2020 proved to be a year of challenge. In the space of twelve months, we experienced an impeachment trial, a global pandemic, a deep recession that bifurcated the economy into big winners and big losers, four hundred thousand COVID-19 deaths, and massive protests. The new year began with a riot in the US Capitol over the election results, and now a second impeachment trial is proposed for former President Trump. Despite all that, the stock and bond markets are near record valuation levels.

In 2020 (if MCS clients’ investments were treated as one large portfolio including their cash), on average clients gained 1.3%, after fees1. For comparison purposes, the S&P 500 Total Return Stock Index (S&P 500) gained 18.4%, and the Barclays Aggregate Bond Index gained 7.5%. The range of MCS individual client returns was from a gain of 9.3% to a loss of 6.1%.

Clients with the lowest returns had their allocation to equities reduced to eliminate further downside risk in the first quarter of this year, so they missed out on the rebound in stock prices in the latter half of the year. Clients with the highest returns had exposure to select technology stocks that did well and higher equity allocations.

Given the magnitude of the crisis, I made decisions to minimize portfolio losses. My focus was not on maximizing returns but on minimizing regret. Had the markets not recovered, client portfolios would remain intact or with minor losses that would be easily recoverable. We are in Act II of a three-act play, and the ending remains unclear.

2020 Financial Markets in Review

I was wrong about the stock market rebound in April of 2020: I played it safe and we missed out on the year’s stock gains. I underestimated the market’s response to trillions of dollars of government help. I questioned the efficiency of such largess, seeing (firsthand) stimulus go to businesses like financial advisers that didn’t need the free money (I wouldn’t touch it). Honestly, if you told me last January what would transpire — that the world economy would be brutalized by a pandemic but financial markets would make terrific gains because governments and central banks decided to print money, guarantee debtors they had previously admonished as imprudent, and commit to buying junk bonds to enable ‘at risk’ companies to borrow their way through the chaos

I wouldn’t have believed it.

What I was right about, unfortunately, was our inability to manage the severity of the pandemic. It has been a disastrous mess. It still is. Investors, gob-smacked by our technical prowess, are ignoring the fact that if you can’t get the technology (PPE, testing, vaccines) to those who need it, when they need it, the outcome will pale in comparison to its hyped-up expectations. This pandemic has not gone according to expectations. ‘WWII in Color’ on Netflix, drives home the chaos of war as a combination of heroics and disasters in which the line between success and failure may come down to chance and/or a few decisions that may or may not have seemed momentous at the time. So it is, now, with the pandemic.

Based on the history of the Fed’s role in financial crises, I simply don’t share the confidence that the stock and bond markets have in the Fed’s ability to manage through the current crisis. Boy, am I in the minority!

One of the great economic miscalculations leading into the Great Recession was Fed Chairman Greenspan misjudging the role of banks in the debacle, believing that banks would self-regulate their lending to protect themselves. Because banks based their executive incentives on sequentially higher quarterly earnings, not on the long-term health of the corporation, bank and investment bank executives drove their bus right off a cliff in the pursuit of annual performance bonuses.

Today, there is ample evidence of extreme speculation in financial markets. Here is a link to a very well-articulated article by Jeremy Grantham of GMO. You can find his commentary here: https://www.gmo.com/americas/ research-library/waiting-for-the-last-dance/#article-metadata. The January 23, Wall Street Journal article on SPACs (special purpose acquisition companies) is yet another glaring example of the abundant excesses that investors are currently engaged in. An investor, only looking at the 2020 S&P 500 returns, could not help but conclude that it was a great year for the economy. With stocks at all-time highs, the outlook must be rosy, indeed. Yet is it, really?

Political Risk and Its Potential Impact on Your Financial Security

Admittedly, I have not paid a lot of professional attention to politics because, over the past 50 to 60 years, political change in the US (including civil unrest) has not had a direct impact on investment returns. Politics is also an area in which everyone has an opinion, often strongly held (In the interests of full disclosure, I’m an independent, having voted for both Republicans and Democrats). I think we all share a deep concern, even alarm, about the direction of the country. Voter surveys of both parties find that financial security is important to people across the political spectrum. For too many, the American Dream is broken, leading to a great deal of anger and frustration.

