The decision to hire a financial advisor is an important one that can have a major impact on the quality of your life. If you are wondering how to find a fee-only financial advisor, we’ll fill you in on the four steps to take to find the right person to help you manage your wealth.

As we get started, please subscribe to our monthly newsletter for more insights about wealth management, retirement, and how to make wise financial decisions for your family.

There are four steps to follow if you want to find a quality fee-only financial advisor.

Step #1: Understand what a fee-only fiduciary financial advisor is

One of the factors that will have the most impact on the service you receive is the standard of care that the advisor follows. A fiduciary is required to act in the best interest of the client, putting the client’s best interests before their own.

You want to delegate investment decisions to an expert, and a fiduciary financial advisor will offer the highest standard of care. There are several benefits to working with a fiduciary.

- It eliminates the need to review every prospectus and scour the associated investment disclosures, because the advisor is obligated to do so on your behalf.

- Conflicts of interest are minimized, and any such conflicts are required to be disclosed fully and frankly.

- The advisor is held accountable for investing your portfolio prudently.

- There are strict anti-fraud rules that generally prohibit advisors from engaging in any practice that is fraudulent, deceptive, or manipulative.

- The advisor is required to seek best execution for client transactions.

For all these reasons, working with a fee-only fiduciary affords you the greatest degree of legal protection, out of all the possible types of advisors you could work with.

It’s important to understand the distinction between fee-only advisors and fee-based advisors. A fee-only advisor is strictly compensated by a fee for services provided; she or he can not accept commissions for trades conducted at any point in the relationship. Other advisors may be brokers who are able to accept commissions for trades performed at various points in the relationship. Such professionals are called “fee-based” advisors, and they are not fiduciaries 100% of the time.

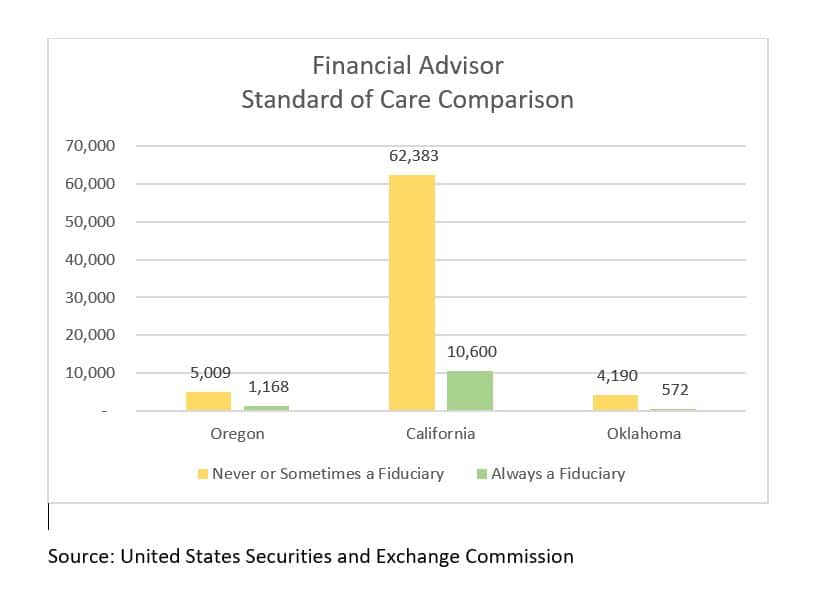

While most people believe that their advisor is a fiduciary, reality shows us a different story.

A very small percentage of advisors are pure fiduciaries, meaning they follow the fiduciary standard in their dealings with clients in 100% of cases.

#2 Understand the different standards of care for financial advisors

“Financial advice” is a broad term that may encompass many areas, from financial planning to investment management and insurance. It is important to consider who the advisor is regulated by. There are three categories.

Investment Advisor Representation (IAR)

An IAR is held to the fiduciary standard of care. She or he is regulated by the United States Securities and Exchange Commission (SEC) or your state. An IAR work with a Registered Investment Advisor (RIA) firm, and the firm itself is registered with either the state or the SEC.

Hybrid or Dual-Registered Advisor (“Two Hats” advisor)

What is far more common is for an advisor to be a “hybrid advisor”, meaning that they are dual-registered as an investment advisor and a broker dealer. These advisors are sometimes held to the Fiduciary Standard of Care. They are regulated by either FINRA or the SEC or your state, depending on the advice provided.

Hybrid advisors will provide you with disclosure documents for each type of advice they provide; however it is your responsibility to read the disclosures and understand the differences in advice they offer (which “hat” they are wearing).

