Oregon is a beautiful and peaceful place to live – but how good an idea is retiring in Bend, Oregon? Read on and we’ll tell you what you need to know!

Before we get started, we are financial advisors in Bend with clients located across the country. We’ve written the following blogs about financial matters in Oregon, please check them out if you’d like.

Why are people moving from California to Bend Oregon?

Protect yourself from financial scams in Bend, Oregon!

Is living in Bend Oregon expensive?

And now onto the blog!

Is Bend, Oregon a good place to retire?

We think it is.

However, we’re biased – we live here and so do many of our clients.

As fee-only financial advisors in Bend and Eugene Oregon, serving clients across the country, we’ve seen our fair share of Oregon retirements. Here is what you need to know if you are considering retiring in Bend, Oregon.

#1 It’s a tad bit expensive to live here

The cost of living in Bend, Oregon, is over 5% higher than the rest of the country, according to Salary.com.

Yet despite how expensive it is, there has been an exodus of Californians moving to Bend in recent years. So even though it may be not be cheap to live in Bend, Oregon at the moment, in some cases it may be less than what you are used to, depending upon where you are coming from.

It’s important to note that inflation statistics may be what they are – and at the time of this blog’s writing inflation is at record highs – but that doesn’t necessarily dictate your personal experience with inflation. Some folks are great with sticking to a budget and living frugally, perhaps even espousing minimalism and exercising discretion with their consumption expenditures. Whether or not you subscribe to these practices varies with each person – and for that reason it is hard to predict how a generally high cost of living in Bend will impact your life.

If you are considering retiring in Bend, Oregon or perhaps just maybe want to get a better handle on your finances, it can’t hurt to think about putting together a retirement strategy to guide you. We are a fee-only, fiduciary wealth management firm based in Bend and Eugene Oregon, and we help folks in these locations as well as across the country with just that. Let us know if you’d like to discuss.

#2 Real estate has skyrocketed in price

Real estate is cyclical and can fluctuate in value – but at the time of this writing, the home prices in Bend, Oregon are off the charts! There is low inventory and supply shortages, resulting in the median home price being 76% higher than for the rest of the country. We’ve detailed all of this research in our blog on how expensive living in Bend is.

You may eventually wind up living in a retirement home in Bend, Oregon – and there are several quite lovely ones here – but for now let’s assume that is not the case.

#3 It’s just splendid

You should do your own research but in our opinion, we think that Bend, Oregon is a good place to retire and a delightful place to live for these reasons:

- Laid back vibe

- Invigorating food and arts scene

- Family-friendly environment

- Beautiful natural attractions such as Deschutes River Trail, Tumalo Falls, etc.

So to revisit the original question…is Bend, Oregon a good place to retire? Yes; if you are able to responsibly handle your financial affairs, we believe it is one of the most peaceful places to retire in Oregon.

Oregon retirement planning: a hypothetical example

Here is a look at the guidelines you should be following, as illustrated through a hypothetical example of retirement planning in Bend, Oregon.

Let’s take Marianne, the pediatric dentist. After dental school she joined a local dental practice as an apprentice, working her way to the top while paying down her debt. Over a span of 25 years, through grit, hard work, and honesty, she eventually became a partner in the practice.

In her late fifties, Marianne attended a steak dinner seminar with a local financial advisor in Bend that one of her dentist colleagues had recommended. The advisor seemed to know his stuff, had a few letters after his name, and history of working with local clientele, as he was highly recommended by one of her wealthiest friends. It all seemed to make sense.

The market was booming when she retired in her early 60s. Her advisor had assumed a “conservative” 9% return on the peak value of investments, and she seemed to be on track for a sound retirement. She confidently sold her stake in the practice and sauntered off into the sunset.

Until the market crashed in 2000, continued to crash in 2001, and fell even further in 2002.

Her nest egg had shrunk by almost a third due to market decline, and she was adding to her portfolio’s deterioration by dipping into it to pay her living expenses. After three years, Marianne had to return back to work as an employee of the dental practice she sold in order to stop the bleeding.

What went wrong?

Common retirement planning mistakes

Here are the common mistakes we see with retirement planning in Bend, Oregon – and it’s not confined to just our town. Unfortunately many investors make these mistakes when trying to figure out how to retire.

Here’s where it all went wrong for Marianne.

- Didn’t reduce risk exposure as approached retirement

As you approach retirement, your time horizon becomes shorter. You have less time to recover from a market pullback. We commonly recommend that people reduce risk the closer they get to retirement, and when they retire. The market can not be predicted, and if it takes a dive there is no telling when the market will bounce back. A retirement projection is not a forecast of the future. It is an average of many possible outcomes under a specific set of assumptions.

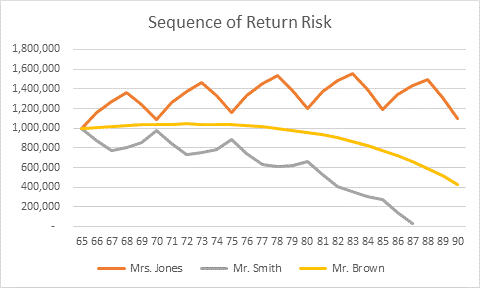

- Sequence of returns risk was ignored.

Your portfolio can be seriously damaged depending on the sequence in which investment returns occur while you are drawing down money to live on. As people typically live off their portfolios during retirement, this is an acute issue for folks in the wealth distribution stage.