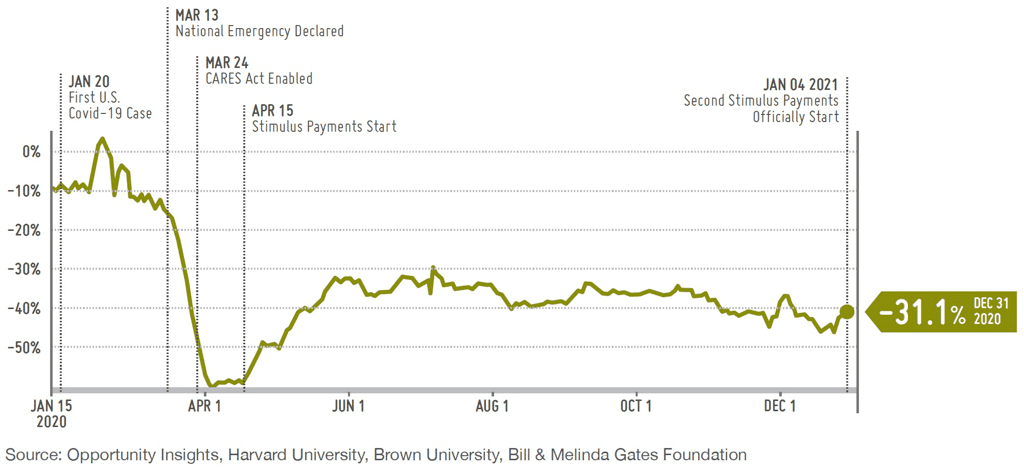

Figure 1

Percentage Change in Small Business Revenue

In the United States, as of December 31 2020, total small business revenue decreased by 31.1% compared to January 2020.

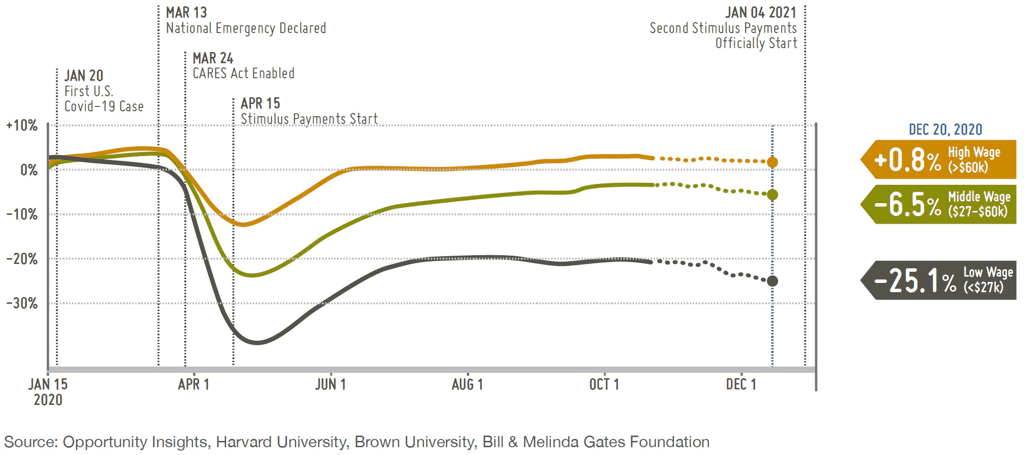

Figure 2

Percentage Change in Unemployment

U.S. unemployment is class based. There are a lot more people at the bottom than the top.

Figure 3

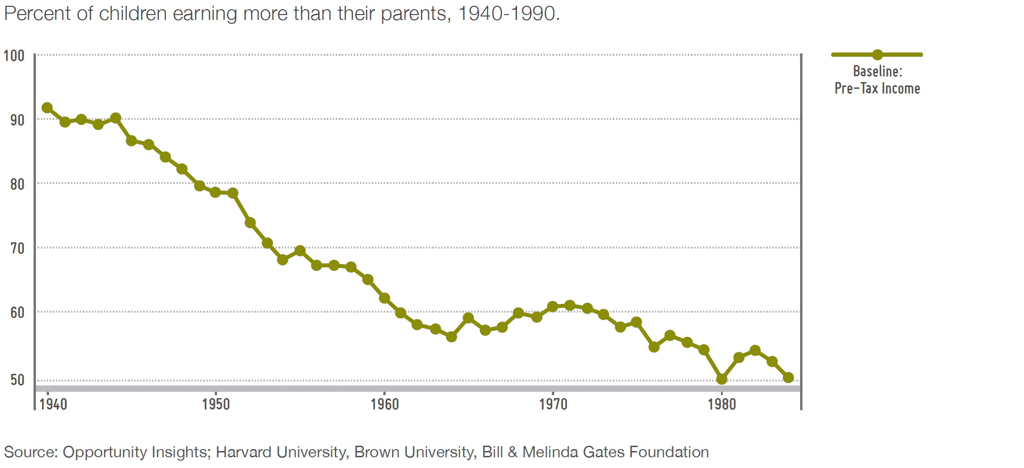

Broken Dreams

Percent of children earning more than their parents, 1940-1990.

For children born in 1940, more than 90% would earn more than their parents whereas, for children born in 1980, only 50% would earn more. For son’s vs. father’s income (graph not shown), 95% of sons born in 1940 would earn more than their fathers whereas, for sons born in 1980, only 40% will out-earn their fathers.

Former President Trump tapped into this anger and frustration among the white middle class voters, enabling him to win the election in 2016.

Four Years Later…

On December 2, I read the transcript of President Trump’s speech, which began, “Thank you. This may be the most important speech I’ve ever made…”. I found the speech incendiary and very disturbing, I encourage you to read it for yourself. (If you would like the transcript of this speech, please email me and I will send it to you)

The following day, I reached out to three investment professionals with strong academic and hands-on experience. My email read:

Gentlemen, would you indulge me in a 2-question survey? Please read Trump’s speech.

