s going to go down tomorrow, but it does mean that the odds are not, in my opinion, in the investor’s favor.”

The strong counterargument is the liquidity-driven rally will keep going and drive prices even higher.

That said, if you are feeling like you’d prefer more risk exposure in your portfolio or would like to evaluate the possibly, let’s have a conversation or send me an email (michael@mcsfwa.com). It’s not difficult to increase your stock exposure.

Michael, when are you going to retire?

An Update on My Succession Dating Adventures

First, let’s start with the question: What do I mean by retirement and succession? Wikipedia defines retirement as “the withdrawal from one’s position or occupation or from one’s active working life.” Succession is a gradual semi-retirement; in my case, a transition of portfolio management and administrative duties to other skilled professional(s) while I retain portfolio and financial services input and supervise the results. I am pursuing a semi-retirement, something that many clients have done.

While my primary job is managing your money, executing a solid succession plan has felt like a second, part-time job focused on courtship and marriage. I last wrote about succession in our 2016 3rd quarter newsletter, and I have done a lot of ‘dating’ since then.

So far, I have not found ‘the one’.

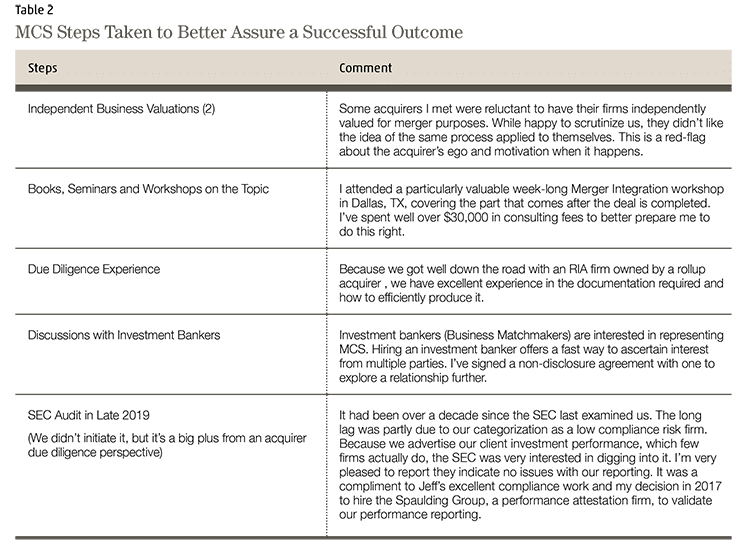

This financial adviser courtship and marriage thing is ‘Yuge’ and growing – not just for small businesses like mine but for very large ones as well. To wit; the proposed Schwab / TD Ameritrade merger is valued at $26 billion. Consolidation is happening everywhere. In 2019, merger and acquisition activity reached a record high for the seventh straight year. So, there’s lots of money and interest chasing deals these days and lots of options out there. Mergers are being driven by investor use of index funds (forcing mergers of mutual fund groups)2 and demographics (38% of advisers are expected to retire in the next 10 years). It’s fair to say that most advisers in their late 50’s and older are either thinking or doing something about this now. Table 2 describes our efforts to prepare for succession.

