If MCS clients’ investments were treated as one large portfolio including their cash, on average clients gained 3.47%1 after fees this year through December 31, 2016. The range of individual client returns was from -0.01% to 6.66%. For comparison purposes, the S&P 500 Total Return Stock index earned 11.96%, and the Barclays Aggregate Bond Index was up 2.65% through December 31st.

At the end of the third quarter, MCS client returns were less than both index returns because clients hold significant cash and one year bonds (indexes used for comparison hold no cash). Bond prices dropped swiftly in the 4th quarter and client returns exceeded the Barclays Aggregate Bond Index as client cash and one year bonds protected returns.

Political history is being made, I know most of you feel it… strongly!

I’m trying to make sense of what these changes mean and how it impacts your life’s savings.

Did your candidate win or lose? How you view the world has a direct impact on your expectations, risk tolerance and actions. Dramatic, yet fuzzy changes are proposed by the incoming administration and emotions are running high both domestically and abroad.

What I’ve learned about change is that most people resist it, unless they feel the change is clearly positive or will not materially affect their circumstances. The diagram on the next page identifies reasons why change attempts fail. The news is awash in stories demonstrating parochial self-interest, a lack of trust and contradictory assessments. Low tolerance to change is evident in Trump’s weak victory: the majority of voters did not support him. The implication is that resistance to substantive change will be high. The fact that Republicans control

congress appears to mitigate resistance but the party is split internally on many issues.

Figure 1

Factors In Change Failure Based On Organizational Behavior Research

Source: Kotter and Schlesinger, 1979

The table below lays out how to address resistance to change.

Figure 2

Methods For Dealing With Resistance To Change

Source: Kotter and Schlesinger, 2008

Which of the above methods do you think will be employed by the incoming administration to overcome resistance to their proposed changes? Based on what I read, the bottom three approaches with emphasis on the bottom two are most likely. As you can see, these methods involve substantial risk by trading short term success with the increased likelihood of a vicious backlash, hence increased instability. What is not addressed above is the resistance to change that springs from different values or a different prioritization of values. Differences can be worked out if there is a general alignment of values and beliefs between two parties. However, if you are a logging company and you see an old growth forest as a cash bonanza to exercise your free enterprise values, you are not going to convince an ecologist (for whom preservation of biosphere is sacrosanct) that turning 1000 year old trees into wood products is a higher value. The American Civil War was an extreme version of a values conflict.

