As I prepared these comments, a large failure happened: IndyMac was taken over by the FDIC. Earlier this year, medium-sized ANB Financial, N.A. (Bentonville, Arkansas) failed.

That failure struck close to home because we had purchased an ANB CD for a client. The client will come out more than whole because the CD was purchased at a discount, and we made sure that the entire amount we purchased was covered by FDIC insurance. ANB large depositors will lose money. I expect this bank failure cycle to be worse than the S&L/bank crisis of the late 1980s and early 1990s.

In conversations with clients and business colleagues over the past seven weeks, I have stressed the need to be vigilant in assessing the credit worthiness of their banks if they keep deposits in excess of the FDIC limits ($100,000; $250,000 if in an IRA). As a depositor, you are lending your money to the bank. This is the environment in which bank and credit union failures start spiking dramatically.

Worse, banks are using accounting rules to delay the reporting of nonperforming loans. One example: Wells Fargo traditionally reported loans as nonperforming if the borrower had missed two payments; now the borrower has to miss three months of payments before the loan is classified as nonperforming. The upshot is that the bank’s financial position may be deteriorating more quickly than financial statements indicate.

Worse yet, the “Smart Money” (big institutional investors, broker dealers, banks and sovereign wealth funds) have been badly burned trying to repeat their previous performance of the early 1990s, when they scooped up beaten-down financial stocks for big profits. Instead of big profits, they’ve watched their recent multibillion dollar investments shrink by 50% or more in less than a year. So now they are reluctant to put more money into the sector. Funny, how that works.

What’s not funny is that the slowing of the recapitalization of the banks will lead to more bank failures while suppressing lending and economic growth. Can you spell:

T A X P A Y E R B A I L O U T ?

I am leaving on vacation as the mortgage lending giants Fannie Mae and Freddie Mac are in the throes of a huge financial crisis. The likely outcome is a taxpayer bailout of some sort, despite much rhetoric to the contrary. Stockholders in these companies may well be left with nothing.

Bottom-line: If you hold deposits at a bank or credit union in excess of insurance deposit limits, call MCS for more information and advice on how to evaluate the risk you are taking. If your deposits are covered by insurance, no worries.

Stocks, the Lost Decade and Counting

Almost every financial adviser will tell you with great confidence about the superiority of stock investing in the long run. Many financial advisers are dismissive of bond investing; the subtext of the message is, “Tut, tut, yes – well, bonds don’t protect you from inflation – and you’ll never accumulate as much wealth as the real investors who buy stocks – you poor thing.”

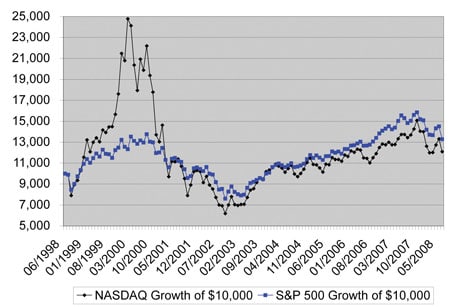

Psst! Have I got an opportunity for you! Earn 2.88% per year for 10 years and experience gut-wrenching fluctuations in your portfolio. Another plus: The 2.88% return is before fees, taxes, and 2.84% inflation! Interested? Not many investors would be, yet this is what a stock index fund investor has earned for the past 10 years ending June 30, 2008 (see chart, below).

It could be worse: For Japanese investors, the Nikkei stock index, which peaked in 1989 at around 39,000, has not returned to its price level of 26,000, set over 22 years ago. The index stands at 13,052 as of July 9, 2008.

The point here is that rules of thumb like, “Buy stocks for the long run,” are dangerous, overly-simplistic sound-bites about how to build and sustain wealth. (Stock investing should be part of a total wealth strategy, but it needs to be placed in the proper context.) In the words of Henry Clay, “Statistics are no substitute for judgment.”

On Saturday, July 12, an incredibly naive article by Jason Zweig appeared in The Wall Street Journal in which he celebrates losing lots of money as a “gift from the financial gods,” because you can buy stocks more cheaply if you have the self-control to stay the course. Does he know the difference between self-control and stubborn ignorance?

The Municipal Bond Market Continues to Exhibit Disarray

Prices seem to be all over the map in the municipal bond market. I am seeing offerings of equivalent bonds with yield differences of 1/2% to 3/4% – a lot in the bond world. It is indicative of a market that is being pushed around by the latest credit crisis news and the loss of the price stabilizing effect that bond insurers once provided. In June, taxable munis rose in price while tax-free munis declined – very unusual.

MCS Performance and Outlook

2008 has presented the most challenging investment environment of my 25-plus year career. The stock market, as measured by the S&P 500, lost 11.9% in the first half of 2008. Most diversified stock funds lost more. The Lehman Aggregate Bond Index gained 1.1%. Both of these figures are before management fees.

The dollar-weighted average, six-month, net return at MCS was –2.6%. The range of MCS client returns was –15.3% to +4.5%. No two client portfolios are alike, and no client is invested to match an index.

For example: The 15% loss occurred in a small aggressive Roth IRA with one stock in it. The 4.5% return was earned in an estate account using a special strategy that earned 7–10% annual returns on FDIC-insured CDs. The returns occur as a result of the account holder’s death and contractual terms of the CD.

By July 11, the stock market was down roughly 15% year-to-date while MCS clients held steady.

A New Millennium Depression in the Making?

In discussions with my staff earlier this year, I wondered whether we are going to experience a modern depression. The odds, which I put at 15% last summer, have risen to 1 in 3.

I do not see this as something to fear – it’s just another economic environment to adapt to. And it’s not all bad news for the prudent investor. Consider: As the wealth of others is destroyed, the purchasing power of those that simply break even increases. Why? Assume you have $2 million, and two years ago a vacation home cost $750,000. Now, the same home costs $500,000. That $2 million buys 4 homes instead of 2.7. And the $250,000 savings will buy a heck of a lot of bread and gas.