Let’s look at a concrete example of 7% average returns while assuming the retiree takes $60,000 per year adjusted for inflation.

In the figure below, the top line is a repeating sequence of 22%, 15%, 12%, -4%, -7% returns, the middle line is 7% annual returns with no variation, and the bottom line -7%, -4%, 12%, 15%, 22% returns (inverse sequence to the top line).[1]

Mrs. Jones experienced the best returns at the start of her retirement, and at 90 years old has a larger account balance than what she began taking distributions. On the other hand, Mr. Brown experience the negative returns first, and he ran out of money in his 87th year.

Please refer to our article on sequence of returns for more detail about this and other hypothetical cases.

- Basing projections upon smoothed historical returns (or the ‘average’ expected return)

As did Marianne’s financial advisor, many investment professionals make the mistake of basing projections upon smoothed, average historical returns. This creates a false sense of security, as there is no guarantee that the average expected return will reflect actual returns in any given year.

- Historically high stock market valuation was ignored

Assuming that returns will follow their normal projection is difficult in a booming market. This paints an overly optimistic picture that often doesn’t hold up to reality, as was Marianne’s case.

When the market is at historically high valuations, it is more likely that we will see future returns stagnate, or go negative.”

Some aspects that you may want to consider if Oregon retirement in on your mind:

- No state sales tax in Oregon

- It is a separate property state (relevant to those facing a divorce settlement)

These may or may not apply to you; there are so many variables at play determining your success in retiring in a place like Bend, Oregon. Given all you’ll have to consider it is useful to put together a retirement strategy. If you’d like to meet and discuss, let us know.

A guide to retiring in Bend, Oregon

Aside from avoiding the investment mistakes mentioned above, there are a few guidelines that dictate how to plan for retirement. These strategies are useful if you are contemplating retiring in Bend, Oregon – or anywhere else in the country!

- Know what you want your money to do for you. Setting realistic expectations and priorities is the foundation of your plan, and it guides your investment risk tolerance.

- Every financial plan should include an income distribution plan. Don’t assume that a big balance in an IRA or other tax-advantaged account will be what you have to draw upon. The implications of taxes on the withdrawals taken from tax-deferred accounts such as Traditional or SEP IRAs can be quite significant, and should not be left to the last minute to address.

- Your financial plan should tie into your estate plan. What is the legacy you want to leave? Who are your beneficiaries, and what is the strategy required to make sure that assets are transferred in an efficient manner under the governing law? All of these questions and more should be addressed with your estate attorney or legal advisor, and should be taken into account in your retirement planning.

- Social Security must be timed appropriately. Just assuming you should take it as early as possible may lead to a reduction in overall benefits in the long term. Also, there is talk of a reduction in Social Security benefits beginning in 2033. All of these factors should be taken into account, as for many people Social Security will be a significant contributor to having enough income in retirement.

Oregon retirement resources

Does retiring in Bend, Oregon sound like a good idea?

If you are thinking about retiring in Oregon (Bend or elsewhere), the following resources may be beneficial.

- The type of advisor you work with matters a great deal in how your accounts are handled. Here are two of our articles on How to find a financial advisor and questions to ask a financial advisor.

- The AARP is a nonprofit organization that helps people over 50 plan out their financial futures.

- TopRetirements.com is a useful tool for retirement planning in Bend, Oregon and other locations. It displays information about retirement community in whatever area you specify.

- If you are a public employee in the state of Oregon looking for retirement advice, visit the OregonPERS website. You’ll get information about how to understand your benefits and how to retire from a PERS entity.

Whoever you are consulting with as resources, take the time to figure out if they are truly independent and nonpartisan. Content can be very biased if the entity publishing it is being paid to publish it. Find out who the sponsors of the publication are, and if the publishing entity is affiliated with any particular companies or is paid in any way for promoting any specific product or service.

Concluding thoughts

We hope you’ve enjoyed this article on retiring in Bend, Oregon. We are a fee-only, fiduciary wealth management firm based in Oregon, serving clients across the country. If you are still worried about the cost of living or retiring here, you may want to work with a Bend Oregon financial advisor.

If there is a topic you’d like us to consider for future newsletters, please let us know through our feedback form.

Disclaimers

Any similarities to people living or deceased are entirely coincidental.

The information on this page does not describe every aspect of our investment advisory services nor does it contain all of our performance records, and it is intended for residents of the United States. Information provided is obtained from sources we believe to be reliable but is not guaranteed. Past results are not indicative of future performance. Nothing on this page should be construed as investment, tax, or financial advice. MCS Family Wealth Advisors® is owned by MCS Financial Advisors, LLC (MCS), an investment adviser registered with the United States Securities and Exchange Commission. We only conduct business where properly registered or exempt from registration.

Sources

Salary.com. Cost of living in Bend, Oregon. Retrieved on February 8th, 2022 from https://www.salary.com/research/cost-of-living/bend-or

Tripadvisor. Things to do in Bend. https://www.tripadvisor.com/Attractions-g51766-Activities-Bend_Central_Oregon_Oregon.html

[1] Starting balance is $1,000,000. $60,000 per year is withdrawn which is annually increased by 3% inflation (for example, $61,800 is withdrawn in year 2, $63,654 is withdrawn in year 3, and so on).