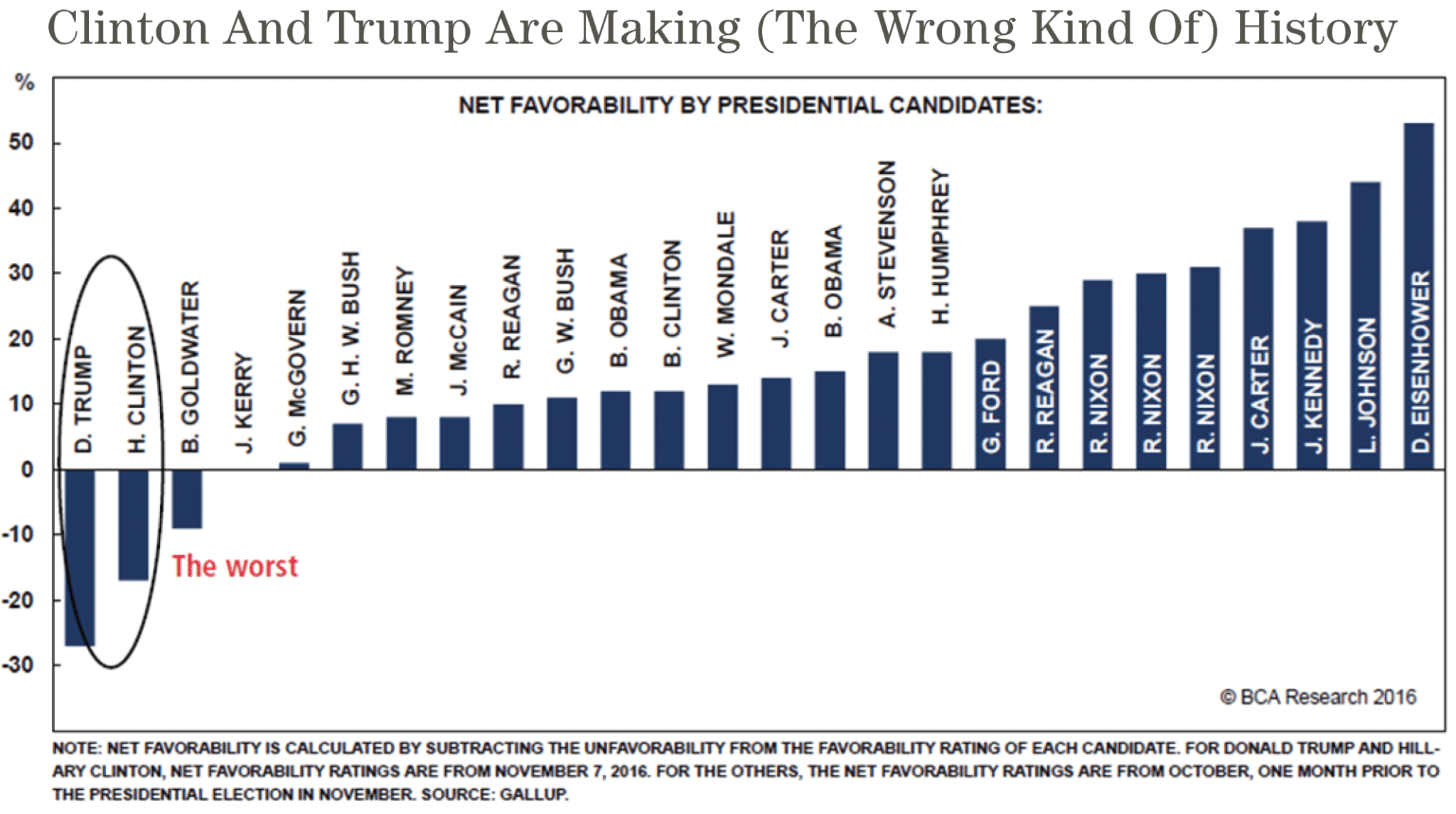

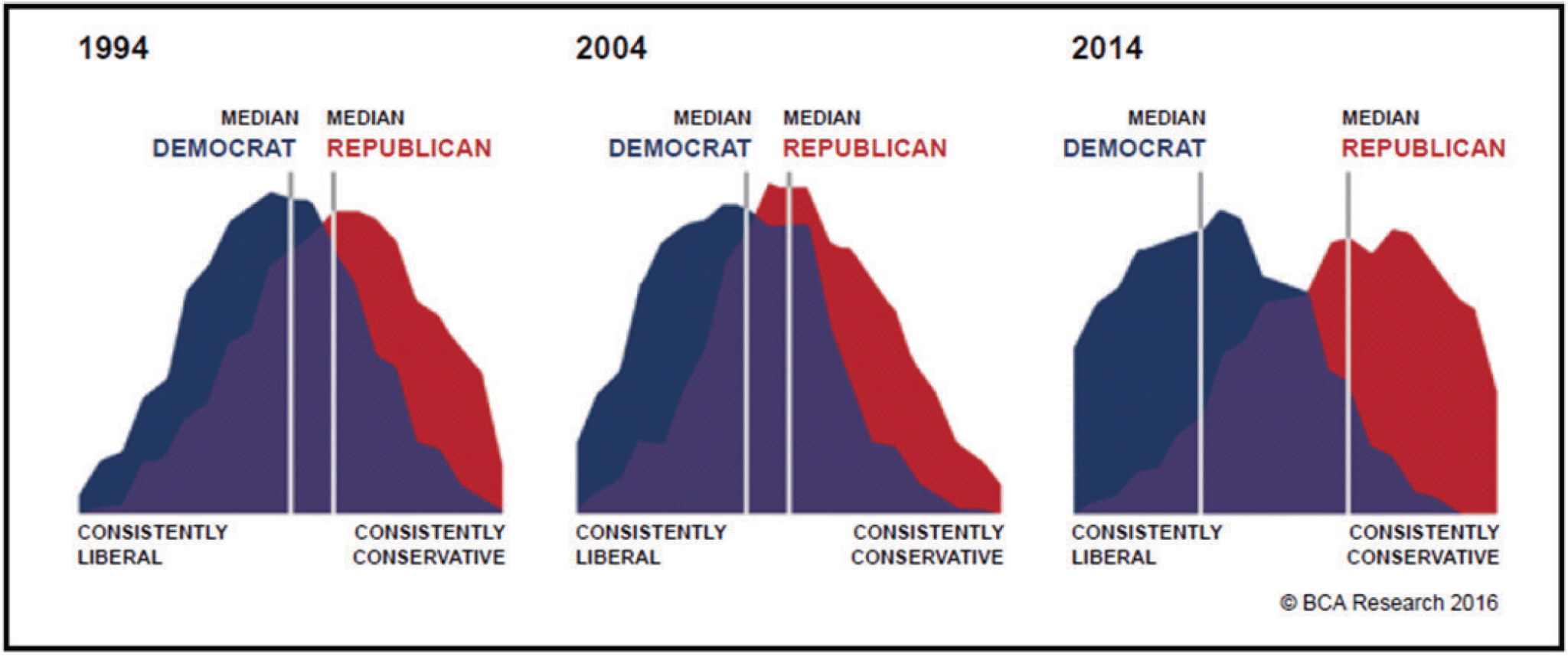

The two graphs below suggest to me that an increase in conflict is on the way.

