“Toto, I’ve a feeling we’re not in Kansas any more.”

Financial Tornado #1

On Monday morning, August 24, 2015, panicky US investors had a boatload of sell orders lined up for the New York Stock Exchange’s 9:30 opening bell. The Chinese stock market had dropped a stunning 8% the day before. By 9:33 the Dow had lost a whopping 1,089 points – the largest point drop ever1. By 9:44, markets were recovering, down just 544. Trading was halted over 1200 times that day due to order imbalances.

Like a tornado, the market panic touched down only briefly and then dissipated. The Dow would subsequently

recover to end down ‘only’ 588 or 3.58%. For more detail see: http://money.cnn.com/2015/08/24/investing/stocks-markets-selloff-china-crash-dow/

Climate Change #1

The financial tornado laid bare concerns I have about how the structure of financial markets has changed since the Great Recession of 2008: concerns that my money manager friends and I have been discussing for some time. In some ways, these changes have made the financial system stronger: financial institutions can not engage in the risky behavior that got them into trouble. However, that risky behavior would sometimes provide market stability. When brokers are allowed to trade for their own accounts to make a profit, they at times provide needed liquidity to the markets and mitigate downturns. Because brokers and banks face significant regulatory restrictions; they will not be buyers hoping to profit from some panicky investors.

Another reason to believe that markets will be more volatile: the dramatic rise in the use of exchange traded funds (ETFs). Unlike open end mutual funds which price at the end of the day, ETFs are mutual funds that trade like stocks throughout the day. With an ETF you can buy or sell an entire basket of stocks with a single trade anytime. Normally there is an orderly balance between buyers and sellers. But what happens when sellers greatly out number buyers? A 1,000 point loss in 3 minutes is what happens. Today, there are many financial advisors that use ETFs to implement most or all of their investment strategy.

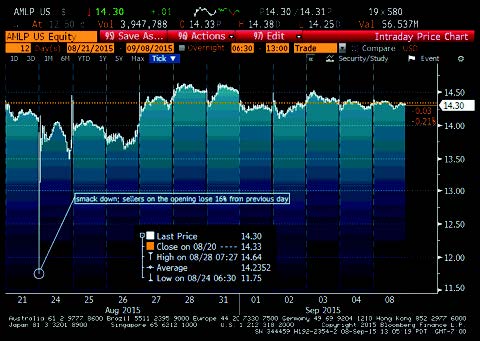

MCS clients have very low exposure to ETF’s – less than 5% of their portfolio. Below illustrates what happened to AMLP, an ETF that most MCS clients do own. Sellers on the opening lost 16% from the previous day, but the price quickly recovered. Ouch!

Source: Bloomberg

ETFs pose a liquidity mismatch, or structural problem, to market operations because selling an ETF is quicker and easier than selling all the underlying securities. Normally, ETF buyers and sellers can be matched and ETF pricing stays within pennies of the underlying shares’ prices. On August 24th, ETF share prices disconnected from their underlying stocks’ prices. This caused some ETFs to drop substantially more than the underlying portfolio – handing outsized losses to sellers. A bigger area of concern is bond ETFs. Bonds are less liquid than stocks and investors stampeding to get out of bond ETFs could force ETF or bonds prices lower than expected, disrupting interest rate signals which could be very negative for other securities.

Financial Tornado #2

On August 26, 2015 a second tornado hit Bank of New York Mellon Corp, the world’s largest mutual fund custodian. A computer ‘glitch’ prevented the custodian from accurately pricing 796 mutual funds. The Wall Street Journal explained the problem as follows (emphasis added):

People can trade thousands of securities betting on assets around the world in a blink of an eye. Ultimately, though, they all end up with BNY Mellon or rivals that officially record who owns what and what those holdings are worth. If the system that tracks that information fails, trades can’t flow smoothly, and some investors may have difficulties getting their money. Last week, that system failed.

SunGard said that routine maintenance of its widely used InvestOne platform caused both the system and a backup to become corrupted. The problems were so severe that SunGard had to rebuild its system from scratch.

While I have no information regarding the nature of ‘glitch’, it would not surprise me to learn that SunGard’s system was the victim of a cyber attack. My point here is not rumor mongering, but to observe that there are forces in the world that would like nothing better than to accomplish what this ‘glitch’ accomplished – disruption of key financial markets.

See: http://www.wsj.com/articles/all-night-push-after-glitch-hit-bny-mellon-1441322064

Climate Change #2 ‐ Rise of the Machines

Over the past decade, markets have become increasingly dominated by computer driven trading strategies. These short-term money making strategies have nothing to do with long-term investing in a profitable company’s stock or bond. Rather, these strategies profit from split-second changes in relationships between securities or in events that affect securities prices throughout the day. Computer programs can buy and re-sell securities in seconds. Many of these programs respond to similar circumstances. Under the wrong conditions, computer programs reacting to the same signals can create a cascade or avalanche effect sending prices plummeting.

Bottom Line

Financial Climate Change Can Trigger Scary Weather

No one fully understands all the ramifications of the changes in the financial markets’ structure. A 1,000 point or more down day on the Dow 30 Stocks could easily occur if investment sentiment changes or for no apparent reason at all.

Over the last year I have been raising cash to take advantage of the opportunities that more volatility creates. If you have transferred cash out of your MCS-managed Schwab account, expect your portfolio’s value to fluctuate more than in the past.

These recent dramatic market events give me an opportunity to explain with actual examples how changes in the market’s structure can affect your investments. The lesson is that the short-term price of your investments can fluctuate wildly for reasons that have nothing to do with their long-term value. When a sudden market structure-driven downturn occurs, rest assured that I have thought about what I am going to do. I will wait for the dust to clear and look for opportunities. And I will remind you that I am prepared for this possibility and feel that these short-term market reactions are not a threat to your long-term financial security. Carry On.

1This is not close to the largest single day percentage drop. That record is held by the Oct. 19, 1987 crash of 22.61% or the equivalent of a 3,721 point drop based on the Dow’s close of 16,450 on August 21, 2015.