At this time, what probability would you assign to civil unrest resulting from the election?

If civil unrest occurred what would be your estimate of the percentage change in the S&P 500?

To avoid anchoring I have not disclosed my estimate. If you send me your estimates individually, I’ll respond with the results & consensus.

I wanted a gut check: their intuitions as subject matter experts.

They responded quickly. I was delighted that they offered more than just a quick numerical assessment, which is what I had done. Here are our responses:

Table 1

Responses

Does Civil Unrest Matter from an Investment Perspective?

Over a half century of stock market history supports the notion that civil unrest does not matter to financial markets.

A Forbes article by Sarah Hansen titled “The Stock Market Doesn’t Care About Violence…” offered an overview of numerous civil unrest events and stock market returns.

Table 2

Civil Unrest? Investors Don’t Care

In response to the BLM unrest earlier this year, Jim Cramer (host of Mad Money, a CNBC TV program dedicated to investing) said: “At the end of the day, the market has no conscience. Investors are simply trying to make money.”

Regarding the Capitol Hill Riot, Cramer explained that computer trading played a major role:

“The people were stunned and individuals were stunned … but the machines don’t get stunned because the machines don’t have a conscience,” he said on “Squawk Box.” … “I don’t think that the market is divorced,” Cramer said. “I think the machines are divorced. They didn’t see what was happening in the Capitol. They weren’t shook … because in the end, they are machines and they don’t think. They just do.”2

These are plausible explanations, and most investment professionals would offer this historical data as convincing evidence to ignore blood in US streets when it comes to investing. After all, the US is not some emerging market like Argentina or Greece, where political instability does boil over and frequently burns investors. Right?

Though I agree that this argument seems convincing, questions kept coming up:

Is there any plausible reason to believe that what’s transpiring now is somehow different?

Are current events of a different magnitude/composition such that a 50- to 60-year historical record is not helpful, or is even potentially misleading?

“The biggest risk is that you have a losing strategy when you think you have a winning one.”

— Jeff Yass, Founder Susquehanna International Group, a global quantitative trading firm.

I put on my risk management hat. Unlike many countries, US financial markets are not priced for economically disruptive civil unrest. This makes it a material risk factor only when the risk probability is high enough and the damage would be significant. For example, if the damage would be a 50% decline in markets for 5 years and yet the risk is 1 in 1,000, you probably don’t care; but if the risk is 1 in 10, maybe you do. And it’s not just a question of how domestic investors would perceive the risk. What if other countries decided America is a less solid bet than it’s historically been?

The next step was to look for data or research that had the potential to undermine the consensus view that political risk doesn’t matter. I needed to understand the current political reality at a deeper level.

Pernicious Polarization

What follows is drawn from the work of Jennifer McCoy, PhD and her colleagues.

“’Pernicious polarization’ – the division of society into mutually distrustful Us versus Them camps in which political identity becomes a social identity – fosters autocratization by incentivizing citizens and political actors alike to endorse nondemocratic action. An exploratory analysis of new V-Dem data on polarization indeed shows the negative relationship between the level of political polarization and liberal democracy ratings.”3 In a nutshell, pernicious polarization is a big threat to democracy.

Figure 4

Common Steps to Erode Democracy

Figure 5

Casual Chain Linking Polarization to Democratic Erosion

As the chart above lays out, polarization leads to democratic erosion. When each side sees the other as an enemy, preventing their version of a better world from becoming a reality, the groundwork is laid for more conflict.

In their recently published book, Four Threats, the Recurring Crises of American Democracy, Suzanne Mettler and Robert C. Lieberman explain:

These crises of democracy did not occur randomly; rather, they developed in the presence of four specific threats: political polarization, conflict over who belongs in the political community, high and growing economic inequality, and excessive executive power. We know from the study of the rise and fall of democratic regimes elsewhere in the world that these conditions are harmful to the sustainability of democracy. When they are absent, democracy tends to flourish; when one or more of them are present, democracy is prone to decay.

Now, for the first time in American history, we face all four threats at the same time. As in the 1790s, or during the conflict that led to the Civil War, we confront deep political polarization…6

Natural Disasters, Economic Consequences and Violent Civil Unrest

Despite record-breaking vaccine research and development programs, the virus is not reined in. The C-19 virus has its own “R&D program,” and we are in a race to see which program dominates. In my estimation, nature has the edge in terms of distribution efficiency; growing geometrically from a huge installed base (number of infected individuals) while simultaneously developing and testing new versions (mutations), whereas mankind’s responses (vaccine development and distribution) grow arithmetically in fits and starts. It boils down to which C-19 variant can infect the most people efficiently; mankind’s disabled variants (vaccines) or nature’s virulent ones (mutations). Increasingly, the vaccine effort is looking more like managing the flu than conquering polio.