Figure 3

Clinton And Trump Are Making (The Wrong Kind Of) History

Source: BCA Research, Gallup

Figure 4

U.S. Political Polarization: Growing Apart

Source: BCA Research, Pew Research Center

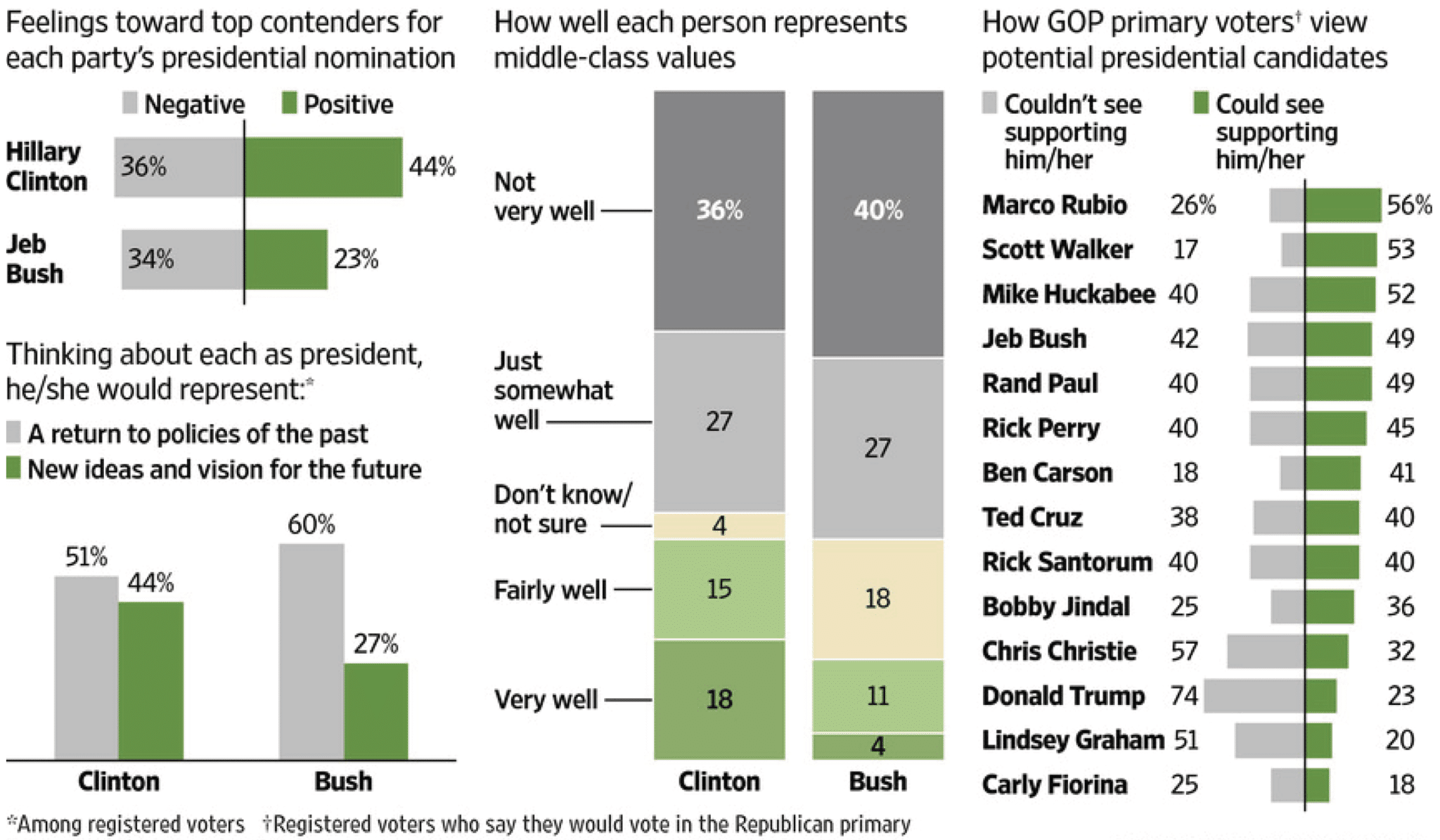

President Trump Will Teach Us Many Lessons

Donald Trump is teaching the Republican Party lessons they are still trying to absorb. Consider Republican voters view of their candidates less than a year ago (chart below). It’s been instructive to me to observe how an outsider can be so thoroughly disruptive to an institutional culture. New lessons will apply to the entire country and the world. The message to me is: it’s not clear to anyone how the future is about to unfold.