Registered Representative of a Broker Dealer (RR)

A Registered Representative of a broker-dealer firm sells suitable securities to investors and is regulated by FINRA, the Financial Industry Regulatory Authority. These individuals are not held to the Fiduciary Standard of Care. They are regulated by FINRA (Financial Industry Regulatory Authority), and work for a Broker-Dealer. Registered reps are bound to provide you with disclosure documents for each investment solicited.

The table below summarizes the different types of advisors, and the standard of care they are held to:

| Always a Fiduciary | Sometimes a Fiduciary | Usually Not a Fiduciary |

| Investment Adviser Representative | Dual Registered Representative or Hybrid Firm | Registered Representative |

The best way to be sure your advisor is held to the fiduciary standard is to have them sign a Fiduciary Oath.

An example of the fiduciary oath would be:

I have a fiduciary duty to you, the client. I shall always act in good faith and with candor, and I will be proactive in disclosing any conflicts of interest that may impact you. I will not accept any referral fees or compensation contingent upon the purchase or sale of a financial product.

If they do not sign, at least some of their advice is at a suitability and not fiduciary standard of care.

#3 Research and Build List of Candidates

A critical part of the answer to how to find a fee-only financial advisor is getting the right person. Once you’ve decided which kind of advisor you want to work with, the next step is to research and build a list of candidates.

Here are the common sources.

Friend/social contacts

One of the first places people go is their friends. It’s easy to fall into what we call “Country Club Due Diligence”, or CCDD, a situation in which someone asks a person they regard as smart and wealthy who their financial adviser is. The logic is that if rich Mr. or Mrs. Smith uses this person, it’s good enough for me!

I want to introduce you to a great guy. He is very selective about who his clients are. He’s done a fabulous job for us. Our portfolios just go up, up, up. (Please, tell him I sent you!) His name is Bernie Madoff.

Staying wealthy is a complicated and often time-consuming business. It is not intuitive. It’s ‘work’ and if you are wandering into someone’s office to hear them tell you about how great they are, then you are not doing the work. It’s up to you and the quality of your questions to cut through the superficial and get to the heart of what you are looking for.

Please review this list of questions to ask a financial advisor.

You may utilize Google Search, especially if you are looking for financial advisors in your local area. If you are utilizing this means, beware of advisor matching sites such as SmartAsset (limited to those willing to pay to be listed). These websites won’t be presenting all the viable candidates as those who are not paying for the right to be on display will not be included.

Associations

Online directories such as those offered by NAPFA, FPA, or the CFP Board may be beneficial to consult with. The financial advisors listed on these sites are paying members of these associations. Fee Only Network and Garrett Planning Network are lookup sites where you can find fee-only advisors. It is important to note that these advisors are not endorsed or approved by any of the organizations whose website they are listed on.

Social Media

It is common to meet financial advisors through social media sites such as LinkedIn, Facebook, Instagram, etc. Many sites have networking groups where you can meet other members of a particular community (e.g. residents of your local area, etc.)

If you’ve followed the process thus far, you probably have a sizable list of candidates. Now, the question takes on a new dimension: how to find a fee-only financial advisor with the right qualifications.

Before you go any further, take some time to learn about the financial designations and what they mean. Many designations require the holder to have attained an undergraduate degree, pass a series of proficiency exams, and complete ongoing educational requirements. There is a litany of designations that financial advisors can have; a popular one is the Certified Financial Planner designation. The CFA designation is the most rigorous and difficult to attain certification for those providing investment advice.

Once you have a number of candidates, narrow the list down to three to five candidates. Here are some guidelines:

- Eliminate non-fiduciary advisors (those registered with FINRA – review “Step Two”)

- Eliminate advisors with spotty records on their ADV Part 1. Client disputes are common, but any sort of deviation from the law is a red flag; there are no minor infractions.

- Look for advisors who are used to working with clients like you (net worth, income, geography, niche focus, etc.)

With your list of finalists in hand, it’s time to take a hard look at who these advisors really are and how they run their practices.

#4 Research candidates thoroughly

Proper due diligence is critical once you have a list of potential financial advisors.

Working with a financial advisor may often feel like a smoke and mirrors show. Do you want clarity about how much they are really making from you, what side-deals they might have, and how much you are really spending for your investment advice? Do you want to know how successful their investment strategies are?

Questions to ask a financial advisor

Questions to ask your financial advisor should focus on the types of service they offer, fees, asset minimums, conflicts of interest, and their process for making investment decisions. Get these responses in writing, if possible.