Vaccine distribution is behind schedule, and it’s plagued by insufficient scale and logistical problems: a replay of PPE production, testing implementation, and contact tracing challenges. If that wasn’t enough, there are a lot of people who refuse to take it. If pandemic stress is unlikely to let up any time soon, what are the implications?

Years ago, I researched the economic impact of natural disasters in response to a Cascadia Subduction Zone earthquake / tsunami, which would have a devasting impact on the Pacific Northwest. Generally, the economic research on disasters is limited to those causing property damage, such as earthquakes, hurricanes, tornados, fires, and floods. Government intervention and private insurance, when available, play a significant role in aiding disaster recovery. (Pandemics are usually excluded from coverage in business interruption insurance policies). In general, high income nations are better able to shake off the economic impact of natural disasters than middle income or poor nations. Pandemics, on the other hand, occur so infrequently that there is little research into their long-term economic and social impact.

One of the research papers I reviewed was Natural Disasters and the Risk of Violent Civil Conflict.7 The study, while robust, has plenty of limitations in providing a guide for this pandemic. The incidence of violent civil conflict and disasters is very low (2.7%) compared to the total number of disasters, and the study covers only the period from 1950 to 2000. Moreover, violent conflict overwhelmingly occurs in low to middle income countries and not high-income countries. That said, the study provides a rational basis for assuming that the pandemic is an additive factor to the risks that already exist in our highly polarized political environment. At the heart of natural disaster induced violence is relative economic suffering and a sense of unfairness. This paper states “Level of inequality is thus an important variable in considering both motives and opportunities for violent conflict.”

Using a table from the research paper titled: ‘Summary of Causal Argument Linking Natural Disasters and Violent Civil Conflict’, I have applied the categories to the current situation and modified the outcome to include more than generalized ‘Violent Civil Conflict’.

Table 3

Disaster Influence on Political Stability

The combination of pernicious polarization and a pandemic with health and economic pressures creates a more volatile social / political environment. Therefore, it’s prudent to consider outcomes that in the past would not have seemed possible. There are many examples in history of pandemics changing the course of nations and civilizations.8

Table 4

Potential Outcomes

The Muddle Through outcome is expected, especially by Democrats. It is also a preferred outcome of traditional Republicans, i.e. those who recognize Donald Trump lost a fair election. However, the majority of Republican voters believe President Biden was not legitimately elected. Once a significant percentage of citizens believe the government is so corrupt it cannot run a fair election, the door is opened to outcomes that would have previously been unthinkable.

The US has attempted secession twice; 1775-1783 (successful) and 1861-1865 (unsuccessful). The reasons were taxes, states’ rights to self-determination, and economic and social threats to a way of life. Does this sound familiar?

Exploring a Potential Outcome: Secession

What is a ‘simple’ path to resolving a highly conflicted relationship? Answer: Divorce.

Or, in the case of a nation, Secession – the act of withdrawing formally from membership of a political state. The US is no stranger to secession, yet, is it really a possibility today? Through my research, I found this comprehensive political poll from Hofstra University dated 9/30/2020.9

I was shocked to see this on page 10:

Finally, we asked respondents whether they would support the most drastic of measures: their state seceding from the union. Interestingly, support for secession is higher than a constitutional convention at 39.3 percent. Whereas Republicans were staunchly against a convention, they are actually the strongest supporters of secession at 43.9 percent (notably, 41 percent of Democrats support the idea). As this is, to our knowledge, the first time a survey has asked this question, we do not have a reliable baseline with which we can compare these responses. The fact that more people would support the dissolution of the union rather than a reworking of that union’s constitution is remarkable.

Note the academic use of ‘remarkable,’ while a non-academic might refer to such bipartisan support for secession as ‘damn scary.’ Another poll will be released in March 2021.

Figure 6

Support for Secession Poll Results

This is a national poll and I am inquiring about the possibility of a state or regional poll to better understand where support for secession is strongest. If you would like a pdf of the entire poll, please email me, or go to the link in the footnotes.

The Macro Implications

Pandemics have altered the course of history when the conditions were ripe. Many Wall Street analysts have described the pandemic as a disrupter and accelerant of existing economic trends: reflected in massive stock price gains in companies that benefit from a pandemic reconfigured economy as well as the bankruptcies of companies that were already struggling, such as mall-based retailers.

What Wall Street has ignored is whether the pandemic is a potent accelerant of our political divisions. Pandemic economics has created big winners and big losers which is polarizing in itself. Wall Street has celebrated political gridlock (informed by pernicious polarity) as an economic stabilizer, rather than seeing it as a possible pressure cooker about to blow a gasket.

Just as the west rooted for the Soviet Union collapse, China and Russia would be delighted to facilitate a shift in the global balance of power. In other words, highly sophisticated, well financed rivals continue to actively support destabilizing the US.

Keep in mind that a Secession movement need not succeed to damage markets. All that needs to happen is that the threat of secession becomes credible to a large enough fraction of investors to get the fear ball rolling. After that, the computer trading kicks in.