Figure 5

Findings From The Latest WSJ/NBC News Poll

Source: Wall Street Journal, March 9, 2016

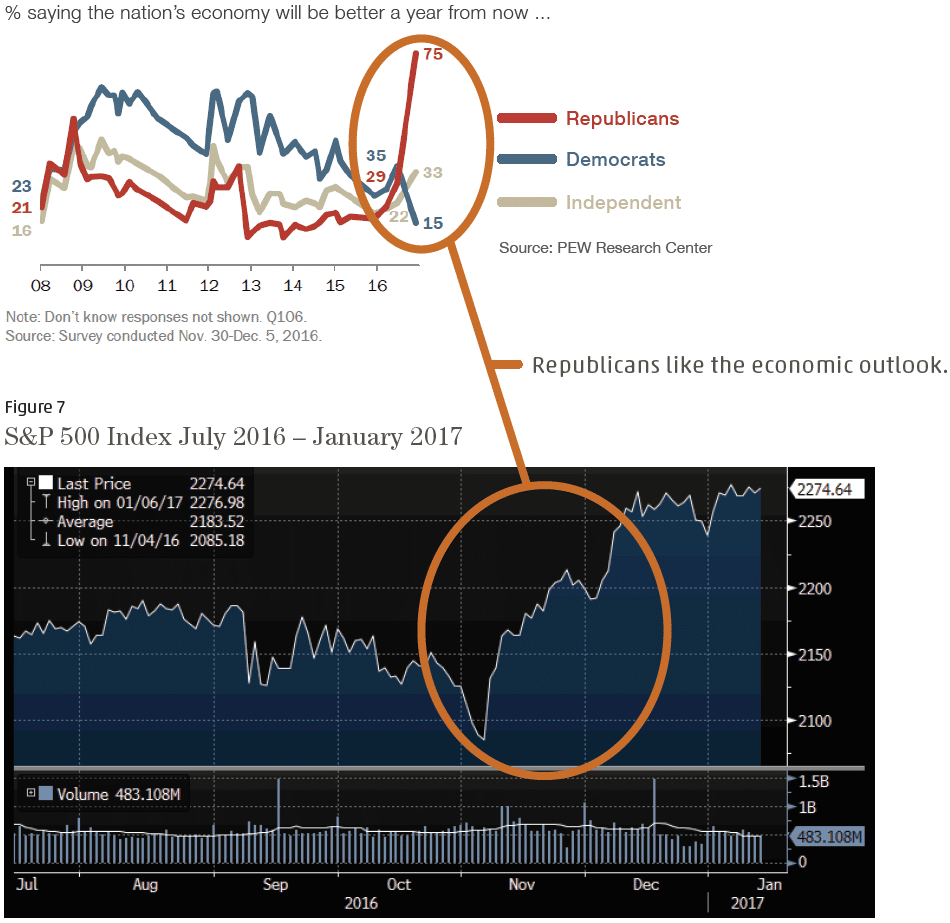

Stocks Climb A Wall Of “What, Me Worry?”

The stock market momentary slumped and then rallied on the Trump victory accounting for over a third of 2016’s 11.96% gain. One rationale for the post-election rally: Trump and a Republican congress will bring lower taxes, reduced regulation and increased government spending on infrastructure. This will translate into higher earnings, more company investment and faster economic growth along with some inflation. A simpler explanation for the rally is that Republicans never believed in the economic recovery under Obama and now that their party is in, they do.

Figure 6

Republicans Have High Expectations For The Nation’s Economy In 2017

Source: Bloomberg

To the extent that beliefs compel action, a further pick-up in economic activity is certainly possible. However, for stocks to justify current prices and gain from here there must be significant improvement in the economy.

The challenge from here is that no one knows what will actually get done. Trump’s cabinet and the Republican Party are filled with folks who have contradictory ideas about what is best for the country. The only aspect that seems predictable to me is both internal and external CONFLICT. The incoming President seems to thrive on it.

MCS Investment Strategy

Half Right, What’s Next?

Previous newsletters discussed my concerns about interest rates and the unattractiveness of investments buoyed by such low rates. My strategy shift to buy bonds maturing in 2017 / 18 proved prudent as interest rates increased causing long term bond prices to drop swiftly after the election. I did not see the stock market rally coming.

I’m Now From Missouri – So Show Me

Normally, I view Presidents as not having a huge impact on markets and the economy unless they go to war. Economic cycles do not abide by presidential terms or election promises. This time it’s different. I am going to proceed cautiously with your money until some proof of improvement arrives in the form of higher than trend economic growth and earnings. These are the same animal spirits that went wild for Dot Com stocks and housing.

I’m a fan of states becoming laboratories for economic policies. Kansas Republican Governor Brownback and the legislature have attempted to apply trickle-down economics (cut taxes on wealthy and businesses hoping more economic growth will follow to offset budgetary impact of tax cuts). It hasn’t worked as expected. The Kansas experiment over the past three years is a cautionary tale. The state’s credit rating has been downgraded as budget shortfalls accumulate and the hoped for economic surge hasn’t materialized. To the extent that the Kansas experiment resembles the proposed changes of lower taxes and less regulation by the Trump Administration, waiting to see the actual results seems prudent.

