As you might imagine, I often find myself working late these days (some of you can attest to this because I’m answering your emails at 9pm or later). There is so much to absorb and process. We are putting in long hours to stay ahead of the pandemic’s operational and investment impact.

We have sent you, and will continue to send you, operational updates and recommendations to help you understand and personally adjust to the changing circumstances.

Results

In the first quarter of 2020 (if MCS clients’ investments were treated as one large portfolio including their cash), on average clients lost 1.90%1, after fees. For comparison purposes, the S&P 500 Total Return Stock Index (S&P 500) fell 19.60%, and the Barclays Aggregate Bond Index gained 3.15%. The range of MCS individual client returns was from a gain of 1.10% to a loss of 12.24%.

The clients with the lowest returns had higher overall allocations to equities, however, most of their investments were in separately reported retirement accounts with very low equity exposure. Clients with the highest returns had no equity exposure at all. Overall, MCS client returns were protected by the defensive posture of their portfolios. Short term bonds and low overall exposure to stocks, a ho-hum strategy in 2019, was an excellent strategy in the first quarter of 2020.

The Market and the Pandemic: Light at Tunnel’s End or Oncoming Train?

We’re not taking anything for granted. People are suffering, dying, and it’s damn scary. And mistakes will be made – by everyone (they’re being made now). And breakthroughs, and heroics by ‘ordinary’ people doing their jobs despite tremendous hardship and risk, and triumphs – these are part of this as well. Still, you can be scared and very functional – maybe hyper-functional. There is an aspect to a crisis that quite frankly invigorates me: so many things vying for my attention, the uncertainty, the contradictions, and the stakes – protecting my clients’ life savings.

The Fed (the United States Federal Reserve Bank) had to take VERY significant measures to counteract the economic slowdown caused by the COVID-19 (C-19) pandemic, otherwise an economic Depression would have likely ensued. A Depression may yet transpire, but the Fed’s interventions have reduced the odds of that outcome. Yet the Fed’s actions to date comprise a huge bet on the nature of the pandemic: going all in on the premise of ONE (ginormous financial push) and DONE.

The bet is this: flatten the curve, move hospitalizations from the brink of disaster to where the illness is manageable for the healthcare system, and then gradually reopen the economy without starting a new upward advance in the infection curve. The payoff of the winning bet is a relatively happy ending: the economy starts recovering in the late third and fourth quarter, and next year we’ll be off to the races with sports stadiums, concerts, air travel, and bars right back where they were before this all started.

As I write this, the market has rallied very strongly off its March lows. The stock market has gone all-in on the Fed’s bet. With C-19 cases peaking, the market is reacting as if the massive government stimulus will work its magic and the economy will fully reboot by 2021. Goldman Sachs and many others agree, and they say it’s time to buy beaten down stocks.

Well, that outcome is certainly possible.

My perspective is that a strong economic recovery, amped up by the Fed’s creation of trillions of dollars, is already priced into the markets. The odds are that the US economic rebound will be very uneven, varying by industry, and it will not quickly recover to pre-pandemic levels.

