Those who have been with me for decades have patiently listened to or read a recurring theme: Contrary to what Wall Street firms repeat ad nauseam, long-term investing in risky assets does not always make you more money. Nor does it make sense to blindly hold risky assets for the (undefined) long run. As a new client recently expressed it, he is “running out of decades to wait!”

Unfortunately, you, your friends, family, and colleagues are now in the midst of what I’ve tried to describe for so long; that is, the reality of investing. That reality, with all its complexity and nuances, has brought many people to an exceptionally difficult position, where fundamental belief systems – and hence expectations – are thoroughly undone. People in that position typically face two choices: denial and blame, or the search for a more accurate understanding (and a commitment to make appropriate changes to be more congruent with reality).

Is There Hope?

Yes, absolutely – for subsequent generations. The U.S. and global economies have endured far worse (1900–1950), but recovery will not be without a difficult, prolonged detox period. Two-income households and increasing debt became the norm to sustain living standards over the past quarter of a century. It may take 10 to 15 years before a sustained economic recovery takes hold. Of course, “sustained economic recovery” assumes that we will have agreed that entitlement programs like Social Security and Medicare need to be reduced.

My best guess is that we will move in and out of economic recovery over the next decade or so; anywhere from a few quarters to a year or two of improvement, followed by a stalling, misfiring economy and flirtations with recession. The main features will be low interest rates, weak credit demand, low investment returns, higher structural unemployment, and roller-coaster consumer demand. These features will translate into a volatile stock market in which investors will be whipsawed by surprising economic data forcing revisions (positive and negative) to the outlooks of companies or of the economy as a whole. If you think making money in a bull market isn’t so easy, wait till you see what’s coming.

For those whose time horizons are immediate to near term, making a realistic economic assessment of your situation and appropriate changes is critical. Your future is now. Today’s decisions will directly impact your future standard of living. The unfortunate truth for some is that expectations and desires may have to be moderated based on the reality of what you have now. Start with a good assessment of your situation, and commit to taking the necessary steps toward achievable goals.

The MSCFA Solution

MCS Financial Advisors’ investment strategy remains focused on investments that produce strong, reliable cash flow. Deflation — the destruction of most forms of equity — is going to make those who can simply maintain their cash flows much richer because the corollary to deflation is the coming Age of Thrift† — the transformation of the world into one big 50%-off sale.

—Michael Stalker, CFA, 25 February 2009

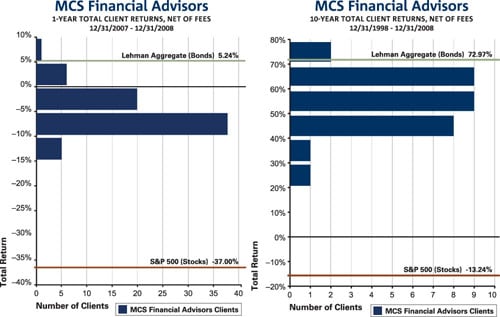

If all MCS client accounts were lumped together as one big account, MCS finished 2008 in great shape; our total performance was down 6% after fees. *This compares with a 37% loss in the S&P 500 and even worse losses in international stocks. The reason for our performance is simple – we got the hell out of stocks.

*Returns shown are time-weighted, net of investment management fees, and include reinvestment of dividends and capital gains. All fully discretionary clients with accounts managed for the entire period are included. The S&P 500 and Lehman Aggregate Index 10-year returns are for comparison purposes only and represent the large-capitalization U.S. equity market and the U.S. fixed income market, respectively. Past performance is not indicative of future results.

†Source: “Age of Thrift” phrase used in BCA Research Special Report: U.S. Consumption: The Age of Thrift Finally Arrives, 10 October 2008.