Below is a list of questions you should ask your advisor, divided into four subject areas.

Conflicts of Interest

- Will you sign this fiduciary oath (below)? If not, why not?

We pledge to:

- charge fees based only on the value of assets we manage, a flat fee, or hourly fees

- never accept commissions

- never accept referral fees

- accept the duty of care and duty of loyalty, act as a prudent expert, and put your best interests before our own

- follow our Code of Ethics

- seek to minimize all conflicts-of-interest, and if any were to occur we will disclose them to you in full capacity and upfront

- follow the fiduciary standard, the highest standard of care in the industry, 100% of the time

- I was referred to you by _________________. Do you have a referral arrangement with this person/entity? If so, what are its terms?

- Do you offer, or recommend to your clients, any financial products that pay a commission to you or to any affiliated business entity? If you do:

- How many of your clients, as a percentage, have paid commissions:

- in their tenure with your firm?

- this year?

- As a percentage of client revenue, how much do these commission products contribute?

- If you cannot answer these questions, why?

- How many of your clients, as a percentage, have paid commissions:

- List the top five conflicts of interest by potential financial impact to me, explain what those conflicts are, and describe how they could impact me financially.

- How much of your advisors’ compensation is determined by the new business they bring in? Describe this policy and how it might affect me.

Fit

- From your ADV Part 1, please list the number of clients and assets managed, in percentages, for each of the categories:

- Individuals

- High Net Worth Individuals

- Pension Plans

- Businesses

- Other entities (please list)

- For individuals and high net worth individuals, what is your average client net worth?

- Where do your clients live?

- Can you provide a SEC-compliant list of clients who I can contact to ask about their experience with your firm?

- How loyal are your clients?

- What is your average client tenure?

- When a client dies:

- How often does their spouse remain with your firm?

- How often do their children remain with your firm?

Expertise

- What services do you offer?

- What certifications do your in-house investment managers have?

- What certifications do your financial planners have?

- What other certifications do your advisors have that might benefit my situation?

- How long has your firm been advising clients?

- How much financial experience does the advisor or advisors who will work with me have?

- What other relevant experience does the advisor or advisors who will work with me have?

- Please provide the actual (SEC compliant) performance of the investment strategy (or strategies) that you are recommending to me:

- Since inception

- In the last decade

- In the period from 12/31/2000 – 12/31/2010

- Have you had this investment performance verified or audited by a third party? If so, who did this verification/audit and what periods were covered?

- What was the maximum drawdown of for this investment strategy (or strategies) during the 2000 – 2002 Crash, in the Great Recession (2007 – 2009), and during the Pandemic Crash (February – March 2020)?

Fees

- What is your fee schedule?

- How much would I expect to pay for services, in addition to your fee schedule, on a $1 million portfolio? Please break out:

- Trading expenses

- Custody expenses

- Investment management expenses, including underlying expenses for mutual funds, ETFs, SMAs (separately managed account), hedge funds or private funds, REITs (real estate investment trust), structured notes, or other investment products you may recommend

- If you cannot provide me with an estimate for these expenses, why not?

- Do you pay, or receive, referral fees? What are the terms of these arrangements?

In addition to conducting a proper interview, you should review the Form Customer Relationship Summary (Form CRS) which is required for every broker. If there are links to additional disclosures, this is a red flag.

Also review their ADV Part 2. You’d want to look for simple language that is easy to understand. As the advisor answers your questions, compare them with Form CRS and ADV Part 2 for consistency. Any inconsistencies should be noted as they may indicate an attempt to obfuscate information.

Closing thoughts on how to find a fee-only financial advisor

We hope you’ve enjoyed our thoughts on the question of how to find a fee-only financial advisor. We hope you will avail yourself of the questions to ask your advisor list.

If there is a topic you’d like us to consider for future newsletter, please let us know through our feedback form.

We are a fee-only, fiduciary wealth management firm based in Oregon, serving clients across the country. If you’re interested in engaging with us further, please reach out and set up a time to meet. If now isn’t the time to make this move, we hope you’ll at least join our newsletter.

The information on this page does not describe every aspect of our investment advisory services nor does it contain all of our performance records, and it is intended for residents of the United States. Information provided is obtained from sources we believe to be reliable but is not guaranteed. Past results are not indicative of future performance. Nothing on this page should be construed as investment, tax, or financial advice. MCS Family Wealth Advisors® is owned by MCS Financial Advisors, LLC (MCS), an investment adviser registered with the United States Securities and Exchange Commission. We only conduct business where properly registered or exempt from registration.