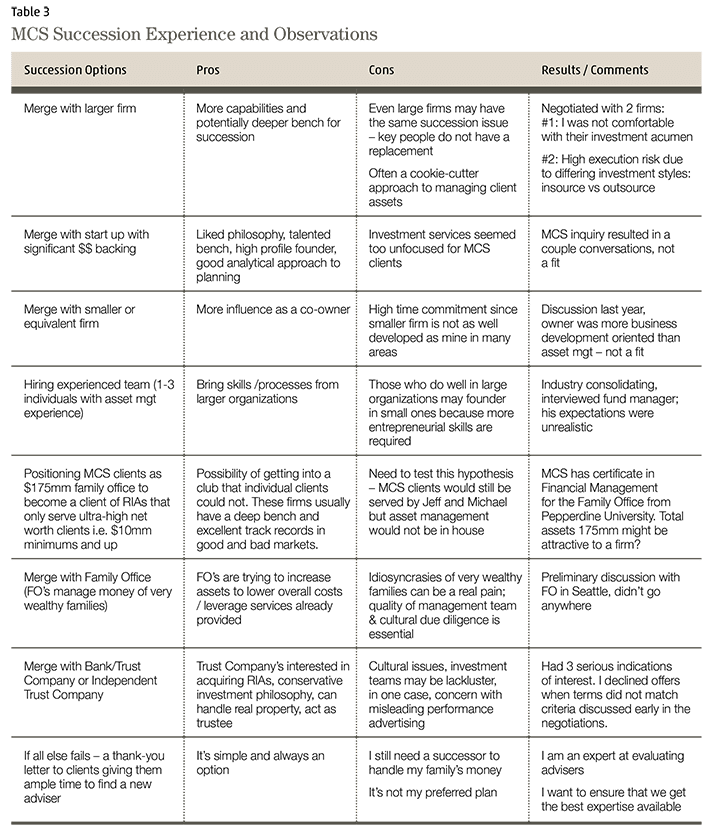

Table 3 (below) is a compressed journal of my efforts at succession ‘dating’. In some cases, there were just a couple of dates, whereas other relationships lasted far longer because we really liked each other.

What Succession Dating is Like

Like many courtship rituals, there is a get to know you phase. This can extend over many months. Each party has their own business to run which takes precedence over the courtship. We learn about the other’s way of doing business. Typically, you are looking for common investment philosophy and operational differences and similarities.

One example, I manage bond portfolios directly. I do the research and trading. Few firms know how to do this. They buy a bond fund to get bond exposure or outsource the management to another adviser that buys individual bonds.

To begin, I read the prospective firm’s website and regulatory filings ADV 1 & 2 to understand how their business works. It’s a little like Match.com but much more time consuming. If they are involved in risky behavior or obvious conflicts of interest, they do not interest me. A typical non-starter is the dual-registered firm. “Dual registered” means the adviser operates as both a fiduciary and a stockbroker (investment salesperson). I would not date (nor invest my money with) a dual registered firm, because it’s hard to tell where their obligations and loyalties lie. Many dual-registered firms are well known; Wells Fargo Advisers, Merrill Lynch, Raymond James, to name a few.

A firm offering insurance product sales is another non-starter.

On the other hand, a firm that operates both a Trust Company and a Registered Investment Adviser (like MCS) is

attractive from a legal and philosophical perspective, because both types of organizations have a fiduciary duty to

the client. I seriously dated a Trust/RIA company and a Trust Company that wanted an RIA subsidiary. The deals

fell apart on the unwillingness of both firms to offer any ownership interest to me in exchange for the ownership

for my firm.

To me, the unwillingness to offer an ownership stake, after I’ve made it clear at the beginning of discussions that:

I don’t need their money, and

I’d like to continue as an owner at some level,

is a warning sign that the suitor’s agenda is not in alignment with mine.

While the suitor may at first acknowledge my commitment to continued ownership, many suitors seem to believe that they are so wonderful in other respects that they’ll be able to charm me out of my foolish desire to continue to be an owner. My desire to retain some ownership, post-transaction, is a form of insurance. I will be highly invested in a good outcome for all. Finally, an exchange of ownership requires a valuation of both parties, and it’s telling when the acquirer is not willing to engage in an objective evaluation process of their business.

Other deal killers are positions or behaviors that suggest the suitor would not be compatible. Sometimes it just takes a phone call to realize, Nyet! I recall one adviser enthusiastically describing all the various services he offered. The guy offered many types financial services that conflicted his client’s best interests with his own. As an example; a client asks an adviser whether she should pay off her house or refinance. If the adviser is also a mortgage broker who would earn a commission on the refinance option, what do you think the answer would be? Services that put a client’s and an adviser’s financial interests in conflict are sold to the public as comprehensive; ‘We can take care of all your financial needs!’ or ‘One Stop Shop!’ Banks, for example, have many inherent conflicts across their financial services platform.

Sometimes, despite some obvious flaws, you really like a potential acquirer, and they really like you, so you try to figure out how you could work together. You minimize the deal flaws by thinking about how those issues could be overcome because a lot of other criteria has been well met. I did this with a large Oregon RIA. The deal flaw was their investment process was all outsourced (I mostly do it myself). One of the then-exiting owners had insisted on a large allocation to alternative investments (I’m not a fan of alternatives). The credentials and experience of the firm’s asset managers was not very high – there were no CFAs like me. Before becoming an independent firm, their clients and the owners had lost a lot of money in the Great Recession. However, I would have been leading the investment strategy aspect post transaction. So, I could have a lot of influence and could improve the investment process through hiring.