The thought of how foreign markets could react to the uncertainty of a secession (divorce) movement gaining traction in the US is enough to give one the cold sweats. What do you think would happen to US Treasuries? Bonds would start selling off, raising yields, and the stock market would tank. Markets might just stop trading altogether, which is what happens when really serious problems arise. In other words, liquidity, that sometimes- fragile attribute that most investors take for granted, may not be there when needed for some markets.

The Fed does not have an answer for the risk of a global loss of confidence in the stability of United States.

Unlike former Presidents, Donald Trump is not going away to a quiet life of stuffy, paid speaking engagements. Filling an arena with screaming fans is more his style. He has millions of followers and he’s going to capitalize on it in some way. He’s also got problems, including a long list of pending lawsuits and a suffering real estate empire. Desperate times can lead to desperate measures.

Strategy

One way to think about investing is comparing it to a board game, with dice to advance and cards to draw after you advance. The dice, having positive and negative numbers, are added up represent your return. You can go backwards! Your progress can change dynamically as new ‘event’ cards are added or removed from the deck. Sometimes you know what the event cards are, and sometimes you don’t. Part of the game is keeping track of event card types, which may allow you to sense when the odds are either more or less favorable for advancement. Finally, if you don’t like what you see, you have the option of skipping turns and watching the game.

This newsletter is to alert you that, as a result of my research, I believe that ‘new event cards’ have been added to the deck – ones I have never previously considered. Cards that have historic precedence, but that you might have thought of as impossible to draw in ‘modern times.’

As a client, you’ve entrusted me with the responsibility to invest your money prudently. To do that, I constantly assess the world to determine how I should risk your money in it. I’m going to play it close to the vest and see how things evolve over the next few months. I’ll investigate potential hedges beyond our current big allocation to cash and near cash investments in the event the proverbial sh*t hits the fan.

I invite you to call or email me on where you think the country is headed and what you feel is the upside and downside to our current state of affairs.

Do you feel the current political situation should influence your investment strategy? If so, how?

What are your thoughts on this quarter’s newsletter?

MCS Family Wealth Advisors (MCS) consolidated client returns are dollar-weighted, net of investment management fees unless stated otherwise, include reinvestment of dividends and capital gains and represent all clients with fully discretionary accounts under management for at least one full month in 2020. Individual client returns represent client discretionary accounts under management for the entire period – starting on 12/31/2019 and ending on 12/31/2020.These accounts represent 95% of MCS’s discretionary fee-paying assets under management as of 12/31/2020 and were invested primarily in US stocks and bonds (12% of client assets on 12/31/2020 were invested in tax-exempt municipal bonds). The Stock Index values are based on the S&P 500 Total Return Index, which measures the large capitalization US equity market. The Bond Index values are based on the Barclays Capital US Aggregate Bond Index, which measures the US investment-grade bond market. Index values are for comparison purposes only. The report is for information purposes only and does not consider the specific investment objective, financial situation, or particular needs of any recipient, nor is it to be construed as an offer to sell or solicit investment management or any other services. Past performance is not indicative of future results.

The book’s five page introduction can be found here: https://us.macmillan.com/excerpt?isbn=9781250244420. Or, call or email me and I will send it to you.

Nel, Philip and Righarts, Marjolein; International Studies Quarterly, Volume 52, Issue 1, March 2008

Categories

2020 Year-End Newsletter and Outlook

2020 proved to be a year of challenge. In the space of twelve months, we experienced an impeachment trial, a global pandemic, a deep recession that bifurcated the economy into big winners and big losers, four hundred thousand COVID-19 deaths, and massive protests. The new year began with a riot in the US Capitol over the election results, and now a second impeachment trial is proposed for former President Trump. Despite all that, the stock and bond markets are near record valuation levels.

In 2020 (if MCS clients’ investments were treated as one large portfolio including their cash), on average clients gained 1.3%, after fees1. For comparison purposes, the S&P 500 Total Return Stock Index (S&P 500) gained 18.4%, and the Barclays Aggregate Bond Index gained 7.5%. The range of MCS individual client returns was from a gain of 9.3% to a loss of 6.1%.

Clients with the lowest returns had their allocation to equities reduced to eliminate further downside risk in the first quarter of this year, so they missed out on the rebound in stock prices in the latter half of the year. Clients with the highest returns had exposure to select technology stocks that did well and higher equity allocations.

Given the magnitude of the crisis, I made decisions to minimize portfolio losses. My focus was not on maximizing returns but on minimizing regret. Had the markets not recovered, client portfolios would remain intact or with minor losses that would be easily recoverable. We are in Act II of a three-act play, and the ending remains unclear.

2020 Financial Markets in Review

I was wrong about the stock market rebound in April of 2020: I played it safe and we missed out on the year’s stock gains. I underestimated the market’s response to trillions of dollars of government help. I questioned the efficiency of such largess, seeing (firsthand) stimulus go to businesses like financial advisers that didn’t need the free money (I wouldn’t touch it). Honestly, if you told me last January what would transpire — that the world economy would be brutalized by a pandemic but financial markets would make terrific gains because governments and central banks decided to print money, guarantee debtors they had previously admonished as imprudent, and commit to buying junk bonds to enable ‘at risk’ companies to borrow their way through the chaos

I wouldn’t have believed it.