It is not clear to me what tax, spending and regulatory policies will be enacted by the new administration, let alone, what will work as expected. The Republicans appear to believe they have a mandate for wholesale changes. Based on my understanding on how change works in organizations and looking at the close election results, the margin for error and disappointment is razor thin.

Do You Have A Strong Positive Conviction About The Trump Presidency?

As I stated at the beginning of this newsletter, how you view the world affects your risk tolerance. If you believe strongly that the Trump administration’s policies will have a positive impact on the economy, I will gladly help you identify the best investment strategy for your outlook and help you implement your Trump investment bets. Please email me your scenario and I will come up with the investment alternatives to profit from it.

1 MCS Family Wealth Advisors (MCS) consolidated client returns are dollar-weighted, net of investment management fees unless stated otherwise, include reinvestment of dividends and capital gains and represent all clients with fully discretionary accounts under management for at least one full month in 2016. Individual client returns represent client discretionary accounts under management for the entire period – starting on 12/31/2015 and ending on 12/31/2016. These accounts represent 97% of MCS’s discretionary fee-paying assets under management as of 12/31/2016 and were invested primarily in US stocks and bonds (17.5% of client assets on 12/31/2016 were invested in tax-exempt municipal bonds). The Stock Index values are based on the S&P 500 Total Return Index, which measures the large-capitalization US equity market. The Bond Index values are based on the Barclays Capital US Aggregate Bond Index, which measures the US investment-grade bond market. Index values are for comparison purposes only. The report is for information purposes only and does not consider the specific investment objective, financial situation, or particular needs of any recipient, nor is it to be construed as an offer to sell or solicit investment management or any other services. Past performance is not indicative of future results.

Categories

2016 Year End Newsletter & Outlook1

If MCS clients’ investments were treated as one large portfolio including their cash, on average clients gained 3.47%1 after fees this year through December 31, 2016. The range of individual client returns was from -0.01% to 6.66%. For comparison purposes, the S&P 500 Total Return Stock index earned 11.96%, and the Barclays Aggregate Bond Index was up 2.65% through December 31st.

At the end of the third quarter, MCS client returns were less than both index returns because clients hold significant cash and one year bonds (indexes used for comparison hold no cash). Bond prices dropped swiftly in the 4th quarter and client returns exceeded the Barclays Aggregate Bond Index as client cash and one year bonds protected returns.

I’m trying to make sense of what these changes mean and how it impacts your life’s savings.

Did your candidate win or lose? How you view the world has a direct impact on your expectations, risk tolerance and actions. Dramatic, yet fuzzy changes are proposed by the incoming administration and emotions are running high both domestically and abroad.

What I’ve learned about change is that most people resist it, unless they feel the change is clearly positive or will not materially affect their circumstances. The diagram on the next page identifies reasons why change attempts fail. The news is awash in stories demonstrating parochial self-interest, a lack of trust and contradictory assessments. Low tolerance to change is evident in Trump’s weak victory: the majority of voters did not support him. The implication is that resistance to substantive change will be high. The fact that Republicans control

congress appears to mitigate resistance but the party is split internally on many issues.

Figure 1

Factors In Change Failure Based On Organizational Behavior Research

Source: Kotter and Schlesinger, 1979

The table below lays out how to address resistance to change.

Figure 2

Methods For Dealing With Resistance To Change

Source: Kotter and Schlesinger, 2008

Which of the above methods do you think will be employed by the incoming administration to overcome resistance to their proposed changes? Based on what I read, the bottom three approaches with emphasis on the bottom two are most likely. As you can see, these methods involve substantial risk by trading short term success with the increased likelihood of a vicious backlash, hence increased instability. What is not addressed above is the resistance to change that springs from different values or a different prioritization of values. Differences can be worked out if there is a general alignment of values and beliefs between two parties. However, if you are a logging company and you see an old growth forest as a cash bonanza to exercise your free enterprise values, you are not going to convince an ecologist (for whom preservation of biosphere is sacrosanct) that turning 1000 year old trees into wood products is a higher value. The American Civil War was an extreme version of a values conflict.