But, in the end, I realized that it could take five years to change that firm’s culture, and the economy would likely be in recession at some point during the change effort. It’s during a recession, when clients are losing money, that all the poor investment decisions float to the surface like dead bodies. And it begins to stink. I would have been a part-owner of this firm that had purchased risky and potentially illiquid alternative investments. I decided the execution risk was too great and stepped away. I suspect the marriage would have destroyed us – our families (firms) were so different in some ways. It just looked too hard to reconcile them when I really thought about it. We parted on good terms.

After we broke it off in late 2018, I put the succession dating on hold. This past 15 months, I shifted my part time job from succession to settling in after our move to Bend, Oregon. Moving to a new community is a significant transition. Last year, we sold our Eugene house and turned a ‘test the waters’ Bend home into a rental. Although I did have some preliminary merger discussions with a local firm, we concluded that it wasn’t the right fit now (It did establish a friendship with another advisor in Bend, who is also a neighbor).Finding the right suitor is not tied to geography. Suitors typically see acquisitions as a way to profitably establish a new geographical footprint. This year, I’ll renew my succession search. Please keep in mind that my target succession outcome is one that keeps me involved in the management of your assets while allowing me to step back from day to day tasks. Rest assured that your goal of not having to worry about your money is the same as mine. Finding the right successor is of the highest importance to me. Please don’t hesitate to call or email me michael@mcsfwa.com with any questions you might have.

1MCS Family Wealth Advisors (MCS) consolidated client returns are dollar-weighted, net of investment management fees unless stated otherwise, include reinvestment of dividends and capital gains and represent all clients with fully discretionary accounts under management for at least one full month during the period. Individual client returns represent client discretionary accounts under management for the entire period – starting on 12/31/2017 and ending on 09/30/2018.These accounts represent 97% of MCS’s discretionary fee-paying assets under management as of 09/30/2018 and were invested primarily in US stocks and bonds (15% of client assets on 09/30/2018 were invested in tax-exempt municipal bonds). The Stock Index values are based on the S&P 500 Total Return Index, which measures the large capitalization US equity market. The Bond Index values are based on the Barclays Capital US Aggregate Bond Index, which measures the US investment-grade bond market. Index values are for comparison purposes only. The report is for information purposes only and does not consider the specific investment objective, financial situation, or particular needs of any recipient, nor is it to be construed as an offer to sell or solicit investment management or any other services. Past performance is not indicative of future results. 2Note: MCS uses index funds on a limited basis 3An RIA rollup acquirer, or consolidator, structures a buy-out of RIA firms, typically through a combination of a partial up-front payment to the RIA owner(s) with a continuing interest in the business. Tens, or even hundreds of firms may be acquired by one consolidator.

Categories

2019 Year End Newsletter and Outlook

2019 Year End Newsletter and Outlook

Despite a trade war and recession fears, 2019 was a blowout year for risk taking. Long-term bonds and stocks posted significant gains as the Fed reduced interest rates to abate recession fears. In 2019 (if MCS clients’ investments were treated as one large portfolio including their cash), on average clients gained 5.35%1, after fees. For comparison purposes, the S&P 500 Total Return Stock Index (S&P 500) gained 31.49%, and the Barclays Aggregate Bond Index gained 8.72%. The range of MCS individual client returns was from a gain of 0.99% to a gain of 17.33%.

Clients with the lowest returns were newer to MCS and were cautiously invested in the low interest rate environment of the past few years (in the hopes rates would increase), whereas clients with the highest returns had high coupon bonds and higher overall allocations to equities. Overall, MCS client returns were muted by the defensive posture of portfolios. Short-term bonds and low overall exposure to stocks, an excellent strategy in 2018, was a middling strategy in 2019. What about this year?

The general consensus for 2020 is ‘risk on’ – meaning take more risk: more stock exposure should be rewarded.

If you have a contrarian bent, you’d observe that at the end on 2018 it was a more ‘risk off’ consensus and the market subsequently performed very well. If the consensus is ‘risk on’ now, the contrarian view would be a ‘risk off’ tilt since prices already reflect a positive outlook for 2020. The argument for still higher prices is there isn’t much alternative to achieve higher returns except to take more risk; bond yields are extremely low and stocks, despite the high prices, offer more potential upside. This is certainly possible.