What I was right about, unfortunately, was our inability to manage the severity of the pandemic. It has been a disastrous mess. It still is. Investors, gob-smacked by our technical prowess, are ignoring the fact that if you can’t get the technology (PPE, testing, vaccines) to those who need it, when they need it, the outcome will pale in comparison to its hyped-up expectations. This pandemic has not gone according to expectations. ‘WWII in Color’ on Netflix, drives home the chaos of war as a combination of heroics and disasters in which the line between success and failure may come down to chance and/or a few decisions that may or may not have seemed momentous at the time. So it is, now, with the pandemic.

Based on the history of the Fed’s role in financial crises, I simply don’t share the confidence that the stock and bond markets have in the Fed’s ability to manage through the current crisis. Boy, am I in the minority!

One of the great economic miscalculations leading into the Great Recession was Fed Chairman Greenspan misjudging the role of banks in the debacle, believing that banks would self-regulate their lending to protect themselves. Because banks based their executive incentives on sequentially higher quarterly earnings, not on the long-term health of the corporation, bank and investment bank executives drove their bus right off a cliff in the pursuit of annual performance bonuses.

Today, there is ample evidence of extreme speculation in financial markets. Here is a link to a very well-articulated article by Jeremy Grantham of GMO. You can find his commentary here: https://www.gmo.com/americas/ research-library/waiting-for-the-last-dance/#article-metadata. The January 23, Wall Street Journal article on SPACs (special purpose acquisition companies) is yet another glaring example of the abundant excesses that investors are currently engaged in. An investor, only looking at the 2020 S&P 500 returns, could not help but conclude that it was a great year for the economy. With stocks at all-time highs, the outlook must be rosy, indeed. Yet is it, really?

Political Risk and Its Potential Impact on Your Financial Security

Admittedly, I have not paid a lot of professional attention to politics because, over the past 50 to 60 years, political change in the US (including civil unrest) has not had a direct impact on investment returns. Politics is also an area in which everyone has an opinion, often strongly held (In the interests of full disclosure, I’m an independent, having voted for both Republicans and Democrats). I think we all share a deep concern, even alarm, about the direction of the country. Voter surveys of both parties find that financial security is important to people across the political spectrum. For too many, the American Dream is broken, leading to a great deal of anger and frustration.

Figure 1

Percentage Change in Small Business Revenue

In the United States, as of December 31 2020, total small business revenue decreased by 31.1% compared to January 2020.

Figure 2

Percentage Change in Unemployment

U.S. unemployment is class based. There are a lot more people at the bottom than the top.

Figure 3

Broken Dreams

Percent of children earning more than their parents, 1940-1990.

For children born in 1940, more than 90% would earn more than their parents whereas, for children born in 1980, only 50% would earn more. For son’s vs. father’s income (graph not shown), 95% of sons born in 1940 would earn more than their fathers whereas, for sons born in 1980, only 40% will out-earn their fathers.

Former President Trump tapped into this anger and frustration among the white middle class voters, enabling him to win the election in 2016.

Four Years Later…

On December 2, I read the transcript of President Trump’s speech, which began, “Thank you. This may be the most important speech I’ve ever made…”. I found the speech incendiary and very disturbing, I encourage you to read it for yourself. (If you would like the transcript of this speech, please email me and I will send it to you)

The following day, I reached out to three investment professionals with strong academic and hands-on experience. My email read:

Gentlemen, would you indulge me in a 2-question survey? Please read Trump’s speech.

To avoid anchoring I have not disclosed my estimate. If you send me your estimates individually, I’ll respond with the results & consensus.

I wanted a gut check: their intuitions as subject matter experts.

They responded quickly. I was delighted that they offered more than just a quick numerical assessment, which is what I had done. Here are our responses:

Table 1

Responses

Does Civil Unrest Matter from an Investment Perspective?

Over a half century of stock market history supports the notion that civil unrest does not matter to financial markets.

A Forbes article by Sarah Hansen titled “The Stock Market Doesn’t Care About Violence…” offered an overview of numerous civil unrest events and stock market returns.

Table 2

Civil Unrest? Investors Don’t Care

In response to the BLM unrest earlier this year, Jim Cramer (host of Mad Money, a CNBC TV program dedicated to investing) said: “At the end of the day, the market has no conscience. Investors are simply trying to make money.”

Regarding the Capitol Hill Riot, Cramer explained that computer trading played a major role:

“The people were stunned and individuals were stunned … but the machines don’t get stunned because the machines don’t have a conscience,” he said on “Squawk Box.” … “I don’t think that the market is divorced,” Cramer said. “I think the machines are divorced. They didn’t see what was happening in the Capitol. They weren’t shook … because in the end, they are machines and they don’t think. They just do.”2

These are plausible explanations, and most investment professionals would offer this historical data as convincing evidence to ignore blood in US streets when it comes to investing. After all, the US is not some emerging market like Argentina or Greece, where political instability does boil over and frequently burns investors. Right?

