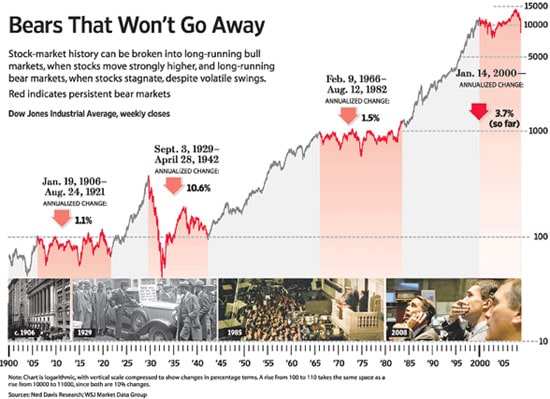

For many years, MCS Financial Advisors has counseled clients that the conventional wisdom regarding the superiority of stock investing is a half truth promoted by the financial services industry as the whole truth and nothing but the truth. The accompanying graph is one of the best I’ve seen to illustrate the point. Financial advisers and financial writers use the long-term averages (draw a straight line from the beginning to the end of the period and calculate the average annual return) to sell the benefits of stock investing. Assuming average returns is like telling a camper going to the mountains for three weeks that the average annual temperature is 56 degrees, so pack accordingly; the camper may find this instruction will work out beautifully – or he may freeze to death.

Looking at the graph, roughly 20-year periods of strong stock market returns are followed by roughly 15-year periods of very poor returns. Could the 20-year periods of strong returns have something to do with the fact that the United States had become the world’s dominant superpower during those times? It’s also interesting to note that there seems to be a long-term flattening of returns after each 10-fold expansion; note the time periods when the market first reaches 100, 1,000, and 10,000, and when the market finally leaves those points behind. Of course, this could just be coincidence.

Bottom Line

What is inescapable is that being heavily invested in stocks “long term” during a long-term bear market cycle can be a financial disaster if you are transitioning from the accumulation of savings to the disbursement of savings (retirement or soon to be).

Warning: Some financial advisers recommend bucket asset allocation strategies. These strategies emphasize placing about two to five years’ worth of portfolio distributions into a safe-assets bucket (cash and bonds) to be drawn down while most investments remain in stocks. The problem is that the portfolio gets riskier and riskier as safe assets are used up. Two or five years’ worth of distributions allocated to safe assets may not allow enough time for a high stock allocation portfolio to recover. The investor would then be forced into liquidating stocks to meet living expenses. Please call MCS Financial Advisors if someone you know is using a bucket strategy and has expressed concern about it.