It seems as if everyone with an email address, cell phone, or internet connection is bombarded by scams trying to trick them into parting with their money. These scams occur on a widespread and consistent basis. In this article we’ll talk about inheritance scam documents, provide a checklist of signs of an inheritance scam, and discuss how you can protect yourself from this type of fraud.

We’ll cover:

- What a typical inheritance scam document includes

- Examples of scam letters

- How to reduce the chances of being contacted by scammers

- What to do if you get such a letter

Please note: These are examples of suspected scam letters. We did not have the time to follow up on all of these, and cannot verify they are scams.

Before we get started, we are financial advisors in Bend with clients located across the country. We’ve written the following blogs about how to protect yourself from scams in Oregon and beyond, please check them out if you’d like.

Protect yourself from scams in Bend, Oregon

Keeping your money safe online

The scammers are only getting smarter

It’s scary to think about the degree to which the scammers seem to be getting smarter – and more convincing. The scammer’s goal is to convince you to give up your personal information (bank account, credit card) or send them money (cash advance, wire transfer, etc). They will prey on any vulnerability, and the saddest thing about it is that most of the time they won’t get caught.

As fee-only financial advisors in Bend, Oregon, we encounter these scammers in our daily lives, and so do our clients, friends, and family members. It’s of highest importance to become familiar with these scams and how they work so that when you are in this situation, which seems almost inevitable, you can prevent yourself from becoming a victim.

Typical signs that it’s an inheritance scam document: a checklist

There are some common characteristics between these scam letters, and it is important to familiarize yourself with them. An inheritance scam document typically:

- Arrives unsolicited via mail, email, or fax from an organization you’ve never heard of before

- Talks about the unclaimed proceeds of either an insurance policy or a bank account

- Appears to be from a law firm or financial institution that really exists, maybe even one that is a household name. They may even have someone pretending to be a lawyer on the line to try to trick you into believing they are real.

- Includes a sense of urgency

- Uses the words “business proposition” or “business opportunity”

- Encourages you to keep the transmission confidential

- Voices a dramatic consequence for not taking action, such as the funds being given away to the government

- Comes from a foreign country

- Mentions a person who died spontaneously such as in a car accident with no listed beneficiaries

- Assures you there is no risk or potential infraction of the law, and may even use the word “legitimate”

- May ask for a cash advance

- It may have a date stamp or seal to try to appear legitimate

The disturbing thing is that these letters are set up to mimic real life – and to the undiscerning eye, they may seem real. The scammers are only getting smarter, and it’s up to all of us to protect ourselves by being aware of the signs to look for.

Use this simple rule: if it seems too good to be true, it probably is.