Though I agree that this argument seems convincing, questions kept coming up:

I put on my risk management hat. Unlike many countries, US financial markets are not priced for economically disruptive civil unrest. This makes it a material risk factor only when the risk probability is high enough and the damage would be significant. For example, if the damage would be a 50% decline in markets for 5 years and yet the risk is 1 in 1,000, you probably don’t care; but if the risk is 1 in 10, maybe you do. And it’s not just a question of how domestic investors would perceive the risk. What if other countries decided America is a less solid bet than it’s historically been?

The next step was to look for data or research that had the potential to undermine the consensus view that political risk doesn’t matter. I needed to understand the current political reality at a deeper level.

Pernicious Polarization

What follows is drawn from the work of Jennifer McCoy, PhD and her colleagues.

“’Pernicious polarization’ – the division of society into mutually distrustful Us versus Them camps in which political identity becomes a social identity – fosters autocratization by incentivizing citizens and political actors alike to endorse nondemocratic action. An exploratory analysis of new V-Dem data on polarization indeed shows the negative relationship between the level of political polarization and liberal democracy ratings.”3 In a nutshell, pernicious polarization is a big threat to democracy.

Figure 4

Common Steps to Erode Democracy

Figure 5

Casual Chain Linking Polarization to Democratic Erosion

As the chart above lays out, polarization leads to democratic erosion. When each side sees the other as an enemy, preventing their version of a better world from becoming a reality, the groundwork is laid for more conflict.

In their recently published book, Four Threats, the Recurring Crises of American Democracy, Suzanne Mettler and Robert C. Lieberman explain:

These crises of democracy did not occur randomly; rather, they developed in the presence of four specific threats: political polarization, conflict over who belongs in the political community, high and growing economic inequality, and excessive executive power. We know from the study of the rise and fall of democratic regimes elsewhere in the world that these conditions are harmful to the sustainability of democracy. When they are absent, democracy tends to flourish; when one or more of them are present, democracy is prone to decay.

Now, for the first time in American history, we face all four threats at the same time. As in the 1790s, or during the conflict that led to the Civil War, we confront deep political polarization…6

Natural Disasters, Economic Consequences and Violent Civil Unrest

Despite record-breaking vaccine research and development programs, the virus is not reined in. The C-19 virus has its own “R&D program,” and we are in a race to see which program dominates. In my estimation, nature has the edge in terms of distribution efficiency; growing geometrically from a huge installed base (number of infected individuals) while simultaneously developing and testing new versions (mutations), whereas mankind’s responses (vaccine development and distribution) grow arithmetically in fits and starts. It boils down to which C-19 variant can infect the most people efficiently; mankind’s disabled variants (vaccines) or nature’s virulent ones (mutations). Increasingly, the vaccine effort is looking more like managing the flu than conquering polio.

Vaccine distribution is behind schedule, and it’s plagued by insufficient scale and logistical problems: a replay of PPE production, testing implementation, and contact tracing challenges. If that wasn’t enough, there are a lot of people who refuse to take it. If pandemic stress is unlikely to let up any time soon, what are the implications?

Years ago, I researched the economic impact of natural disasters in response to a Cascadia Subduction Zone earthquake / tsunami, which would have a devasting impact on the Pacific Northwest. Generally, the economic research on disasters is limited to those causing property damage, such as earthquakes, hurricanes, tornados, fires, and floods. Government intervention and private insurance, when available, play a significant role in aiding disaster recovery. (Pandemics are usually excluded from coverage in business interruption insurance policies). In general, high income nations are better able to shake off the economic impact of natural disasters than middle income or poor nations. Pandemics, on the other hand, occur so infrequently that there is little research into their long-term economic and social impact.

One of the research papers I reviewed was Natural Disasters and the Risk of Violent Civil Conflict.7 The study, while robust, has plenty of limitations in providing a guide for this pandemic. The incidence of violent civil conflict and disasters is very low (2.7%) compared to the total number of disasters, and the study covers only the period from 1950 to 2000. Moreover, violent conflict overwhelmingly occurs in low to middle income countries and not high-income countries. That said, the study provides a rational basis for assuming that the pandemic is an additive factor to the risks that already exist in our highly polarized political environment. At the heart of natural disaster induced violence is relative economic suffering and a sense of unfairness. This paper states “Level of inequality is thus an important variable in considering both motives and opportunities for violent conflict.”

Using a table from the research paper titled: ‘Summary of Causal Argument Linking Natural Disasters and Violent Civil Conflict’, I have applied the categories to the current situation and modified the outcome to include more than generalized ‘Violent Civil Conflict’.