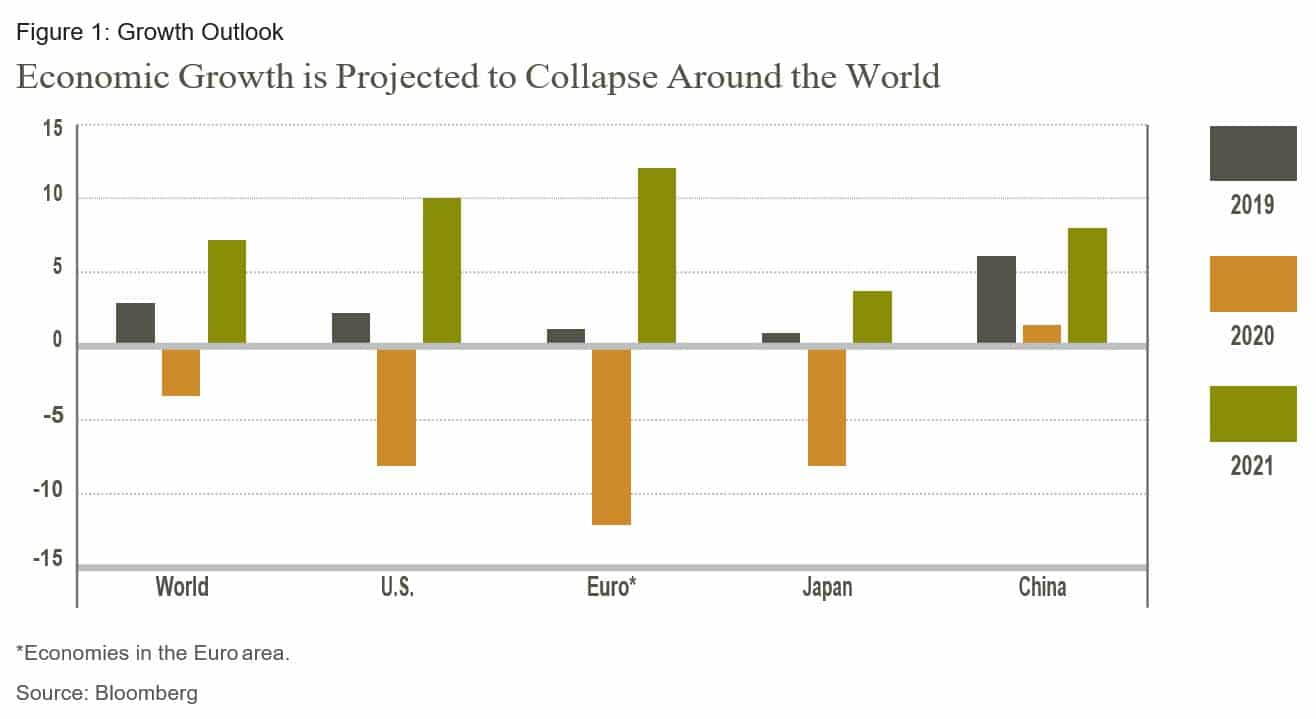

Figure 1 below (conveniently) illustrates growth in 2021 making up all the losses from 2020. Whew! Don’t I feel better now… (sarcasm)

We are already seeing headlines screaming about record improvements in this economic index or that, such as this Reuters, March 18th headline: “U.S. oil reverses losses, posts largest one-day gain on record.”

As exciting and encouraging as a one-day, 25% price gain sounds, it must be viewed in context. Oil prices had already declined from roughly $60 to $20 per barrel, a loss of roughly 67%. This 25% record one-day gain moved prices from $20 to $25! The problem is many US shale oil producers must get $48-54 a barrel to break even – cutting cost aggressively might get them to around a $40-barrel break even.

Note: As I am editing my newsletter (on April 20th), oil delivery contracts (futures) settling tomorrow plunged into historically unprecedented negative prices. The May 2020 West Texas Intermediate oil futures contract settled at -$37.63 per barrel today. Because there is no place to store oil, those holding contracts to receive oil deliveries are paying to have it taken off their hands.

We are going to see a lot of headlines about record gains as the economy restarts. Don’t be fooled by big improvements off a disastrous base number.

My point is this: there seems to be no margin of error in current prices. When I reflect on how this pandemic (a known risk, like earthquakes and other natural disasters) has caught the US and most of the developed world so off guard, I become… well… more guarded.

Execution, Execution, Execution

Saying is one thing, but Doing in a chaotic, complex situation is just not easy.

Vaccine

70 Covid-19 Vaccines are in Development.

How does vaccine selection work? Does the first to the finish line win?

As a consumer anxious to get a vaccine, but wary of being part of a rushed expiriment, how the heck do I sort this out?

Maybe I let others get the first vaccine(s), stay at home, and see how it goes.

The Schism: Your Money or Your Life (or Both)?

What does society accept as the health / economic /cultural cost for resuming the economy? It looks like

a very messy experiment…

By cultural cost, I mean the level of privacy that we need to give up in order to track and contain the

outbreaks.

Federal vs. state vs. state conflict

Differences over the ‘correct’ response to the emerging pandemic resulted in varying timelines regarding

shelter in place orders.

They fell along political party lines, with some exceptions (Ohio).

The same differences are playing out now in (and within) states that want to lift shelter in place orders.

Conflict about reopening the economy reveals the inability of the Federal government to coordinate a

national policy.

Testing: Reliable, easily available tests and contact tracing all need to come together.

The promise of accurate, broad based testing hasn’t come close to the reality.