Example of inheritance scam letter

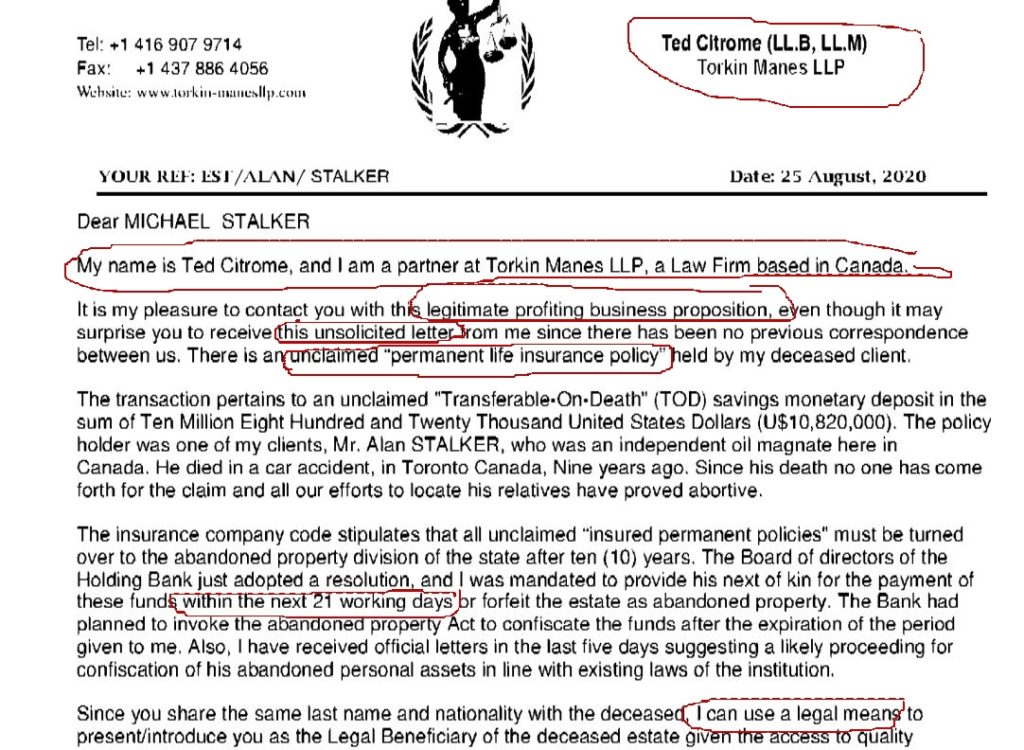

Here is one example of an inheritance scam letter.

You can see that this letter has many of the qualities identified on the checklist. The person impersonating the attorney contacts me out of the blue, and tries to ease my apprehension by acknowledging that. He then talks about some unclaimed life insurance proceeds, and cites 21 days as the time allowed to award them to the beneficiary.

We have other examples of scam letters on this web page to increase public awareness. If you have received a scam letter and would like to add it to the page to help others avoid being victims, please send it to us.

How to reduce the chances of being scammed

The best way to reduce the chance of being sent an inheritance scam document is to protect your personal information.

- Please download our cybersecurity checklist to learn how to reduce the amount of unwanted solicitations, many of which are scams.

- Review our blog about how to protect your identity online.

Aside from the specifics mentioned in the resources above, a general guideline is that your personal information should only be given out through 100% secure means, and on an as-needed basis. By personal information, we are referring to:

- Your name

- Your address

- Your social security number

- Checking, savings, and investment account numbers

- Credit card numbers

- Where you work

- Information about who you are related to

- Your birthday

Give out as little information as possible, and only to those who need to know. As a general practice, you should never give out money over the phone. If someone calls and says you own them money, and you are not sure if it is a true statement, tell them you need to call them back and do the research. Do not move forward with payment until you are 100% sure that they are legitimate.

When in doubt, tell the person that you have to confirm some details with your advisors before responding, and you will get back to them at a later point. Anyone who objects to that is likely trying to trick you into parting with your money.

There are also services such as EverSafe, which act as an extra set of eyes and will issue an alert if there are transactions in your accounts that are out of tolerance. While this service can’t necessarily help you avoid insurance fraud, it is worthy of mention in any discussion about cybersecurity.

What to do if you get a scam letter in the mail

If you get a scam letter in the mail, do not respond to it. Contact the appropriate agency. Retain a copy of the email for your records.

What to do if you get a scam letter over email

Even if you don’t do what the scam letter says, just by opening the email or clicking a link you may be exposing your computer to malware or other vulnerabilities. It is best to not open the email and instead block the sender. Retain a copy of the email for your records.

Report the email to your email service provider (Gmail, etc.) as a phishing scam. If the company that sent the letter has a mechanism by which you can report the email, send them a copy.

It’s the same as in the case of getting a letter in the mail; contact the appropriate agency.

Summing it up on inheritance scam documents

Study these examples of inheritance scam documents and learn the typical signs. Know what to do if you get one.

But aside from responding properly, the best thing you can do to avoid inheritance scams is to limit your exposure by giving out your personal information only on an as-needed basis and making it hard for people to easily access your information.

We are a fee-only, fiduciary wealth management firm based in Oregon, serving clients across the country. If you’re interested in engaging with us further, please reach out and set up a time to meet.

If now isn’t the time to make this move, we hope you’ll at least join our newsletter.

If there is a topic you’d like us to consider for future newsletter, please let us know through our feedback form.

Disclaimers

Any similarities to people living or deceased are entirely coincidental. MCS Family Wealth does not verify the legality or illegality of any correspondence presented herein.

The information on this page does not describe every aspect of our investment advisory services nor does it contain all of our performance records, and it is intended for residents of the United States. Information provided is obtained from sources we believe to be reliable but is not guaranteed. Past results are not indicative of future performance. Nothing on this page should be construed as investment, tax, or financial advice. MCS Family Wealth Advisors® is owned by MCS Financial Advisors, LLC (MCS), an investment adviser registered with the United States Securities and Exchange Commission. We only conduct business where properly registered or exempt from registration.