Table 3

Disaster Influence on Political Stability

The combination of pernicious polarization and a pandemic with health and economic pressures creates a more volatile social / political environment. Therefore, it’s prudent to consider outcomes that in the past would not have seemed possible. There are many examples in history of pandemics changing the course of nations and civilizations.8

Table 4

Potential Outcomes

The Muddle Through outcome is expected, especially by Democrats. It is also a preferred outcome of traditional Republicans, i.e. those who recognize Donald Trump lost a fair election. However, the majority of Republican voters believe President Biden was not legitimately elected. Once a significant percentage of citizens believe the government is so corrupt it cannot run a fair election, the door is opened to outcomes that would have previously been unthinkable.

The US has attempted secession twice; 1775-1783 (successful) and 1861-1865 (unsuccessful). The reasons were taxes, states’ rights to self-determination, and economic and social threats to a way of life. Does this sound familiar?

Exploring a Potential Outcome: Secession

What is a ‘simple’ path to resolving a highly conflicted relationship? Answer: Divorce.

Or, in the case of a nation, Secession – the act of withdrawing formally from membership of a political state. The US is no stranger to secession, yet, is it really a possibility today? Through my research, I found this comprehensive political poll from Hofstra University dated 9/30/2020.9

I was shocked to see this on page 10:

Finally, we asked respondents whether they would support the most drastic of measures: their state seceding from the union. Interestingly, support for secession is higher than a constitutional convention at 39.3 percent. Whereas Republicans were staunchly against a convention, they are actually the strongest supporters of secession at 43.9 percent (notably, 41 percent of Democrats support the idea). As this is, to our knowledge, the first time a survey has asked this question, we do not have a reliable baseline with which we can compare these responses. The fact that more people would support the dissolution of the union rather than a reworking of that union’s constitution is remarkable.

Note the academic use of ‘remarkable,’ while a non-academic might refer to such bipartisan support for secession as ‘damn scary.’ Another poll will be released in March 2021.

Figure 6

Support for Secession Poll Results

This is a national poll and I am inquiring about the possibility of a state or regional poll to better understand where support for secession is strongest. If you would like a pdf of the entire poll, please email me, or go to the link in the footnotes.

The Macro Implications

Pandemics have altered the course of history when the conditions were ripe. Many Wall Street analysts have described the pandemic as a disrupter and accelerant of existing economic trends: reflected in massive stock price gains in companies that benefit from a pandemic reconfigured economy as well as the bankruptcies of companies that were already struggling, such as mall-based retailers.

What Wall Street has ignored is whether the pandemic is a potent accelerant of our political divisions. Pandemic economics has created big winners and big losers which is polarizing in itself. Wall Street has celebrated political gridlock (informed by pernicious polarity) as an economic stabilizer, rather than seeing it as a possible pressure cooker about to blow a gasket.

Just as the west rooted for the Soviet Union collapse, China and Russia would be delighted to facilitate a shift in the global balance of power. In other words, highly sophisticated, well financed rivals continue to actively support destabilizing the US.

Keep in mind that a Secession movement need not succeed to damage markets. All that needs to happen is that the threat of secession becomes credible to a large enough fraction of investors to get the fear ball rolling. After that, the computer trading kicks in.

The thought of how foreign markets could react to the uncertainty of a secession (divorce) movement gaining traction in the US is enough to give one the cold sweats. What do you think would happen to US Treasuries? Bonds would start selling off, raising yields, and the stock market would tank. Markets might just stop trading altogether, which is what happens when really serious problems arise. In other words, liquidity, that sometimes- fragile attribute that most investors take for granted, may not be there when needed for some markets.

The Fed does not have an answer for the risk of a global loss of confidence in the stability of United States.

Unlike former Presidents, Donald Trump is not going away to a quiet life of stuffy, paid speaking engagements. Filling an arena with screaming fans is more his style. He has millions of followers and he’s going to capitalize on it in some way. He’s also got problems, including a long list of pending lawsuits and a suffering real estate empire. Desperate times can lead to desperate measures.

Strategy

One way to think about investing is comparing it to a board game, with dice to advance and cards to draw after you advance. The dice, having positive and negative numbers, are added up represent your return. You can go backwards! Your progress can change dynamically as new ‘event’ cards are added or removed from the deck. Sometimes you know what the event cards are, and sometimes you don’t. Part of the game is keeping track of event card types, which may allow you to sense when the odds are either more or less favorable for advancement. Finally, if you don’t like what you see, you have the option of skipping turns and watching the game.

This newsletter is to alert you that, as a result of my research, I believe that ‘new event cards’ have been added to the deck – ones I have never previously considered. Cards that have historic precedence, but that you might have thought of as impossible to draw in ‘modern times.’

As a client, you’ve entrusted me with the responsibility to invest your money prudently. To do that, I constantly assess the world to determine how I should risk your money in it. I’m going to play it close to the vest and see how things evolve over the next few months. I’ll investigate potential hedges beyond our current big allocation to cash and near cash investments in the event the proverbial sh*t hits the fan.

I invite you to call or email me on where you think the country is headed and what you feel is the upside and downside to our current state of affairs.

I appreciate your patience with our investment strategy in these extraordinary times.

– Michael C. Stalker, CFA

Download the full PDF version newsletter here.