High probability of multiple types of tests competing with each other.

Shortages of reagents, supplies needed to get to large scale test implementation.

It’s not clear yet that having C-19 antibodies (an objective of testing) confers immunity from disease. Will enough Americans comply to make tracing effective, or will privacy issues intercede?

The pandemic itself is bouncing around all over the world and is being addressed at different speeds and levels of

intervention, hence even successful efforts may be undone.

The Economy – What does the recovery path look like?

Chicken (supply) or Egg (demand) first? It’s unclear:

While consumer demand started to wane as the virus threat became better recognized, shelter in place requirements destroyed the supply of goods and services and lead to massive layoffs (demand). The belief is that, if we can get people back to work improving supply, demand that is ‘pent up’ will encourage a virtuous cycle of increased employment / more demand, and the economy will recover quickly.

OR does it? The government stimulus checks are designed to buy time and keep consumer pent-up demand strong enough to jump start the economy. But if the economic restart takes too long (C-19 persists), those government checks will have been spent, and pent-up demand will fade very quickly due to a lack of employment income. This could mean a much deeper, longer-lasting recession.

$350 billion for small businesses, on a first come, first served basis, has run out. Another $320 billion is authorized.

Stock market prices, a leading indicator, already reflect a quick recovery

A stop and start or slower than expected recovery will put renewed pressure on asset prices.

The Fed is essentially creating money and credit facilities to support market functioning and to make up for the economic shock, both of which are unprecedented in terms of their speed and scope.

The recovery outside the US will be at varying speeds as countries adjust their reopening strategies to pandemic realities. The virus is not going away soon.

Consumer purchases make up roughly 70% of the economy.

Consumers will prioritize their spending based on how safe they feel, not by some political mandate.

Older and more affluent consumers may be more cautious about reengaging in pre-C-19 activities

The unemployed and ‘soon to be’ were financially strapped while employed. Almost half of Americans surveyed by the Fed last year said they had no emergency savings. Sixty percent (including those with no savings) could not cover three months of expenses. Despite the longest bull market on record, most Americans’ standard of living has been tenuous since the Great Recession of 2007-08. Will government checks be enough to thicken the thin financial ice that most Americans skate on?

The Fed Short-Circuits MCS Strategy

Desperate times call for desperate measures, and in March the Fed stepped up and calmed the markets with the unprecedented interventions mentioned above – dwarfing the assistance provided in the Great Recession.

As the pandemic unfolded, and over-inflated valuations came back down to earth, I started to see opportunities develop. With trillions of freshly printed new monies (money created out of thin air), the Fed re-inflated prices when it agreed to buy all manner of assets; including investment grade and junk corporate bonds and municipal bonds. The Fed intervention stepped in front of the investments I had hoped to make on your behalf.

