This is part two of a two-part series on IRAs. In our last newsletter, I addressed “The Importance of IRA Beneficiary Designations.” When done correctly, beneficiary designations can be an inexpensive yet powerful estate planning tool. When done poorly, they can be a disaster waiting to happen. This article addresses the tax and legacy benefits of a “Stretch IRA.”

What Is a Stretch IRA?

First, a “Stretch IRA” is not a special kind of IRA. A Stretch IRA is a term used to describe a technique of stretching the payments from a Traditional IRA over time, and therefore stretching the benefits of tax deferral. Three key factors come into play when stretching an IRA:

- Who you name as your beneficiary(s) – see my article in the last newsletter

- Who your beneficiary(s) name as their beneficiary(s)

- Educating beneficiaries about their distribution options

Why Stretch Your IRA?

We often hear that IRAs are a poor asset to transfer at death because of the tax consequences. That’s because IRAs receive no step-up in basis at the death of the IRA owner; any distributions the beneficiary receives from the IRA are fully taxed as ordinary income to the beneficiary. The tax inefficiency is particularly painful if the beneficiary takes a lump sum distribution, causing 100% of the distribution to be taxed as ordinary income for the year it is received. Thanks to our progressive tax system, taking a lump sum distribution can, and often will, cause the beneficiary to move into a higher marginal tax bracket as well.

For those who have little, if any, need for income from their IRA to maintain their lifestyle, the strategy of stretching an IRA can be compelling and powerful. Because a picture or, in this case, a graph is worth a thousand words, I thought it best to provide a few graphs along with this narrative. To keep it simple, I assumed a 6% annual rate of return during all phases.

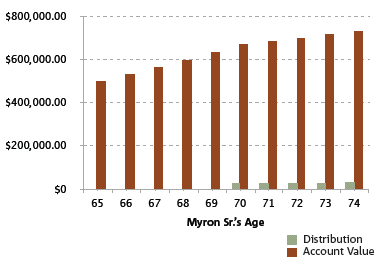

Phase 1

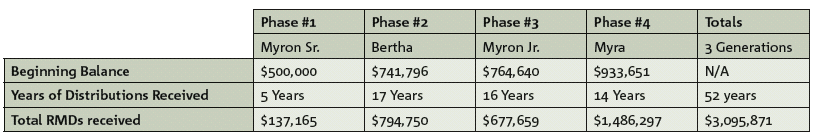

When Myron Sr. retired at age 65, he had an IRA valued at $500,000. He had other assets to maintain his family’s lifestyle (for example, rental income, pension income, etc.), so he decided not to take income from the IRA. At age 70½, when he had to start taking required minimum distributions (RMDs), his account was worth $669,112. Myron Sr. died at age 75 after a short battle with cancer. During his lifetime, he received $137,165 in distributions from his IRA, and by the time of his death the account had grown to $741,796. His wife, Bertha was the sole beneficiary of his IRA.

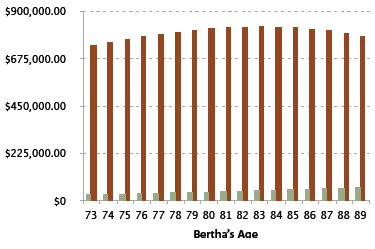

Phase 2

Bertha was 73 when she inherited Myron Sr.’s IRA, and she rolled it into an IRA in her own name. Prior to his death, Myron Sr. and Bertha discussed the income sources that would be available to her after his passing and how those sources could meet her lifestyle needs. Bertha had sufficient income that she did not need to take withdrawals from the IRA. She decided to withdraw only the RMDs which were then re-calculated on her own life expectancy.

Bertha passed away at the age of 89, and her son, Myron Jr., was the sole beneficiary of her IRA. During her lifetime, Bertha received $794,749 in distributions from the IRA, and by the time of her death the account had grown to $764,640.

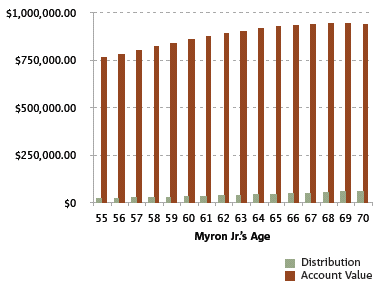

Phase 3

Myron Jr. was 55 when he inherited his mother’s IRA. He was tempted to take a lump sum distribution and buy a Porsche 918 Hybrid, but realized that, after paying over 40% in federal and state taxes, he would be left with a little over $450,000 to spend. Even though $450,000 was still enough to buy a really nice car, he remembered the conversation he had with his parents about stretching the payments over his lifetime. He decided to stretch his Beneficiary/Inherited IRA based on his own life expectancy. Myron Jr. passed away at the age of 70. During his lifetime, he received $677,659 in distributions from his Beneficiary/Inherited IRA, and the account had grown to $933,651. Myron Jr. had named his daughter Myra ashis sole beneficiary.

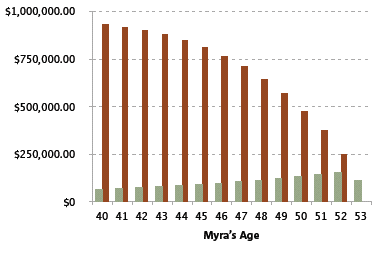

Phase 4

Myra was 40 when she inherited Myron Jr.’s IRA. Instead of taking a lump sum distribution, she decided to receive the reminder of her father’s RMDs. She could not recalculate the distributions based on her own life expectancy, but she could continue her father’s distributions based on his scheduled RMDs. The additional annual income allowed Myra to cut back her hours at the veterinarian office in order to spend more with her young family and develop a veterinary management software program. Myra received $1,486,297 in RMDs during the remaining 14 years before the account was depleted.

Was It Worth It?

Myron Sr. started with a $500,000 IRA. He and his family were able to stretch the distributions over three generations for a total of 52 years

And that, my friends, is a Stretch IRA.