The 2020 risk factors include:

In summary, the consensus view is ‘take more risk’ because the above cited risks are unlikely to manifest in a materially negative way. My view is more in line with Howard Marks, Co-Chairman of Oaktree Capital Group, a very well-respected, high yield (junk) bond investor. Both junk bond and stock prices are highly sensitive to the economic outlook and, in a recession, can decline significantly. Falling junk bond prices may foreshadow trouble for stocks.

“The market’s been up for 11 years, it’s quadrupled off the low, we’re in the longest bull market, the longest expansion in history, profits are not rising, stock prices are, it’s what we call a liquidity-driven rally,” he (Marks) said in an interview on Bloomberg Television. “It doesn’t mean that the market’s going to go down tomorrow, but it does mean that the odds are not, in my opinion, in the investor’s favor.”

The strong counterargument is the liquidity-driven rally will keep going and drive prices even higher.

That said, if you are feeling like you’d prefer more risk exposure in your portfolio or would like to evaluate the possibly, let’s have a conversation or send me an email (michael@mcsfwa.com). It’s not difficult to increase your stock exposure.

Michael, when are you going to retire?

An Update on My Succession Dating Adventures

First, let’s start with the question: What do I mean by retirement and succession? Wikipedia defines retirement as “the withdrawal from one’s position or occupation or from one’s active working life.” Succession is a gradual semi-retirement; in my case, a transition of portfolio management and administrative duties to other skilled professional(s) while I retain portfolio and financial services input and supervise the results. I am pursuing a semi-retirement, something that many clients have done.

While my primary job is managing your money, executing a solid succession plan has felt like a second, part-time job focused on courtship and marriage. I last wrote about succession in our 2016 3rd quarter newsletter, and I have done a lot of ‘dating’ since then.

So far, I have not found ‘the one’.

This financial adviser courtship and marriage thing is ‘Yuge’ and growing – not just for small businesses like mine but for very large ones as well. To wit; the proposed Schwab / TD Ameritrade merger is valued at $26 billion. Consolidation is happening everywhere. In 2019, merger and acquisition activity reached a record high for the seventh straight year. So, there’s lots of money and interest chasing deals these days and lots of options out there. Mergers are being driven by investor use of index funds (forcing mergers of mutual fund groups)2 and demographics (38% of advisers are expected to retire in the next 10 years). It’s fair to say that most advisers in their late 50’s and older are either thinking or doing something about this now. Table 2 describes our efforts to prepare for succession.

Table 3 (below) is a compressed journal of my efforts at succession ‘dating’. In some cases, there were just a couple of dates, whereas other relationships lasted far longer because we really liked each other.

What Succession Dating is Like

Like many courtship rituals, there is a get to know you phase. This can extend over many months. Each party has their own business to run which takes precedence over the courtship. We learn about the other’s way of doing business. Typically, you are looking for common investment philosophy and operational differences and similarities.

To begin, I read the prospective firm’s website and regulatory filings ADV 1 & 2 to understand how their business works. It’s a little like Match.com but much more time consuming. If they are involved in risky behavior or obvious conflicts of interest, they do not interest me. A typical non-starter is the dual-registered firm. “Dual registered” means the adviser operates as both a fiduciary and a stockbroker (investment salesperson). I would not date (nor invest my money with) a dual registered firm, because it’s hard to tell where their obligations and loyalties lie. Many dual-registered firms are well known; Wells Fargo Advisers, Merrill Lynch, Raymond James, to name a few.

A firm offering insurance product sales is another non-starter.

On the other hand, a firm that operates both a Trust Company and a Registered Investment Adviser (like MCS) is

attractive from a legal and philosophical perspective, because both types of organizations have a fiduciary duty to

the client. I seriously dated a Trust/RIA company and a Trust Company that wanted an RIA subsidiary. The deals

fell apart on the unwillingness of both firms to offer any ownership interest to me in exchange for the ownership

for my firm.

To me, the unwillingness to offer an ownership stake, after I’ve made it clear at the beginning of discussions that:

is a warning sign that the suitor’s agenda is not in alignment with mine.