MCS Strategy

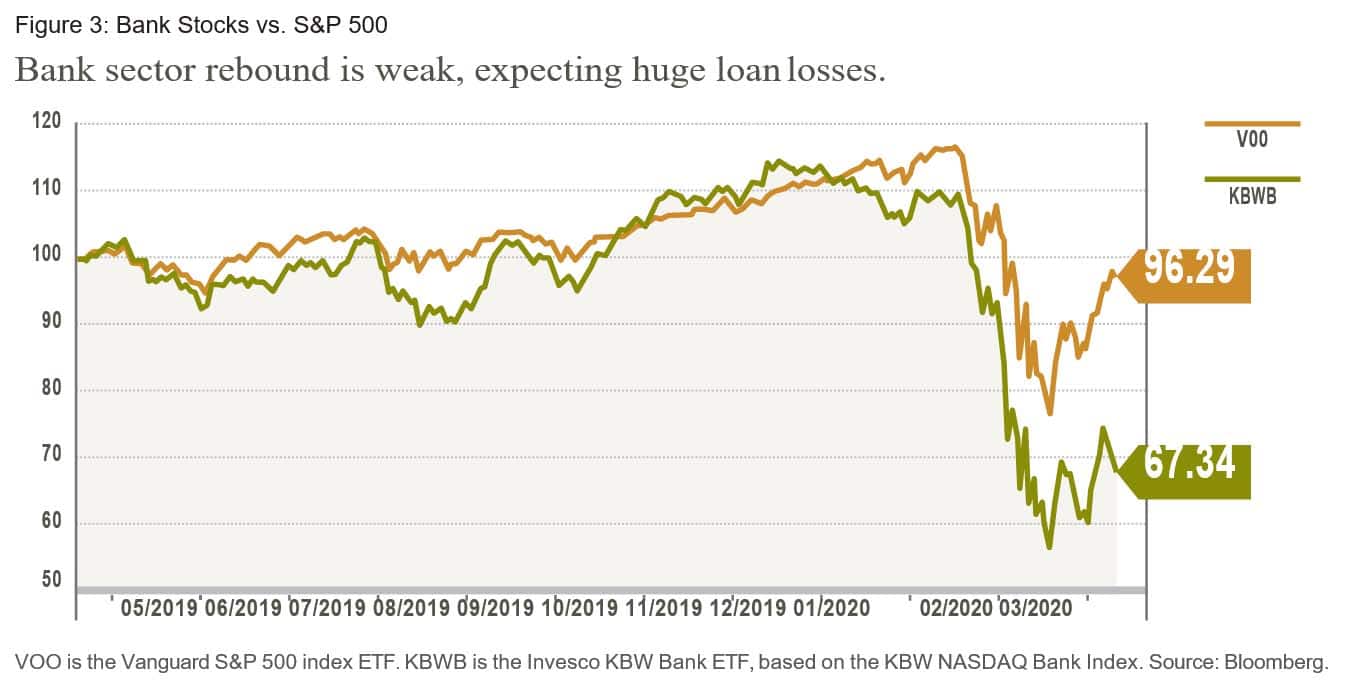

Currently, most stocks and bonds, including broad indexes, do not offer enough potential upside gain vs downside loss. The Fed’s massive intervention has boosted assets prices and stabilized markets. I am researching investments that more clearly reflect the current state of the US and global economy. Assets that are not benefiting from the Fed’s money printing may offer better value. Tellingly, bank stocks have not enjoyed the rally that other stocks have. This suggests that, despite banks being in much better financial condition vs 2008, all is not right with the quick recovery thesis (Figure 3).

Bottom Line

Our situation is unprecedented on many levels. The government response to mitigate the economic damage is also unprecedented, and it will have significant side effects that can’t be easily determined. The world is not going back to what it was once was after this health crisis has passed.

I believe the key to getting through this is maintaining a great deal of financial flexibility and liquidity, and that is what MCS clients currently have: a healthy allocation to short-term bonds, money funds, and FDIC-Insured CDs.

There are times in economic history where the ‘winners’ are mostly those who lose the least. I am actively looking for investment opportunities on your behalf, while approaching current events with humility. I am wary of those who are too certain about what comes next. It’s worth noting that Ray Dalio’s flagship Pure Alpha II fund was gut punched by events to date (down 20% first quarter). Dalio runs the world’s largest hedge fund ($160 billion). I referenced some of his economic views in a previous newsletter.

This is chaos: a period of great uncertainty when inputs, regardless of size, can have outsized effects. The outsized effect of small inputs is well expressed in a proverb: “For Want of a Nail” dating to the 13th century and later included by Ben Franklin in Poor Richard’s Almanac, preface (1758). Even small things can make a big difference. Here is an unattributed version:

For want of a nail the shoe was lost; For want of a shoe the horse was lost; For want of a horse the bugler was lost; For want of a bugler the battle was lost; For want of a battle the war was lost; For want of the war the kingdom was lost— All for the want of a horse-shoe nail.

In the case of MCS clients, my efforts are to respect the enormity of what’s unfolding and not get nailed.

1MCS Family Wealth Advisors (MCS) consolidated client returns are dollar-weighted, net of investment management fees unless stated otherwise, include reinvestment of dividends and capital gains and represent all clients with fully discretionary accounts under management for at least one full month in 2020. Individual client returns represent client discretionary accounts under management for the entire period – starting on 12/31/2019 and ending on 03/31/2020. These accounts represent 99% of MCS’s discretionary fee-paying assets under management as of 03/31/2020 and were invested primarily in US stocks and bonds (9% of client assets on 03/31/2020 were invested in tax-exempt municipal bonds). The Stock Index values are based on the S&P 500 Total Return Index, which measures the large capitalization US equity market. The Bond Index values are based on the Barclays Capital US Aggregate Bond Index, which measures the US investment-grade bond market. Index values are for comparison purposes only. The report is for information purposes only and does not consider the specific investment objective, financial situation, or particular needs of any recipient, nor is it to be construed as an offer to sell or solicit investment management or any other services. Past performance is not indicative of future results.