The two graphs below suggest to me that an increase in conflict is on the way.

Figure 3

Clinton And Trump Are Making (The Wrong Kind Of) History

Source: BCA Research, Gallup

Figure 4

U.S. Political Polarization: Growing Apart

Source: BCA Research, Pew Research Center

President Trump Will Teach Us Many Lessons

Donald Trump is teaching the Republican Party lessons they are still trying to absorb. Consider Republican voters view of their candidates less than a year ago (chart below). It’s been instructive to me to observe how an outsider can be so thoroughly disruptive to an institutional culture. New lessons will apply to the entire country and the world. The message to me is: it’s not clear to anyone how the future is about to unfold.

Figure 5

Findings From The Latest WSJ/NBC News Poll

Source: Wall Street Journal, March 9, 2016

Stocks Climb A Wall Of “What, Me Worry?”

The stock market momentary slumped and then rallied on the Trump victory accounting for over a third of 2016’s 11.96% gain. One rationale for the post-election rally: Trump and a Republican congress will bring lower taxes, reduced regulation and increased government spending on infrastructure. This will translate into higher earnings, more company investment and faster economic growth along with some inflation. A simpler explanation for the rally is that Republicans never believed in the economic recovery under Obama and now that their party is in, they do.

Figure 6

Republicans Have High Expectations For The Nation’s Economy In 2017

Source: Bloomberg

To the extent that beliefs compel action, a further pick-up in economic activity is certainly possible. However, for stocks to justify current prices and gain from here there must be significant improvement in the economy.

The challenge from here is that no one knows what will actually get done. Trump’s cabinet and the Republican Party are filled with folks who have contradictory ideas about what is best for the country. The only aspect that seems predictable to me is both internal and external CONFLICT. The incoming President seems to thrive on it.

MCS Investment Strategy

Half Right, What’s Next?

Previous newsletters discussed my concerns about interest rates and the unattractiveness of investments buoyed by such low rates. My strategy shift to buy bonds maturing in 2017 / 18 proved prudent as interest rates increased causing long term bond prices to drop swiftly after the election. I did not see the stock market rally coming.

I’m Now From Missouri – So Show Me

Normally, I view Presidents as not having a huge impact on markets and the economy unless they go to war. Economic cycles do not abide by presidential terms or election promises. This time it’s different. I am going to proceed cautiously with your money until some proof of improvement arrives in the form of higher than trend economic growth and earnings. These are the same animal spirits that went wild for Dot Com stocks and housing.

I’m a fan of states becoming laboratories for economic policies. Kansas Republican Governor Brownback and the legislature have attempted to apply trickle-down economics (cut taxes on wealthy and businesses hoping more economic growth will follow to offset budgetary impact of tax cuts). It hasn’t worked as expected. The Kansas experiment over the past three years is a cautionary tale. The state’s credit rating has been downgraded as budget shortfalls accumulate and the hoped for economic surge hasn’t materialized. To the extent that the Kansas experiment resembles the proposed changes of lower taxes and less regulation by the Trump Administration, waiting to see the actual results seems prudent.

It is not clear to me what tax, spending and regulatory policies will be enacted by the new administration, let alone, what will work as expected. The Republicans appear to believe they have a mandate for wholesale changes. Based on my understanding on how change works in organizations and looking at the close election results, the margin for error and disappointment is razor thin.

Do You Have A Strong Positive Conviction About The Trump Presidency?

As I stated at the beginning of this newsletter, how you view the world affects your risk tolerance. If you believe strongly that the Trump administration’s policies will have a positive impact on the economy, I will gladly help you identify the best investment strategy for your outlook and help you implement your Trump investment bets. Please email me your scenario and I will come up with the investment alternatives to profit from it.