While the suitor may at first acknowledge my commitment to continued ownership, many suitors seem to believe that they are so wonderful in other respects that they’ll be able to charm me out of my foolish desire to continue to be an owner. My desire to retain some ownership, post-transaction, is a form of insurance. I will be highly invested in a good outcome for all. Finally, an exchange of ownership requires a valuation of both parties, and it’s telling when the acquirer is not willing to engage in an objective evaluation process of their business.

Other deal killers are positions or behaviors that suggest the suitor would not be compatible. Sometimes it just takes a phone call to realize, Nyet! I recall one adviser enthusiastically describing all the various services he offered. The guy offered many types financial services that conflicted his client’s best interests with his own. As an example; a client asks an adviser whether she should pay off her house or refinance. If the adviser is also a mortgage broker who would earn a commission on the refinance option, what do you think the answer would be? Services that put a client’s and an adviser’s financial interests in conflict are sold to the public as comprehensive; ‘We can take care of all your financial needs!’ or ‘One Stop Shop!’ Banks, for example, have many inherent conflicts across their financial services platform.

Sometimes, despite some obvious flaws, you really like a potential acquirer, and they really like you, so you try to figure out how you could work together. You minimize the deal flaws by thinking about how those issues could be overcome because a lot of other criteria has been well met. I did this with a large Oregon RIA. The deal flaw was their investment process was all outsourced (I mostly do it myself). One of the then-exiting owners had insisted on a large allocation to alternative investments (I’m not a fan of alternatives). The credentials and experience of the firm’s asset managers was not very high – there were no CFAs like me. Before becoming an independent firm, their clients and the owners had lost a lot of money in the Great Recession. However, I would have been leading the investment strategy aspect post transaction. So, I could have a lot of influence and could improve the investment process through hiring.

But, in the end, I realized that it could take five years to change that firm’s culture, and the economy would likely be in recession at some point during the change effort. It’s during a recession, when clients are losing money, that all the poor investment decisions float to the surface like dead bodies. And it begins to stink. I would have been a part-owner of this firm that had purchased risky and potentially illiquid alternative investments. I decided the execution risk was too great and stepped away. I suspect the marriage would have destroyed us – our families (firms) were so different in some ways. It just looked too hard to reconcile them when I really thought about it. We parted on good terms.

After we broke it off in late 2018, I put the succession dating on hold. This past 15 months, I shifted my part time job from succession to settling in after our move to Bend, Oregon. Moving to a new community is a significant transition. Last year, we sold our Eugene house and turned a ‘test the waters’ Bend home into a rental. Although I did have some preliminary merger discussions with a local firm, we concluded that it wasn’t the right fit now (It did establish a friendship with another advisor in Bend, who is also a neighbor).Finding the right suitor is not tied to geography. Suitors typically see acquisitions as a way to profitably establish a new geographical footprint. This year, I’ll renew my succession search. Please keep in mind that my target succession outcome is one that keeps me involved in the management of your assets while allowing me to step back from day to day tasks. Rest assured that your goal of not having to worry about your money is the same as mine. Finding the right successor is of the highest importance to me. Please don’t hesitate to call or email me michael@mcsfwa.com with any questions you might have.

1MCS Family Wealth Advisors (MCS) consolidated client returns are dollar-weighted, net of investment management fees unless stated otherwise, include reinvestment of dividends and capital gains and represent all clients with fully discretionary accounts under management for at least one full month during the period. Individual client returns represent client discretionary accounts under management for the entire period – starting on 12/31/2017 and ending on 09/30/2018.These accounts represent 97% of MCS’s discretionary fee-paying assets under management as of 09/30/2018 and were invested primarily in US stocks and bonds (15% of client assets on 09/30/2018 were invested in tax-exempt municipal bonds). The Stock Index values are based on the S&P 500 Total Return Index, which measures the large capitalization US equity market. The Bond Index values are based on the Barclays Capital US Aggregate Bond Index, which measures the US investment-grade bond market. Index values are for comparison purposes only. The report is for information purposes only and does not consider the specific investment objective, financial situation, or particular needs of any recipient, nor is it to be construed as an offer to sell or solicit investment management or any other services. Past performance is not indicative of future results.

2Note: MCS uses index funds on a limited basis

3An RIA rollup acquirer, or consolidator, structures a buy-out of RIA firms, typically through a combination of a partial up-front payment to the RIA owner(s) with a continuing interest in the business. Tens, or even hundreds of firms may be acquired by one consolidator.