Categories

COVID-19 and Its Economic Repercussions

COVID-19 and Its Economic Repercussions

As you might imagine, I often find myself working late these days (some of you can attest to this because I’m answering your emails at 9pm or later). There is so much to absorb and process. We are putting in long hours to stay ahead of the pandemic’s operational and investment impact.

We have sent you, and will continue to send you, operational updates and recommendations to help you understand and personally adjust to the changing circumstances.

Results

In the first quarter of 2020 (if MCS clients’ investments were treated as one large portfolio including their cash), on average clients lost 1.90%1, after fees. For comparison purposes, the S&P 500 Total Return Stock Index (S&P 500) fell 19.60%, and the Barclays Aggregate Bond Index gained 3.15%. The range of MCS individual client returns was from a gain of 1.10% to a loss of 12.24%.

The clients with the lowest returns had higher overall allocations to equities, however, most of their investments were in separately reported retirement accounts with very low equity exposure. Clients with the highest returns had no equity exposure at all. Overall, MCS client returns were protected by the defensive posture of their portfolios. Short term bonds and low overall exposure to stocks, a ho-hum strategy in 2019, was an excellent strategy in the first quarter of 2020.

The Market and the Pandemic: Light at Tunnel’s End or Oncoming Train?

We’re not taking anything for granted. People are suffering, dying, and it’s damn scary. And mistakes will be made – by everyone (they’re being made now). And breakthroughs, and heroics by ‘ordinary’ people doing their jobs despite tremendous hardship and risk, and triumphs – these are part of this as well. Still, you can be scared and very functional – maybe hyper-functional. There is an aspect to a crisis that quite frankly invigorates me: so many things vying for my attention, the uncertainty, the contradictions, and the stakes – protecting my clients’ life savings.

The Fed (the United States Federal Reserve Bank) had to take VERY significant measures to counteract the economic slowdown caused by the COVID-19 (C-19) pandemic, otherwise an economic Depression would have likely ensued. A Depression may yet transpire, but the Fed’s interventions have reduced the odds of that outcome. Yet the Fed’s actions to date comprise a huge bet on the nature of the pandemic: going all in on the premise of ONE (ginormous financial push) and DONE.

The bet is this: flatten the curve, move hospitalizations from the brink of disaster to where the illness is manageable for the healthcare system, and then gradually reopen the economy without starting a new upward advance in the infection curve. The payoff of the winning bet is a relatively happy ending: the economy starts recovering in the late third and fourth quarter, and next year we’ll be off to the races with sports stadiums, concerts, air travel, and bars right back where they were before this all started.

As I write this, the market has rallied very strongly off its March lows. The stock market has gone all-in on the Fed’s bet. With C-19 cases peaking, the market is reacting as if the massive government stimulus will work its magic and the economy will fully reboot by 2021. Goldman Sachs and many others agree, and they say it’s time to buy beaten down stocks.

Well, that outcome is certainly possible.

My perspective is that a strong economic recovery, amped up by the Fed’s creation of trillions of dollars, is already priced into the markets. The odds are that the US economic rebound will be very uneven, varying by industry, and it will not quickly recover to pre-pandemic levels.

Figure 1 below (conveniently) illustrates growth in 2021 making up all the losses from 2020. Whew! Don’t I feel better now… (sarcasm)

We are already seeing headlines screaming about record improvements in this economic index or that, such as this Reuters, March 18th headline: “U.S. oil reverses losses, posts largest one-day gain on record.”

As exciting and encouraging as a one-day, 25% price gain sounds, it must be viewed in context. Oil prices had already declined from roughly $60 to $20 per barrel, a loss of roughly 67%. This 25% record one-day gain moved prices from $20 to $25! The problem is many US shale oil producers must get $48-54 a barrel to break even – cutting cost aggressively might get them to around a $40-barrel break even.

Note: As I am editing my newsletter (on April 20th), oil delivery contracts (futures) settling tomorrow plunged into historically unprecedented negative prices. The May 2020 West Texas Intermediate oil futures contract settled at -$37.63 per barrel today. Because there is no place to store oil, those holding contracts to receive oil deliveries are paying to have it taken off their hands.

We are going to see a lot of headlines about record gains as the economy restarts. Don’t be fooled by big improvements off a disastrous base number.

My point is this: there seems to be no margin of error in current prices. When I reflect on how this pandemic (a known risk, like earthquakes and other natural disasters) has caught the US and most of the developed world so off guard, I become… well… more guarded.

Execution, Execution, Execution

Saying is one thing, but Doing in a chaotic, complex situation is just not easy.

a very messy experiment…

outbreaks.

shelter in place orders.

national policy.

intervention, hence even successful efforts may be undone.

The Economy – What does the recovery path look like?

The Fed Short-Circuits MCS Strategy

Desperate times call for desperate measures, and in March the Fed stepped up and calmed the markets with the unprecedented interventions mentioned above – dwarfing the assistance provided in the Great Recession.

As the pandemic unfolded, and over-inflated valuations came back down to earth, I started to see opportunities develop. With trillions of freshly printed new monies (money created out of thin air), the Fed re-inflated prices when it agreed to buy all manner of assets; including investment grade and junk corporate bonds and municipal bonds. The Fed intervention stepped in front of the investments I had hoped to make on your behalf.

MCS Strategy

Currently, most stocks and bonds, including broad indexes, do not offer enough potential upside gain vs downside loss. The Fed’s massive intervention has boosted assets prices and stabilized markets. I am researching investments that more clearly reflect the current state of the US and global economy. Assets that are not benefiting from the Fed’s money printing may offer better value. Tellingly, bank stocks have not enjoyed the rally that other stocks have. This suggests that, despite banks being in much better financial condition vs 2008, all is not right with the quick recovery thesis (Figure 3).

Bottom Line

Our situation is unprecedented on many levels. The government response to mitigate the economic damage is also unprecedented, and it will have significant side effects that can’t be easily determined. The world is not going back to what it was once was after this health crisis has passed.

I believe the key to getting through this is maintaining a great deal of financial flexibility and liquidity, and that is what MCS clients currently have: a healthy allocation to short-term bonds, money funds, and FDIC-Insured CDs.

There are times in economic history where the ‘winners’ are mostly those who lose the least. I am actively looking for investment opportunities on your behalf, while approaching current events with humility. I am wary of those who are too certain about what comes next. It’s worth noting that Ray Dalio’s flagship Pure Alpha II fund was gut punched by events to date (down 20% first quarter). Dalio runs the world’s largest hedge fund ($160 billion). I referenced some of his economic views in a previous newsletter.

This is chaos: a period of great uncertainty when inputs, regardless of size, can have outsized effects. The outsized effect of small inputs is well expressed in a proverb: “For Want of a Nail” dating to the 13th century and later included by Ben Franklin in Poor Richard’s Almanac, preface (1758). Even small things can make a big difference. Here is an unattributed version:

For want of a nail the shoe was lost;

For want of a shoe the horse was lost;

For want of a horse the bugler was lost;

For want of a bugler the battle was lost;

For want of a battle the war was lost;

For want of the war the kingdom was lost—

All for the want of a horse-shoe nail.

In the case of MCS clients, my efforts are to respect the enormity of what’s unfolding and not get nailed.

1MCS Family Wealth Advisors (MCS) consolidated client returns are dollar-weighted, net of investment management fees unless stated otherwise, include reinvestment of dividends and capital gains and represent all clients with fully discretionary accounts under management for at least one full month in 2020. Individual client returns represent client discretionary accounts under management for the entire period – starting on 12/31/2019 and ending on 03/31/2020. These accounts represent 99% of MCS’s discretionary fee-paying assets under management as of 03/31/2020 and were invested primarily in US stocks and bonds (9% of client assets on 03/31/2020 were invested in tax-exempt municipal bonds). The Stock Index values are based on the S&P 500 Total Return Index, which measures the large capitalization US equity market. The Bond Index values are based on the Barclays Capital US Aggregate Bond Index, which measures the US investment-grade bond market. Index values are for comparison purposes only. The report is for information purposes only and does not consider the specific investment objective, financial situation, or particular needs of any recipient, nor is it to be construed as an offer to sell or solicit investment management or any other services. Past performance is not indicative of future results.